Last Week:

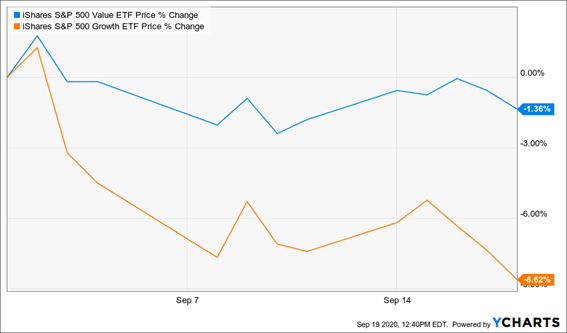

Hot tech IPOs and renewed optimism on the development of COVID-19 vaccines provided a springboard for a rally in the markets on Monday and Tuesday, but Wednesday afternoon’s FOMC meeting poked the bears back into action. The Nasdaq 100 sank as much as 2.8% on Thursday, dragged down by a slump in the mega cap technology stocks that have powered this year’s rebound. The slide came after Fed policy makers suggested that rates would remain near zero until 2024 due to challenges in the economy, pledging to keep interest rates low until inflation averages over 2%. The lack of any specific commitment on further quantitative easing, combined with the somber economic outlook, sent a shudder through tech stocks, which have benefited massively from rock-bottom rates. Near-zero borrowing costs have helped drive the Nasdaq 100 to over 40 times earnings, its highest price-earnings ratio since 2004. The selling continued on Friday leaving the S&P 500 in the red by -0.64%, its third straight week of losses. Despite the roller coaster ride, the VIX (volatility index) remained in its recent range and actually declined during the week.

The stability of the VIX at a somewhat elevated level suggests that the fear of a significant market sell-off has been fairly constant, regardless of the short-term rallies and retreats.

Bond volatility reached its lowest level on record as the yield on the Ten-Year Treasury was essentially unchanged at 68 basis points. “Lower for longer” seems baked into investor expectations for interest rates. The Consumer Sentiment Index registered at 78.9, which modestly exceeded expectations, but still is sharply lower than the pre-pandemic level. Gold inched up and the dollar inched down, both following their 2020 trends. Crude oil prices jumped 10% and the Energy sector was the best performance group in the equity markets. Over the last few weeks during the market downturn the beaten up “value” stocks, such as Energy and Financials, have had good relative performance, reversing a lengthy period of historic underperformance. We think the value universe remains very attractive for investment, especially the higher quality small-cap companies.

The clock kept ticking on the TikTok countdown without a clear outcome. The potential of retribution by China against U.S. tech companies could be contributing to their weakness.

This Week:

The major market-moving themes for the next 6 weeks will all be at play, with politics probably dominating the headlines this week. In addition to the hotly contested election in November and the multi-trillion gap between the two parties stimulus plans, Ruth Bader Ginsburg’s death over the weekend has vaulted the Supreme Court into the forefront.

COVID-19 cases and deaths remain elevated, while the development of vaccines and therapeutics accelerate. Winter is coming, and even though White Walkers (Game of Thrones reference) might be fictional, the Flu virus is for real.

Nike and Costco will report quarterly results, which could provide some information about the state of the consumer. On the macro scene, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify before Congress twice in an otherwise quiet economic calendar.

Stocks on the Move:

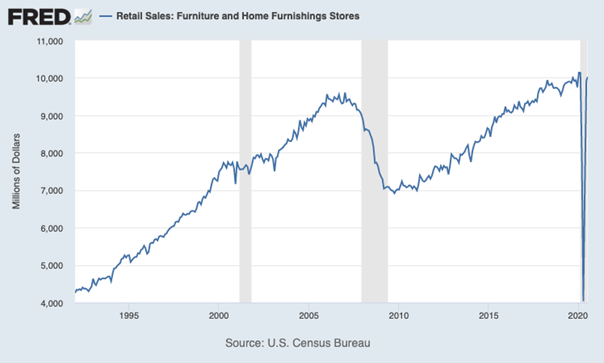

Three of the companies this week are furniture stocks, suggesting some industry tailwinds influenced by Herman Miller’s (NASDAQ: MLHR) most recent earnings. The graph below also demonstrates the recovery of this sector.

PRTS + 18.9%: CarParts.com Inc is an online provider of automotive aftermarket parts and repair information. The company principally sells its products to individual consumers through its network of websites and online marketplaces. The company’s products consist of collision parts servicing the body repair market, engine parts to serve the replacement parts market, and performance parts and accessories. There was no significant company news this week. PRTS is a 6.79% holding in the North Star Micro Cap Fund and a 2.69% holding in the North Star Opportunity Fund.

OESX + 11.7%: Orion Energy Systems Inc is a developer, manufacturer, and seller of lighting and energy management segments. Orion U.S. Markets segment sells commercial lighting systems and energy management systems to the wholesale contractor markets. Orion Engineered Systems segment, which is the key revenue driver, develops and sells lighting products, and provides construction and engineered services for commercial lighting and energy management systems. Orion Distribution Services segment focuses on selling lighting products through manufacturer representative agencies and a network of broadline North American distributors. There was no significant company news this week. OESX is a 6.27% holding in the North Star Micro Cap Fund and a 6.04% holding in the North Star Opportunity Fund.

APOG +20.6%: Apogee Enterprises Inc is a manufacturer of architectural glass and metal glass framings. The company also provides building glass installation services. Its four main business segments are Architectural Framing Systems; Architectural Glass; Architectural Services and Large-Scale Optical Technologies (LSO). It generates maximum revenue from the Architectural Framing Systems segment. The segment designs, engineers, fabricates, and finishes the aluminum frames used in customized aluminum and glass window, curtainwall, storefront, and entrance systems comprising the outside skin and entrances of commercial, institutional, and high-end multifamily residential buildings. This week, the company reported second-quarter fiscal 2021 EPS of 73 cents and revenues down 11% YoY. APOG is a 1.04% holding in the North Star Dividend Fund and a 0.88% holding in the North Star Micro Cap Fund.

CLCT +13.6%: Collectors Universe Inc provides authentication and grading services to dealers and collectors of coins, trading cards, event tickets, autographs and historical and sports memorabilia. The company generates revenues principally from the fees paid for its authentication and grading services. There was no significant company news this week. CLCT is a 4.21% holding in the North Star Dividend Fund and a 3.42% holding in the North Star Micro Cap Fund.

EPM +14%: Evolution Petroleum Corp is an independent oil and gas company operating in the U.S. It is engaged primarily in the acquisition, exploitation, and development of properties for the production of crude oil and natural gas, onshore in the United States. The company’s principal assets include interest in a carbon dioxide enhanced oil recovery project in Louisiana’s Delhi field. The revenue generated by the company includes royalty, mineral, and working interests. There was no significant company news this week. EPM is a 1.79% holding in the North Star Dividend Fund and a 0.80% holding in the North Star Micro Cap Fund.

FLXS: +21.9%: Flexsteel Industries Inc is a United States-based company that manufactures, imports, and markets residential and commercial upholstered wooden furniture products. The products offering include sofas, loveseats, chairs, rockers, desks, tables convertible bedding units and bedroom furniture. The company’s products are intended for use in home, office, hotel, healthcare, and other contract applications. This week, the company declared a $0.05 dividend, in line with historical numbers. As well as that, FLXS may be benefiting from industry tailwinds stated above this section. FLXS is a 2.38% holding in the North Star Dividend Fund.

SCS + 23.9%: Steelcase Inc is a furniture company primarily based in the United States and has operations in Europe, the Middle East, and Africa. Steelcase markets its products primarily through a network of independent and company-owned dealers. The company operates through the Americas and EMEA segments, which offers architecture, furniture and technology products as well as storage and seating solutions. There was no specific company news this week, however SCS may be benefiting from industry tailwinds stated above this section. SCS is a 1.07% holding in the North Star Dividend Fund.

ETH +10%: Ethan Allen Interiors Inc is a US-based company that manufactures and retails home furnishing and accessories. The company’s activities are divided between its wholesale unit that includes case goods, upholstered products, and home accents, and its Retail segment. This week, the company announced strong retail written orders ahead of an investor meeting. ETH is a 1.40% holding in the North Star Micro Cap Fund.

CNSL -12.4%: Consolidated Communications Holdings Inc provides communication services for businesses and residential customers. Its business product suite includes data and Internet solutions, voice, data center services, security services, managed and IT services, and an expanded suite of cloud services. It provides wholesale solutions to wireless and wireline carriers and other service providers including data, voice, network connections, and custom fiber builds and last-mile connections. This week, the company priced $750 million senior notes to initiate refinancing. CNSL is a 1.30% holding in the North Star Micro Cap Fund and CNSL corporate bonds are a 3.86% holding in the North Star Bond Fund and 1.76% holding in the North Star Opportunity Fund.

GRBK +11.8%: Green Brick Partners Inc acquires and develops land, as well as providing land and construction financing to its controlled builders. The company is engaged in various aspects of the homebuilding process, including land acquisition and development, entitlements, design, construction, marketing, sales, and brand image creation. Green Brick Partners segments its operations into land development and homebuilding services, which is subdivided into Texas and Georgia. This week, Zacks upgraded the stock to Strong Buy. GRBK is a 1.23% holding in the North Star Micro Cap Fund.

LAKE -11.5%: Lakeland Industries Inc manufactures and sells safety garments and accessories for industrial protective clothing market. It offers limited use / disposable protective clothing, chemical protective suits, and firefighting and heat protective apparel. Its customers include integrated oil, chemical/petrochemical, utilities, automobile, steels, glass, construction, smelting, munition plants, janitorial, pharmaceutical, mortuaries, as well as scientific and medical laboratories. There was no significant company news this week. LAKE is a 1.06% holding in the North Star Micro Cap Fund.