Last Week:

Where are we and where do we go from here?

Reflecting on the current status of the economy and markets, I find myself swaying back and forth on the optimism/pessimism pendulum. Although on balance trending more towards the arc of optimism.

Certain data points suggest the economy is faring much better than expected, as evidenced by a 5.3% jump in retail sales in January from December and 7.4% from a year ago. Fourth-quarter corporate profit reports continued to exceed expectations and now are on track to show a rise 3.2% from fourth quarter 2019. Let’s pause and digest this information. Corporate profits were higher than they were a year ago, despite the stiff COVID-19 headwinds. When combined with the third-quarter results, we just experienced the largest six-month earnings “beat” in history. Moreover, with forecasts for 2021 rising, annual S&P 500 profits are now expected to exceed previous highs by double-digits!

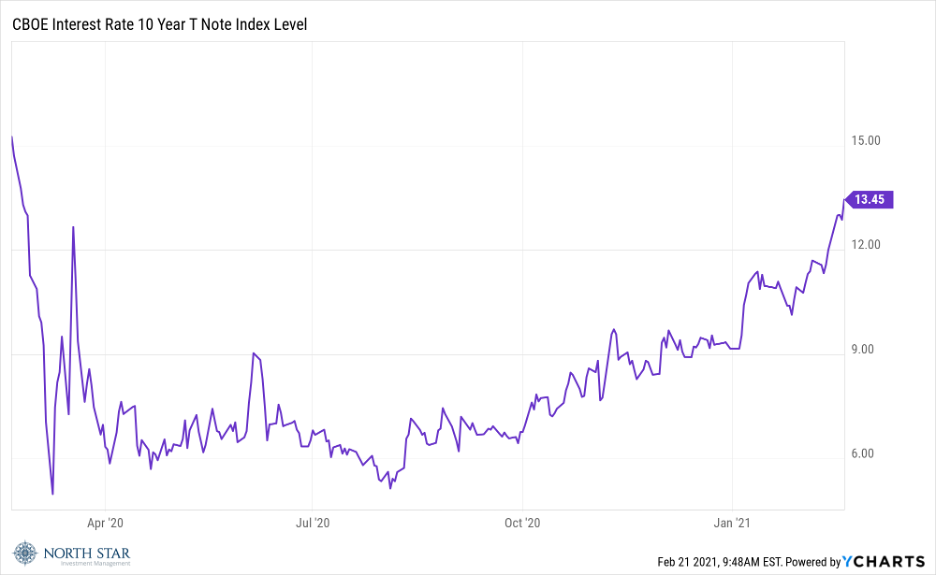

On the other end of the pendulum, initial claims for unemployment jumped to 861,000 versus 215,000 in the comparable week last year. Additionally, producer prices increased by 1.3%, which was the biggest monthly increase since December 2009. That combination of rising prices and elevated unemployment paints a far less rosy picture and presents an enormous challenge to the Fed’s ultra-accommodating monetary policy. Bonds yields have started to rise on the long end, as the yield on the Ten-Year Treasury increased another 15 basis points to 1.35%, its highest level in a year, and almost triple its level from last summer.

The stock market was closed on Monday in celebration of Presidents Day, and treaded water the rest of the week, with the S&P 500 and Russell 2000 declining 0.71% and 0.96% respectively. Tech stocks were amongst the worst performers as the Nasdaq dropped 1.57%. Where are we on valuation? The S&P 500 is now trading around 22 times 2021 consensus estimates. Whereas that multiple still seems high to us, we are getting more confident in the ability of companies to meet or exceed those estimates, which I have previously characterized as overly optimistic. This brings us back to COVID-19, where more people are being vaccinated and the number of new cases and deaths are falling. All forward-looking statements need to be accompanied by a disclaimer that they are based on the prevailing assumptions over the future of the pandemic. Based on the current set of assumptions, equities, particularly small-cap companies that will prosper as the economy reopens, should continue to attract investment dollars. Although expected future returns on the overall market might be below average given the current high P/E multiples. The outlook is much more challenging for fixed income with intermediate and longer maturities, making inflation-protected securities, such as TIPS, a safer investment option. Along those lines, we still believe portfolios would benefit from gold or other commodity exposure.

This Week:

The progress on the new stimulus bill will continue to be in focus. The Democrats are using a “budget reconciliation” process to move forward without Republican support. The stimulus package, called the American Rescue Plan Act of 2021, includes payment for up to $1,400 to individuals in need as soon as next month. The legislation would also potentially extend federal unemployment aid through August and fund vaccine distribution. Stimulus negotiations have been both continuous and cantankerous since July, so don’t count your chickens yet.

Earnings season enters the final innings, with 67 S&P 500 reporting results for the fourth quarter.

The economic calendar is light, with the report on personal income and spending for January on Friday likely in focus. Expectations are for a 9.9% increase in personal income and a 2.3% rise in consumption. Higher levels of consumption would be a good indicator of individual’s improved confidence in their future and would help fuel a more robust recovery.

Stocks on the Move:

We only had one company whose share price changed more than 10% during the week, by far the lowest number since we started the blog.

-11.4% Lakeland Industries Inc (LAKE) manufactures and distributes protective work clothing. The Company offers disposable, chemical, cleanroom, hand, arm, fire, and heat protective clothing for on-the-job hazards, toxic-waste cleanup, and industrial work. There was no significant company news last week. LAKE is a 1.3% position in the North Star Micro Cap Fund.

Final thought:

Let’s hope the recent path of the pendulum towards optimism does not get disrupted by unforeseen events. Stay warm and safe.