A Day Late & a Dollar Short

The financial markets were in a “blue Moody” with stocks suffering early in the week following the rating agency’s downgrade on 10 regional banks, and bond prices slumping on Friday in response to a stronger-than-expected producer price index report. The damage was minimal, with the S&P 500 losing a modest 0.3% and the yield on the 10-year Treasury rising just 11 basis points to 4.17%. The Mega cap tech stocks were the biggest losers, as the Nasdaq slid 1.9%, although the index is still ahead by a whopping 30.4% for the year. It was also a difficult week for small caps, with the Russell 2000 dropping 1.6%, while the Oil & Gas sector was the top performer.

The Moody’s downgrades combined with Fitch’s downgrade of the U.S. government’s debt the previous week both seem a day late and a dollar short, as the markets adjusted back in the spring to the stresses highlighted by those agencies. It is somewhat reminiscent of the financial crisis during which many AAA-rated securities were downgraded months after their prices suffered precipitous declines.

There was good news on Thursday from a benign consumer price index report that showed a 0.2% monthly increase, reinforcing that the Federal Reserve would hold off on further rate hikes. Economic data out of China suggests that the world’s second-largest economy could be looking at deflation, as its consumer prices fell in July by 0.3% year over year. The impact of China’s struggles on U.S. markets is a mixed bag, with some companies facing lower demand, and others benefiting from lower costs. In any event, a resilient economy with moderating inflation, and reasonable valuations (outside of the expensive popular tech mega caps) make the U.S. markets well-positioned to perform, particularly as corporate earnings resume their historic growth over the next few quarters. As investors remain hyper-focused on the tone of comments from the U.S. Federal Reserve, China’s economic trends may seep into policy-related comments as occurred in prior recessionary Chinese economic periods.

On the Chicago sports scene, the Bears looked good in their preseason victory over the Titans, while the Cubs have cooled off a bit but remain in the pennant race.

Back from Vacay

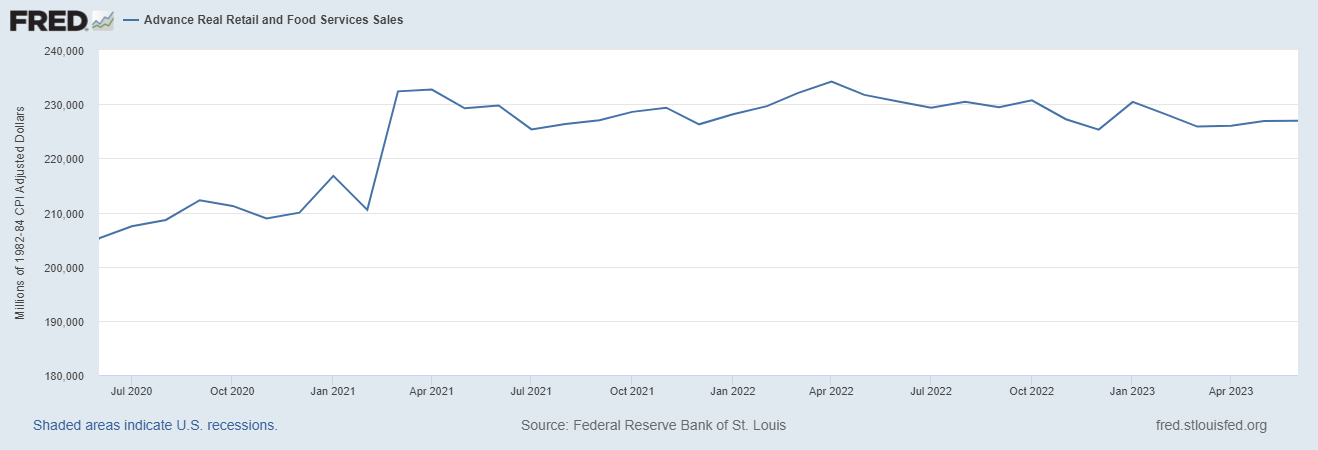

As the traditional August vacation period emerges this week and next, equity market trading volumes usually decline seasonally. However, quarterly earnings from retail heavyweights Home Depot, Target, and Walmart will attract attention this week, especially regarding comments on consumer spending trends. The consumer will also get attention this week from the U.S. Census Bureau’s July Retail Sales report. So far in the recent period of central bank interest rate increases, consumer spending has not slowed (see chart below), so any change in spending trajectory would likely be a surprise.

Finally, the July FOMC meeting minutes will be available this week. Given a strong signal from the Fed that it will pause its increase process, at least temporarily, we expect little attention to the meeting minutes.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.