Last Week

There have been bull markets and there have been bear markets. Now, some strategists are referring to the summer of 24 as a kangaroo market, with investor sentiment bouncing between fear and greed with all eyes on the Fed’s attempt to use monetary policy to manage the economy. Concerns abound that the fed has waited too long to cut rates; for example, the cover story in this week’s Barron’s is “The Housing Crisis,” which discusses how high interest rates have left homeownership out of reach for millions of Americans. On the other hand, positive bounces of enthusiasm have come from the economic data that shows the resilience of the economy coupled with the confidence that the Fed rate-cutting cycle is finally upon us. Last week’s rebound erased the previous week’s sell-off, marking the first time since June 2022 that the S&P 500 fell at least 4% in one week and then rallied more than 4% the next. It was tame inflation data and a nice rebound in consumer confidence during the last week that counterbalanced the soft data from the labor market the week earlier and renewed the debate over the size of the impending rate cut. The 4% increase in the S&P 500 took the index to within 1% of its record close, Small- and Mid-Cap stocks followed suit gaining over 3%, and the Nasdaq Composite topped the leaderboard with nearly a 6% jump. Advancing issues overwhelmed declining issues by a factor of 4-1, and every sector except Oil & Gas finished higher by at least 1%.

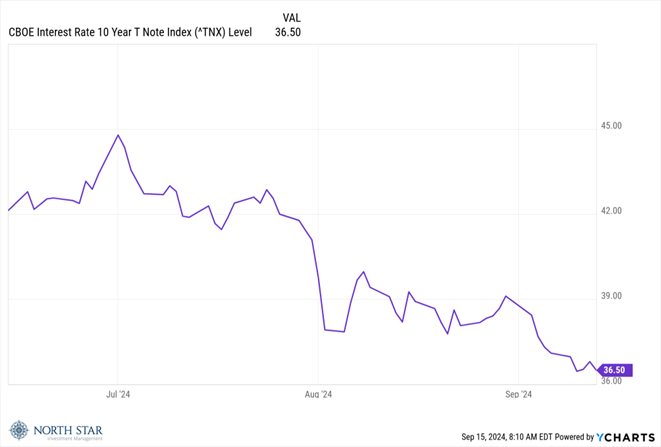

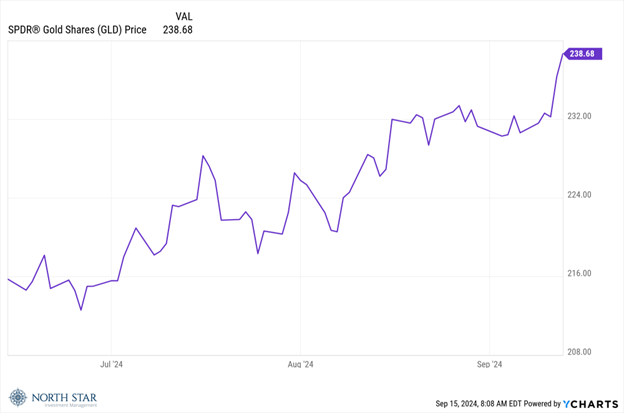

While equities have been playing kangaroo, it has been a bull market summer for bonds and gold. During the last week, gold reached a record high, while the yield on the 10-Year Treasury reached its lowest level since early in the summer of 23.

The Chicago Sports Scene could use a little kangaroo bounce, as it was a grim week for the Bears, Cubs, White Sox, and Sky. The Bears offense looks like perhaps spending some of the draft picks and money on the offensive line might have made sense. The Cubs’ odds of making the playoffs are slim to none, and none just left town. The White Sox need to get hot to avoid topping the 1962 Mets record for most losses in a season. Our best hope for a playoff berth is from the 13-25 Sky, who are in a three-way tie for the last playoff spot in the WNBA.

This Week

The economic calendar includes retail and food services sales on Tuesday, with expectations for flat numbers. Analysts also expect existing home sales for August to be unchanged at a depressed level when released on Thursday.

Wednesday’s FOMC meeting will clearly be in focus, as the Fed’s monetary policy committee is finally ready to cut interest rates for the first time since 2020. The debate is over whether the size of the rate cut should be 25 or 50 basis points. Financial markets participants will likely be most sensitive to the Fed’s comments regarding the go-forward pace and magnitude of interest rate reductions, as well as any wording changes in the much-anticipated Fed statement released Wednesday afternoon. Given the recent softness in the labor market, the concerns over the housing market, and the dramatic decrease in the inflation rate, we think the Fed should move from its current 5.25%-5.5% target range down to 4% over the next few meetings. Those rate cuts should be very favorable for small caps, financials, gold, and dividend-paying stocks.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.