Last Week

A banana affixed to the wall with a piece of silver duct tape sold for $6.2 million to a cryptocurrency operator as the price of Bitcoin approached $100,000. Turning to more traditional assets, the U.S. dollar, gold, crude oil, and every stock market sector rallied sharply, with advancing issues outnumbering declining issues by a factor of more than 2.5-1. The S&P 500 recouped the previous week’s decline by rising just under 2%, and Small- and Mid-caps doubled that gain. The Tech sector trailed all the other sectors with a still not-so-shabby +1.7% move in the Nasdaq composite. Earnings reports from Nvidia, Walmart, and Target were in focus as investors took the temperature for AI growth and the health of the U.S. consumer. The results from Nvidia were terrific, but not enough to move its share price to new banana-like levels. Target shares languished as the company had soft sales in discretionary items, which management suggested could improve in the holiday shopping season. We think the 20% plus decline in Target’s share price was a dramatic overreaction resulting in an attractive valuation for a high-quality business. Walmart, on the other hand, posted excellent results and its shares surged to new record highs. Walmart derives a much higher percentage of its revenues from food, and given the demand for bananas, that vertical is obviously ripe. The bond market was quiet, with the yield on the 10-year Treasury unchanged at 4.41%.

The incoming administration’s proposed economic policies are contributing to the recent volatility and surge in cryptocurrencies. As such, we believe the markets will remain volatile over the next few months as those policies become better defined. We suggest caution, as the road between rhetoric and reality is long and winding.

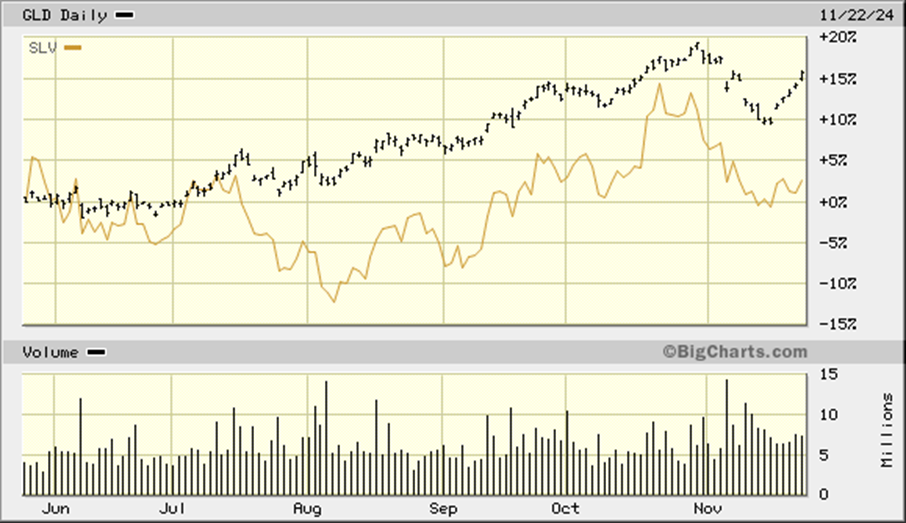

One interesting asset that has seen less appreciation over the past six months is silver, shown as the exchange-traded-fund SLV in the chart below. In the same period, Gold (GLD) has risen approximately 15% and the S&P 500 and the NASDAQ 100 each have risen more than 10%. Silver interests us because it is both a rare commodity AND has an increasing importance in the ongoing energy transition as a key input for solar generation and electricity transmission. The recent elections have created more excitement about fossil fuel-related businesses, detracting from the global long-term trend toward clean energy solutions and reducing interest in silver among short-term traders. Long-term investors should consider this recent weakness as a buying opportunity.

This Week

Happy Thanksgiving! At North Star we are thankful for all our clients and business partners. The markets will be closed on Thursday and trading will be light on Friday.

The minutes from the recent FOMC meeting will be released on Tuesday. In that meeting, the Fed cut rates by 25 basis points and provided a balanced statement about future monetary policy changes.

On Wednesday, the BEA will release the personal consumption expenditures price index (PCE) for October. The consensus estimate is for a 2.3% year-over-year increase. Any deviation from that consensus could influence just how thankful investors feel on Thursday.

Our research team took a brief detour to select the best “banana” song and settled on Jack Johnson’s “Banana Pancakes.” Let us know if you have another favorite.

Speaking of bananas, the Chicago Bears season continued to resemble the comedy sketch of a guy slipping on a banana peel. This Sunday’s version included the most remarkable and improbable comeback from down 11 with 30 seconds left to tie the game, only to falter in overtime and drop their fifth game in a row.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.