Last Week:

Earnings season got back on track, and the market responded with a nice rebound early in the week, only to have the gains dissipate with the market finishing flat to slightly lower by the close on Friday. So far, major bank earnings in particular are looking very good, both the level of earnings and the quality of the earnings. I believe that as interest rates rise, the large, multi-regional banks will be leaders in raising dividends because those banks are currently reporting earnings below their underlying economic results (over-reserving for possible bad loan events).

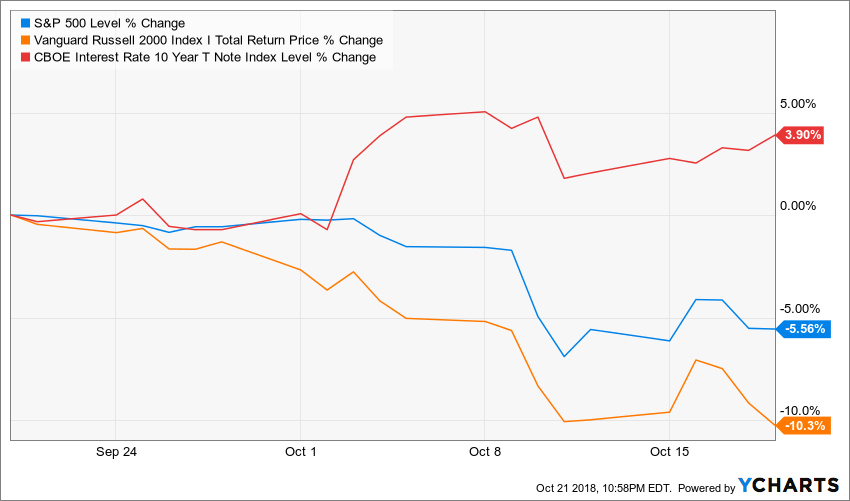

Soft housing data, hawkish commentary from the Fed, and another international political crisis (Saudi Arabia), all contributed to the somber mood later in the week. Whereas it doesn’t seem “loco”, it does seem curious that the recently released FOMC minutes suggest that the majority of Fed officials seem comfortable with taking short-term rates into restrictive territory. The U.S. Dollar responded by inching higher and the yield on the Ten-Year Treasury rose 5 basis points to 3.20%. In short, the damage done the first ten days of October neither was repaired nor worsened last week, as the strong corporate earnings reports were offset by other concerns.

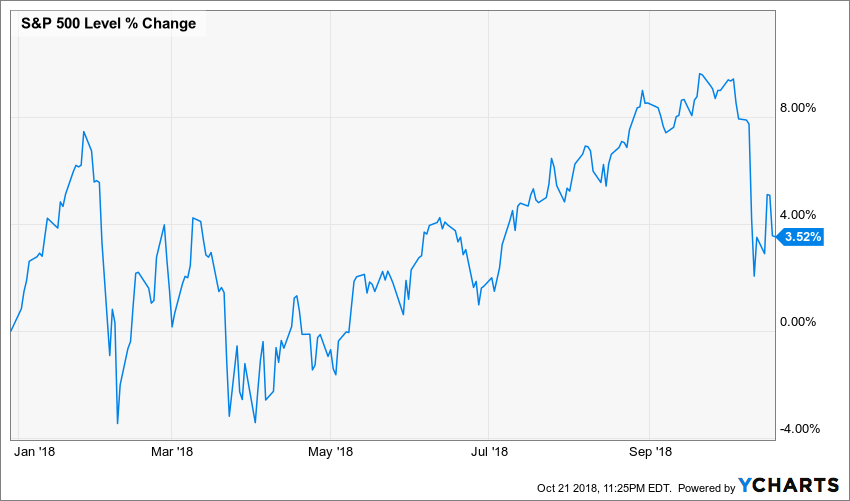

On the positive side, the recent spike in volatility seems more similar to the pattern in late March than the more severe sell-off in early February.

Even though that sell-off was less severe, it still took almost four months for those losses to be recouped. Unfortunately, in the short-term the market tends to go down faster than it rises, despite the long-term upward trend.

This Week:

It will be the busiest week of the earnings season with 158 S&P 500 companies reporting third quarter results. More attention will likely be placed on forward guidance, as concerns over rising materials and labor costs, supply chain disruptions (self-inflicted by the “trade war”), and the strong dollar might lead to downward revisions. The good news is that the market is now trading at a somewhat reasonable 15.5x forward earnings. U.S. – China relations will also remain in focus (there was some modest optimism for vague reasons last week), as will the crisis in Saudi Arabia, and developments in the budget/debt negotiations in Italy.

Stocks on the Move:

Acme United Corporation (ACU) -12.7%: Net sales for the third quarter were $34.7 million compared to $33.8 million in 2017, while net income for the quarter was $800,000 or $0.23 per diluted share, compared to a net income of $1.2 million or $0.32 per diluted share for the same period of 2017. There was a laundry list of issues that contributed to the reduction in profits, most notably a slowdown in sales to Amazon on the revenue side and an increase in SG&A due to higher outbound freight costs and sales commissions as a result of the sales growth, and the addition of sales and marketing personnel. The Company also had to contend with the typhoon in Hong Kong and the Hurricane in North Carolina. Acme United is a supplier of cutting, measuring, first aid and sharpening products to the school, home, office, hardware, sporting goods and industrial markets. ACU is a 2.1% holding in the North Star Dividend Fund, a 3.1% in the North Star Micro Cap Fund and a 2.9% holding in the North Star Opportunity Fund.

Blue Bird Corporation (BLBD) -10.3%: The Company announced that approximately 8% of the shares tendered at $28 had been accepted as a result of its $50 million offer. Blue Bird is the leading independent designer and manufacturer of school buses, with more than 550,000 buses sold since its formation in 1927 and approximately 180,000 buses in operation today. In addition, Blue Bird is the market leader in alternative fuel applications with its propane-powered, electric and compressed natural gas-powered school buses. BLBD is a 4.5% holding in the North Star Micro Cap Fund and a 2.0% holding in the North Star Opportunity Fund.