Monetary Phenomenon

Bankers around the world stole the headlines and fortunately not their depositors’ money. The new breed of bankers is quite different than those envisioned in the song “A British Bank” from Mary Poppins:

“They must feel the thrill of totting up a balanced book

A thousand ciphers neatly in a row

When gazing at a graph that shows the profits up

Their little cup of joy should overflow!”

From Silicon Valley to New York and across the Atlantic to Switzerland, there was apparently little neat or balanced. The panic did not spread, as regulators swiftly stepped in and brokered rescue deals to minimize the contagion. Most notably, UBS came to terms to acquire Credit Suisse with the assistance of the Swiss government sending stocks sharply higher Monday and Tuesday. Those gains were erased on Wednesday after the Fed continued its negative jawboning and rate hikes. The actual statement from the FOMC was somewhat reasonable suggesting that future hikes were uncertain following the tightening credit conditions generated by the recent banking crisis. Chairman Powell’s comments during the press conference that followed, on the other hand, were disconcerting including his statement that rate cuts later in the year were not contemplated, and that monetary policy that would drive the unemployment rate up to 4.5% was appropriate. For those watching at home, that suggests it is good policy for a million people to lose their jobs to drive down inflation rate by an extra 1%. Fed funds futures and the bond market painted quite a different picture for the path forward on interest rates indeed forecasting a decline of over 1% in short-term rates by the end of the year. The stock market rebounded on Friday with the S&P 500 finishing the week +1.4%, the Nasdaq Composite +1.7%, and even banks and small caps managing to eke out small advances. The dollar, gold, and the yield on the 10-year Treasury were all little changed while crude oil bounced off recent lows leading the Oil and Gas sector to top the leaderboard with a 2.3% gain.

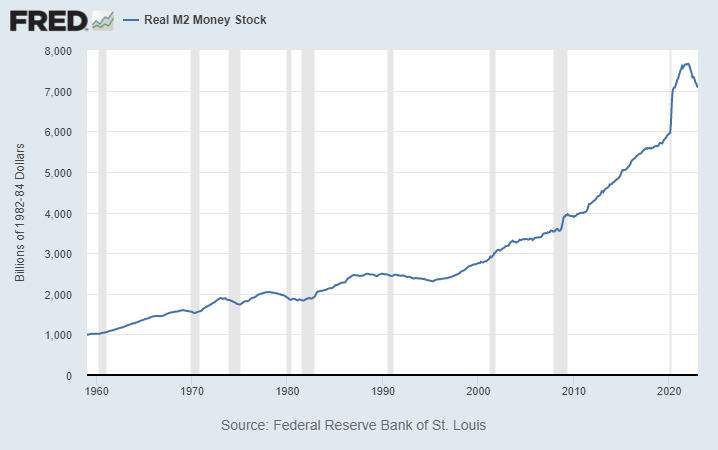

The recent sharp decline in the money supply combined with the gradual improvements in the supply chain provide a rationale for the market to discount the Fed’s hawkish rhetoric. After all, economist Milton Friedman famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

The below chart of the money supply – known as M2 – shows a recent sharp decline in what the Fed defines as “…U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.” More simply put, M2 is currency and other assets frequently convertible into currency.

While a sharp M2 decline suggests lessening inflationary pressures, it also foreshadows an economic slowdown, and a shift from spending on items that typically need to be financed to items less commonly financed. In other words, while tighter credit availability can diminish some opportunities, it also allows the shareholders of other companies to enjoy “gazing at a graph that shows profits up”. We are focused on uncovering those opportunities.

Chicago Sports Scene

The Bulls are hot, winning seven of their last ten games, and pretty much locking up the coveted final playoff spot in the Eastern Conference.

The White Sox and Cubs are both undefeated, with only 162 games ahead of them to keep those perfect records. Opening day is this Thursday, with the Cubs hosting the Brewers at Wrigley Field and the Sox on the road at Houston versus the Astros.

In Flux

Banks will dominate the headlines again as information on the health of other financial institutions remains in flux. The blame game will be in play as the Senate Banking Committee holds a hearing on bank failures, with the witness list including FDIC Chairman Martin Gruenberg, Federal Reserve Vice Chairman Michael Barr, and Treasury Undersecretary Nellie Liang.

The economic and earnings calendars are light.

Stocks on the Move

-14.9% Movado Group Inc (MOV) designs, manufactures, retails, and distributes watches, as well as jewelry, tabletop, and accessory products. Its brands include Movado, Calvin Klein, Hugo Boss, Lacoste, Ferrari, Coach, and Tommy Hilfiger. Last week, Movado reported fourth quarter adjusted earnings of $1.03 per share and revenue of $194.3M which beat consensus estimates by $0.17 and $10M, respectively. The company also declared a regular dividend of $0.35 per share, as well as a special dividend of $1.00 per share. The sell off was attributed to very soft guidance for this upcoming fiscal year. Management is projecting net sales between $725M-$750M and EPS between $2.70-$2.90, which is significantly below the $814M and $4.61 EPS expectation. The company believes it will “continue to face a difficult retail market in the U.S. and Europe.”

-16.1% Duluth Holdings Inc (DLTH) is a lifestyle brand of men’s and women’s casual wear, workwear, and accessories sold primarily through the Company’s own omnichannel platform. The Company’s products are marketed under the Duluth Trading names, with most products being exclusively developed and sold as Duluth Trading branded merchandise. There was no significant news last week.

-12.6% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals. There was no significant news last week.

-11.7% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Superior Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. There was no significant news last week.

+11.1% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. There was no significant news last week.

+12.8% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant news last week.

+13.0% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. There was no significant news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.