Soft-ish

It’s beginning to look like Goldilocks might be hitching a ride in Santa’s sled, with the odds for a “softish” landing continuing to improve. Even the big, bad, Fed Chair Jerome Powell restrained from huffing and puffing and blowing the economy down during his address at the Brookings Institute on Wednesday. Instead, he confirmed that a slower pace of interest rates increases was likely. Following the Chairman’s remarks, the S&P rallied 3.6% over the next two hours. The week had started with a market sell-off triggered by protests against China’s zero-Covid policies, which renewed supply chain and global demand concerns. Stock trading was also volatile on Friday after U.S. employment data for November showed stronger jobs growth than forecasted. However, the early losses on Friday were reversed by the end of the day, as further analysis suggested that the jobs report was less “hot” than first thought.

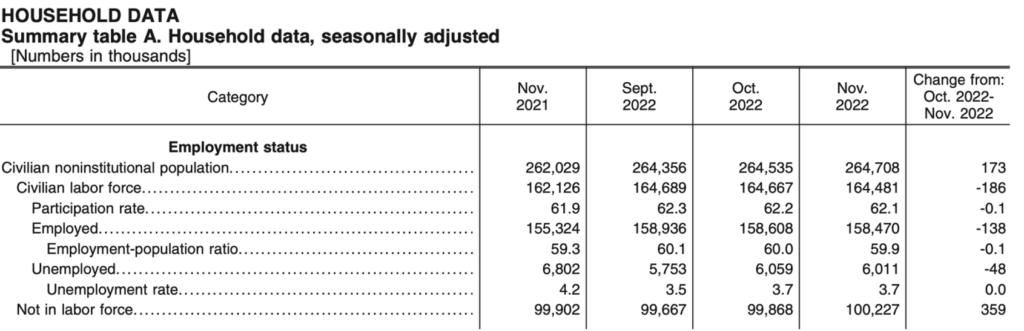

As shown in the below table, the number of employed persons in the U.S. declined in both October and November, defying the headline ‘November Jobs Created’ number of 263,000 that exceeded the consensus analyst prediction of 200,000. Despite other data reported on Friday, the table below shows that “employed” persons declined by 138,000 in November after declining 328,000 in October. If this recent sequential two-month trend continues in upcoming reports, then further Fed rhetoric will likely become less hawkish before turning to outright dovish. In fact, this data series has historically been more useful at times of economic turns, as this household survey tends to turn positive or negative before the headline unemployment data turns.

The bond market is also clearly signaling an economic slowdown, as the yield on the 10-year Treasury slid another 18 basis points to 3.51%, and has now dropped 75 basis points over the last five weeks. The dollar continued its recent retreat, falling over 1%, while gold rallied almost 3%. The S&P finished the week up 1.1%, the Nasdaq gained 2.1%, and the Russell 2000 added 1.3%. Concerns over recession remained evident, with the two-year Treasury yield exceeding the 10-year yield by 77 basis points, the sharpest inversion since 1981.

North Star Chief Investment Officer Eric Kuby went to the Bears game on Sunday versus the Packers. The Bears are now 3-10.

Volatility Ahead

The release of November PPI and the December Michigan Sentiment Index, both on Friday, could be in focus. We expect modest improvement on both fronts. The financial markets will very likely be volatile short term whenever out-of-consensus inflation-related data is reported, given read-throughs to Fed implications. However, as the Holidays get closer and closer, we would expect trading volumes to decline and financial market participants to focus more and more what might work in 2023 rather than what gains are available in the waning days of 2022.

The OPEC+ meeting that began over the weekend could influence the Energy sector. The alliance of oil producers on Sunday agreed to maintain its current policy on reducing production by 2 million barrels a day. An additional factor in the oil patch is the impact of European Union’s sanctions on the purchases of Russia’s seaborne crude exports and a potential G-7 price cap on Russian oil.

The Reserve Bank of Australia and the Bank of Canada both are expected to raise interest rates this week, although FOMC members in the U.S. will mercifully be quiet as a part of a blackout period ahead of the December 14-15 meeting.

Stocks on the Move

-24.1% Duluth Holdings Inc (DLTH) is a lifestyle brand of men’s and women’s casual wear, workwear, and accessories sold primarily through the Company’s own omnichannel platform. The Company’s products are marketed under the Duluth Trading names, with the majority of products being exclusively developed and sold as Duluth Trading branded merchandise. Duluth reported a major third quarter miss last week with a GAAP loss of $0.19 for the period due to increased competition and promotional activity. Revenue was up marginally for the quarter. The Company also lowered its FY2022 guidance significantly to a range of $0.05-$0.20 per share vs prior view of $0.61-$0.71.

+34.3% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. BBW reported fantastic earnings last week with $0.51 per share beating estimates by $0.13 and revenue of $104.5M up 10% y/y. The company has refreshed its website and is opening stores to increase its omnichannel presence. Additionally, the Company is becoming a recognizable name in major entertainment with several film, radio, and even NFT projects on deck.

+11.6% 1-800-Flowers.Com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no significant company news last week.

+10.5% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. There was no significant company news last week.

-11.1% Steelcase Inc (SCS) designs and manufactures products used to create high performance work environments. The Company offers products such as office furniture, furniture systems, interior architectural products, technology equipment, seating, and related products and services. There was no significant company news last week.

+12.9% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.