Last Week

Although not referring to the stock market, the first line in the T.S. Eliot poem “The Waste Land” reads, “April is the cruelest month,” and thus far, those words are ringing true for investors. Indeed, the month kicked off with the worst weekly performance of the year, with the decline primarily driven by a “hot” jobs report and another dose of Fedspeak suggesting that the Federal Reserve was in no hurry to cut interest rates. A quick rally in energy prices (likely driven by increasing investor concerns regarding political conflicts in oil-producing regions) contributed to the pain, reigniting inflationary concerns. The bond market also suffered, with the yield on the 10-year Treasury rising 17 basis points to 4.38%, its highest level of the year.

It was a case of good news at first being viewed as bad news, as Friday’s nonfarm payrolls report showed the economy added 303K jobs, the unemployment rate ticked down, and there was a slight increase in the labor force participation rate. We note that those strong numbers came with wage growth remaining at 4.1% year-over-year, as expected. We continue to believe that it is good news that the economy, in general, and the labor market both remain in the Goldilocks zone of not too hot or too cold. Wage growth in excess of the inflation rate also strikes us as a positive for U.S. consumers. Nevertheless, we recognize that the odds are shrinking that the Fed will cut interest rates at its meeting in June. The rising expectation that high short-term rates will persist hit small caps the hardest, with the Russell 2000 sinking 2.9%. Despite recouping some of the losses as trading progressed on Friday, the S&P 500 finished down 1.0%, the Nasdaq Composite lost 0.8%, and declining issues doubled advancing issues. Crude oil spiked more than 4%, leading to a positive week for the Oil & Gas sector, and gold continued to set record highs. We have recently increased our Energy sector exposure in the North Star Funds and have a favorable outlook on a few selective gold shares, including PHYS, GLD, SII, and NEM.

This Week

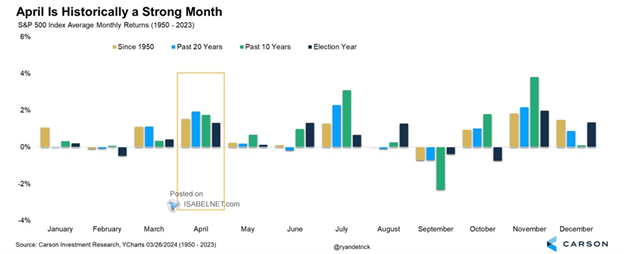

Historical financial market data shows that April is an above-average stock market month and also one of the best months during an election year. While we are not technical investors, the equity indexes set for the upcoming 1Q24 earnings report season suggest low near-term expectations that could be exceeded given the strong recent economic data reports.

Perhaps the start of earnings season this week will help get the month back on track, with 9 S&P companies reporting first-quarter results, including J.P. Morgan, Delta Air Lines, and Constellation Brands, providing insight into the health of the bank, travel, and booze industries. Analyst expectations call for a solid 3.2% growth in overall S&P 500 earnings for the quarter, with actual results likely to “beat” as usual.

The eyes of the world will be on the release of the Bureau of Labor Statistics consumer price index for March on Wednesday. The consensus estimate is for a 3.4% year-over-year increase, with the core CPI expected to show a 3.7% rise. Any deviation from expectations would impact sentiment regarding the timing and magnitude of Fed Funds rate cuts for 2024.

It is with tremendous sadness that we report that William “Bill” Richards died suddenly last week. Bill was the President of the North Star Family Office and a dear friend and mentor to the entire North Star Team. He was a beloved husband, brother, loving father, and proud Grandfather. We all will miss Bill.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.