All Eyes (Including Ours) on Gas Prices

Perhaps the best way to describe the current market environment would be to edit the opening of Charles Dickens’ masterpiece “A Tale of Two Cities” by removing all the “best of times” references.

“It was the worst of time…it was the age of foolishness…it was the epoch of incredulity…it was the season of Darkness…it was the winter of despair…”

The S&P 500 sank 5.8%, its worst weekly decline since the onset of the pandemic in March 2020. In some measures it has been the most painful stretch of selling in the history of the stock market. The best performing sector was Health Care with a -4.6% decline, while the Oil & Gas sector nose-dived 12.3%. Small caps got pummeled, with the Russell 2000 shedding 7.5% of its value. Small caps are now down 26% in 2022, marking the worst first-half performance on record. Gold was down approximately 1% for the week, while the most visible cryptocurrency, Bitcoin, lost approximately 25% on the week.

The news was all bad. The Fed, apparently spooked by May’s spike in inflation and in direct contradiction from Chairman Powell’s comments less than a month ago, raised rates by 75 basis points on Wednesday. Additionally, there were signs that the economy is already slowing as the Housing and Retail Sales reports later in the week showed sharp declines. Following those soft reports, bond yields headed south, with the 10-year Treasury, having touched nearly 3.5% on Wednesday, backing up to 3.24% by the closing bell on Friday.

Our research team has been meeting with company management from our portfolio companies to take their temperature on current business conditions. So far, the consistent message is that while costs remain elevated, demand remains strong. Beth Garvey, CEO of BGSF Inc (BGSF), is hiring more regional managers to address higher demand for its Real Estate and Professional customers across the entire United States. Additionally, the Company has determined the “required minimum wage” across multiple verticals so that potential new hires are enticed to apply to open positions and BGSF’s clients are less adversely impacted by wage inflation.

Additionally, our weekly screening shows record numbers of bargains and the metrics both on the Russell 2000 and on our Fund holdings continue to reach the lowest valuation ratios in over a decade. Perhaps these bargain prices can provide a season of light and a spring of hope for investors.

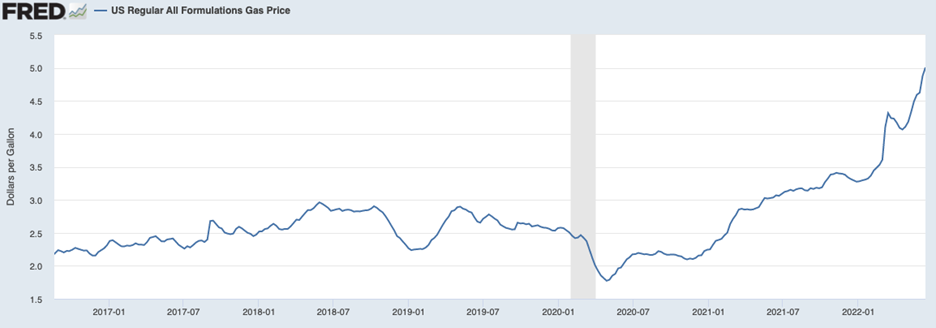

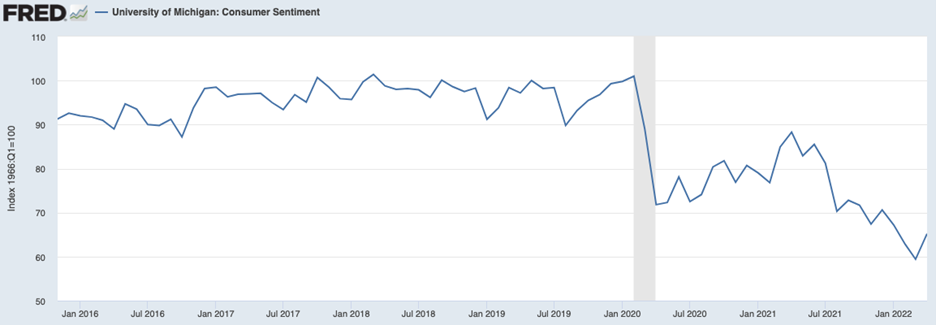

While of course news from eastern Europe and Fed Speak will be front-and-center for investors in the coming weeks and months, perhaps the most meaningful economic factor will be available to every U.S. driver every day: average gasoline prices. The two charts below show that historically low Consumer Sentiment readings have coincided with historically high gasoline prices. While there are other important economic statistics to professional investors and economists and policymakers, such as CPI, PPI, PMI, Unemployment, etc., for the average consumer fuel costs might be the most important statistic.

The average gas mileage of cars in the U.S.A. is approximately 25 miles per gallon, while the miles driven per week is 260. Therefore, the average driver is using approximately 10 gallons of gas per week and given the doubling of gas prices since before the pandemic, that equates to $25 per week increased operating costs and $100 more per month and $1200 more per year. The median U.S. income is $44,225 annually according to the professional career services firm, Zippia. So, the run-rate impact of $1,200 equates to approximately 3% of pretax income at the median income level. Forbes agrees with our analysis: “Broadly speaking the current picture suggests that consumers may have to cut back spending on other goods and services by 3% to cover rising energy costs.”

The gasoline price-related news is not positive. However, we remain vigilant for catalysts to lower fuel prices because the data is compelling that gas prices and consumer sentiment are highly indirectly correlated. A fall in gas prices would certainly be a boon to companies in the consumer discretionary sector, such as those “Target”ing (hint, hint, hint) the median income U.S. consumer.

To the Moon

The markets were closed on Monday in observance of the Juneteenth national holiday. Stocks prices moved higher Tuesday morning, as buyers looked to scoop up bargains following the previous week’s brutal declines.

The Fed will remain in focus as Chairman Jerome Powell is due to testify before Congress and expected to reiterate the need to combat inflation through aggressive rate hikes. A year ago, in our commentary we expressed the opinion that Chairman Powell was “pretending” (referencing the Eric Clapton song) that inflation was “transitory”, while continuing extraordinarily easy monetary policies. In the sage words of noted economist, Robert Z. Aliber, “Powell Fed has lost its credibility. The Fed was established to dampen shocks, not to amplify them. The Fed should publish a list of scheduled modest increases in interest rates over the next eighteen months, and then take a vacation on a rocket ship to the moon.”

The economic reports due out next week include updates on existing home sales on Tuesday, initial jobless claims on Thursday, and the University of Michigan reading on consumer sentiment on Friday, which as we just discussed has been at record low levels the last few months as gas prices have skyrocketed.

Developments concerning the war in Ukraine as well as the pandemic will continue to be of the utmost importance.

Stocks on the Move

Companies that moved with news…

-13.5% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. AMD plunged as the broader chip sector experienced a selloff related to recession concerns.

-16.7% The Blackstone Group Inc (BX) operates as an investment company. The Company focuses on real estate, hedge funds, private equity, leveraged lending, senior debts, and rescue financing. Asset manager stocks fell last week as the financing environment will become trickier and more expensive due to the 75-bps interest rate hike announced last week.

-11.7% KKR & Co Inc (KKR) operates as an investment firm. The Company manages investments such as private equity, energy, infrastructure, real estate, credit strategies, and hedge funds. Asset manager stocks fell last week as the financing environment will become trickier and more expensive due to the 75-bps interest rate hike announced last week.

-13.7% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Paramount slid last week along with the broader communications sector despite a report from Nielsen that showed streaming services representing a record share of 31.9% for all television usage.

-17.6% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. HEAR slid on news of videogame sales sinking to a 27-month low in May, with YTD spending on accessories down 14% y/y.

-15.0% Innovative Industrial Properties Inc (IIPR) owns and leases industrial real estate assets. The Company focuses on the acquisition, disposition, construction, development, and management of industrial facilities leased to tenants in the regulated medical-use cannabis industry. IIPR declared a $1.75/share quarterly dividend last week, in line with previous payouts. The Company also announced the acquisition of a Texas property for $12M which, once completed, will include 49,000 sq. ft. of cultivation space.

-10.4% John Wiley & Sons Inc (WLY) publishes print and electronic products. The Company specializes in scientific, technical, and medical books and journals, as well as professional and consumer books and subscription services. Wiley also provides textbooks and educational materials. WLY reported FQ4 non-GAAP earnings of $1.08 per share and revenue of $545.7M which beat consensus estimates by $0.11 and $5.4M respectively. For FY2023, the Company anticipates mid-single digit revenue growth and adjusted EPS performance to be adversely impacted by 35 cents of non-operational items such as higher interest expense, higher tax expense, and lower pension income.

-12.4% Denny’s Corporation (DENN) operates as a full-service family restaurant chain directly and through franchises. The Company consists of more than 1,700 franchised, licensed, and company-operated restaurants around the world. Denny’s price target was cut from $13 to $10 by Citi last week.

-22.0% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. GRBK was one of three homebuilder stocks downgraded by B. Riley last week on news of the 75-bps rate hike.

Companies that moved with no news…

-10.4% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations.

-12.1% BorgWarner (BWA) is the leader in clean and efficient technology solutions for combustion, hybrid, and electric vehicles. Its products help improve vehicle performance, propulsion efficiency, stability, and air quality.

-16.5% Madison Square Garden Entertainment Corp (MSGE) produces, presents, and hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, in its venues including New York’s Madison Square Garden, Hulu Theater, Radio City Music Hall, the Beacon Theater, and The Chicago Theater. The Company also operates entertainment dining and nightlife venues in New York City, Las Vegas, Los Angeles, Chicago, Singapore, and Australia under the Tao, Marquee, Lavo, Avenue, Beauty & Essex, and Cathédrale brand names.

-12.8% Apogee Enterprises Inc (APOG) designs and develops value-added glass products. The Company offers glass and aluminum windows, storefront and curtainwall systems, and glass for framed art and pictures. Customers include architects, general contractors, glazing subcontractors, and building owners.

-10.4% Douglas Dynamics Inc (PLOW) designs and manufactures snow and ice control equipment. The Company produces snowplows and sand and salt spreaders.

-14.7% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates.

-11.9% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin.

-13.2% Steelcase Inc (SCS) designs and manufactures products used to create high performance work environments. The Company offers products such as office furniture, furniture systems, interior architectural products, technology equipment, seating, and related products and services.

-11.0% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options.

-15.8% Accuray Inc (ARAY) designs, develops, and sells advanced radiosurgery and radiation therapy systems for the treatment of tumors throughout the body.

-11.3% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels.

-10.1% Great Lakes Dredge & Dock Corporation (GLDD) offers marine services. The Company deepens and maintains waterways, shipping channels, ports, creates and maintains beaches, excavates harbors, builds docks and piers, and restores aquatic and wetland habitats.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvest.com.