Last Week:

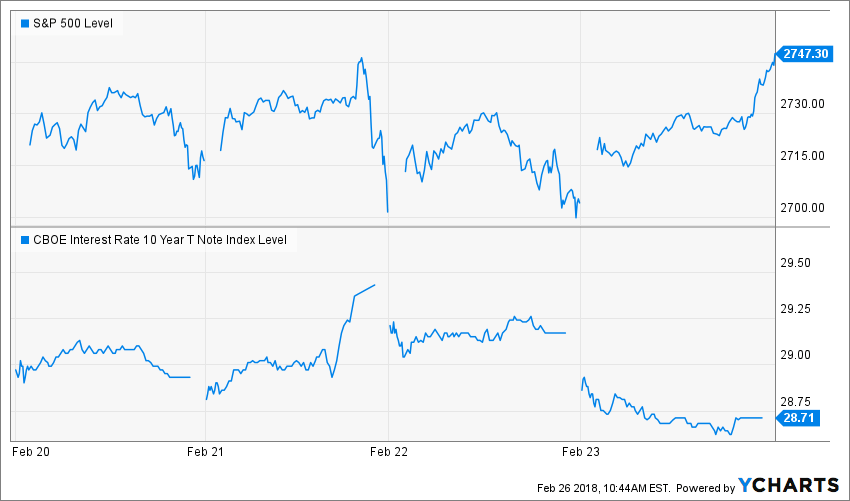

Even though the S&P eked out a modest gain, the almost minute by minute focus on interest rates has certainly made the stock market ride quite bumpier. In the chart below, the top panel shows the S & P 500 and the bottom panel the yield on the Ten-Year Treasury. On Tuesday morning, yields were up and stocks down. The next big move came on Wednesday after the release of the FOMC minutes, which showed a more hawkish tone to the strengthening economy. Interest rates spiked to 2.94%, their highest level in four years, and stocks nosedived. On Friday, the trend reversed, perhaps as traders closed out their positions in front of the weekend, as the Ten-Year finished unchanged for the week at 2.87%, while the S&P finished up 0.60%.

The University of Chicago Maroons finished their season with an impressive 86-77 victory over the number 2 ranked team in division 3, Washington University-St. Louis. Between that game and the U.S. Men winning the Gold in curling, it was quite a shocking weekend of sports!

This Week:

The economic calendar is busy, but Fed Chair Powell’s testimonies before the House on Tuesday and the senate on Thursday will probably dominate the action. Another brewing storm could be the Trump administration’s renewed focus on trade restrictions, with harsh sanctions now expected on steel and aluminum.

Stocks on the Move:

Rocky Brands, Inc. (RCKY) +12.1%: Fourth quarter net sales were $67.0 million versus net sales of $67.0 million in the fourth quarter of 2016. The Company reported fourth quarter net income of $4.4 million, or $0.59 per diluted share, compared to a fourth quarter net loss of $0.6 million, or ($0.09) per diluted share in the year ago period. Jason Brooks, President and Chief Executive Officer, commented, “We concluded a productive 2017 with a very solid fourth quarter performance which was highlighted by mid-single digit growth for both our wholesale and retail divisions. The product, marketing and distribution strategies we’ve recently implemented aimed at increasing full-price selling for our branded work, western and outdoor footwear businesses are contributing to better top and bottom line results. Rocky Brands is a designer, manufacturer and marketer of footwear and apparel marketed under a portfolio of brand names including Rocky, Georgia Boot, Durango, Lehigh, Creative Recreation and the licensed brand Michelin. The North Star Dividend Fund holds a 3.6% position and the North Star Micro Cap Fund holds a 3.0% position in RCKY.

1-800-Flowers.com Inc (FLWS) +13.6%: The Company’s shares rallied two weeks after a mixed earnings release. Perhaps investors were looking for a way to recoup the money they spent on flowers and other goodies on the Valentine holiday? 1-800-Flowers.com is a U.S. based provider of gourmet food and gift baskets, consumer floral, and BloomNet wire service. The North Star Micro Cap Fund holds a 3.5% position in FLWS.

American Software, Inc. (AMSWA) +6%: Total revenues for the quarter ended January 31, 2018 were $30.1 million, an increase of 14% over the comparable period last year. GAAP net earnings for the quarter ended January 31, 2018 increased 149% to $5.6 million or $0.18 per fully diluted share compared to $2.2 million or $0.08 per fully diluted share for the same period last year. “We are pleased with our third quarter fiscal year 2018 results which reflect our ability to serve customers in new and expanded ways with the investments we’ve made in our Logility Voyager Solutions™, Demand Solutions®, Halo and NGC Andromeda™ platforms,” said Allan Dow, president of American Software. “Consistent with the previous two quarters, the trend towards SaaS subscriptions as a preferred engagement method for new customers is accelerating and is positively highlighted by our 217% growth in SaaS subscription revenue.” American Software Inc develops enterprise management and supply chain related software and services. Its solutions consist of global sourcing, workflow management, customer service applications, and ERP solutions. The North Star Dividend Fund holds a 3.9% position and the North Star Micro Cap Fund holds a 3.2% position in AMSWA.