Last Week:

First quarter corporate earnings continued to hop over the low bar that was set as positive earnings surprises reported by companies in multiple sectors (led by the Health Care sector) were responsible for a decrease in the overall earnings decline to 0.8% from 2.3% the week earlier. The market inched up to new record levels on Tuesday, however the unanimous decision by the Fed to leave rates unchanged on Wednesday led to a steep decline that erased those gains. A surprisingly strong Jobs reports on Friday, indicating the lowest unemployment rate in 50 years, sparked a nice rally that took the market to a 0.2% gain for the week.

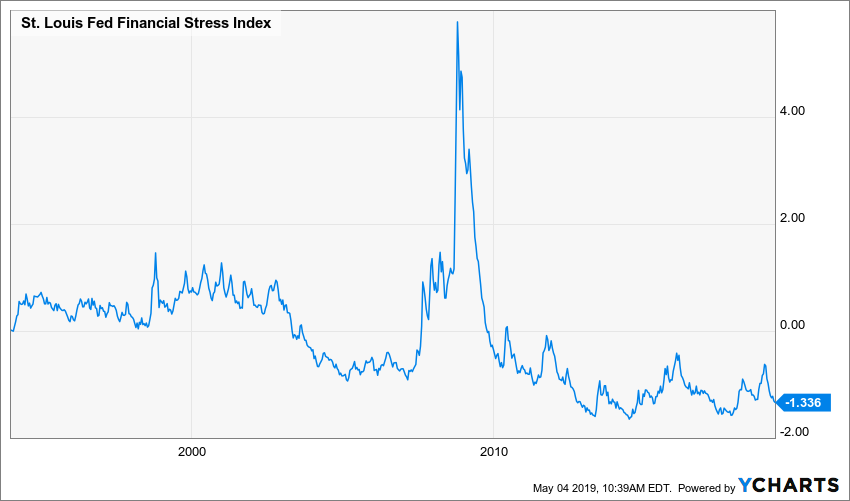

The much-repeated adage on Wall Street is to be fearful when others are greedy, and greedy when others are fearful. Throughout most of this 10-year-old Bull market that followed the financial crisis, investors have seemed complacent rather than fearful or greedy. As such we would like to coin a new phrase, “be attentive when others are complacent”. In particular we have been following the St. Louis Fed Financial Stress Index for warning signs. The St. Louis Fed Financial Stress Index (STLFSI) measures the degree of financial stress in U.S. markets. The STLFSI combines 18 financial market variables into a single index that is compiled on a weekly basis. The index consists of seven interest rate series, six yield spreads and five other indicators. A value of zero represents the long-term average of financial market stress. Values above zero indicate above-average financial stress while values below zero indicate below-average financial stress. The Index did give warnings signs in advance of the last two recessions as seen below.

The good news is that the recent uptick in the Index never reached zero and has recently returned back to near the historic lows.

The yield on the Ten-Year Treasury was more or less unchanged (again) at 2.53%. These very low levels of interest rates provide nice support for the somewhat high valuation of 16.8x forward earnings for the S&P 500.

This Week:

Earnings season will start to wind down, with 59 S&P 500 companies reporting results. If the recent pattern of positive surprises continues, then composite earnings might end up growing marginally for the quarter.

Chinese Vice Premier Liu He might return to Washington to continue trade talks, however the negotiations took a nasty turn over the weekend when President Trump tweeted that the talks were occurring “too slowly” and declared a 10% increase on $200 billion of Chinese imports to take place on Friday with additional tariffs will be apply “shortly”.

On Thursday, the March trade deficit is expected to have widened to $50.9 billion. PPI on Thursday and CPI on Friday will put inflation report in focus. An inflation reading over 2.1% might cause concern, while a reading under 1.9% will put pressure on the Fed to cut rates.

NBA and NHL playoffs continue, as the Bulls and Blackhawks players enjoy their lengthy vacations.

Stocks in the News:

PETIQ, Inc. (PETQ) -13.9%: PetIQ is a manufacturer and distributor of health and wellness products for dogs and cats. Short-seller Spruce Point Capital Management released a scathing report on PetIQ, which was countered by several Wall Street research firms later in the week. PETQ is a 1.03% holding in the North Star Opportunity Fund.

Brooks Automation, Inc.(BRKS) +23.44%: The Company has two core business segments: Brooks Semiconductor Solutions Group, which primarily provides wafer handling robotics and systems, semiconductor contamination control solutions, cryogenic pumps and compressors, and support services; and Brooks Life Science Systems, which mainly provides automated cold-storage systems, sample management services, consumables, instruments and devices, informatics, and support services. Revenue for the quarter was $198 million, up 11% sequentially and 26% year-over-year, and GAAP operating income was $14 million, an increase of 156% compared to the first quarter of 2019 and 32% higher compared with the second quarter of 2018. “We are pleased to report solid Q2 operating results with 26% year-over-year revenue growth. Life Sciences grew 76% while Semiconductor Solutions remained solid with 4% growth, despite the semiconductor capital equipment slow down. Our Semiconductor Solutions resilience is a testament to our product portfolio that serves a broadening customer base across the range of chip technologies,” commented Steve Schwartz, president and CEO. BRKS is a 2.43% holding in the North Star Dividend Fund.

Ethan Allen Interiors, Inc. (ETH) +11.81%: Ethan Allen manufactures and retails home furnishings and accessories. During the third quarter, improved gross margin, cost containment and a lower effective tax rate helped drive a 233% increase in diluted earnings per share taking diluted EPS to $0.30 up from $0.09 in the prior year third quarter. Consolidated net sales were $177.8 million compared to $181.4 million. An increase of 1.5% for retail net sales was offset by a decrease of 8.9% for wholesale net sales. ETH is a 2.56% holding in the North Star Dividend Fund.

Allied Motion Technologies, Inc. (AMOT) +13.54%: Allied Motion designs, manufactures and sells precision and specialty motion control components and systems. Record revenue of $93.9 million was up $17.3 million, or 22.6%. The increase was due to growth across all of the Company’s served markets. Earnings before interest, taxes, depreciation, amortization, stock compensation expense and business development costs (“Adjusted EBITDA”) was $11.7 million, up $2.0 million or 20%. “Our One Allied approach continues to prove effective, driving strong organic growth and record orders as we expanded our market share in many of our served markets. Further, our acquisition of TCI is meeting our expectations as it has expanded our offerings, brought excellent talent and broadened our markets. TCI’s new projects and customers complemented our organic growth to drive total revenue up 23%,” commented Dick Warzala, Chairman and CEO. AMOT is a 1.12% holding in the North Star Micro Cap Fund.

Johnson Outdoors, Inc. (JOUT) + 13.35%: Johnson Outdoors is a global manufacturer and marketer of branded seasonal, outdoor recreation products. “Innovation is at the core of who we are, powering sustained marketplace success and growth of our brands. This year’s strong customer response to new products and the ongoing popularity of legacy innovations firmly position Minn Kota® and Humminbird® on an upward trajectory heading into the warm-weather season. Likewise, Diving is benefitting from new product performance, currently representing about a third of Scubapro® sales. Conversely, challenging market conditions in Watercraft Recreation and Camping emphasize the critical importance of continued investment in digital and marketing excellence and eCommerce sophistication,” said Helen Johnson-Leipold, Chairman and Chief Executive Officer. Sales in the second fiscal quarter reflect shipments to customers in anticipation of the primary retail-selling period for the outdoor recreation industry’s warm-weather products. Net sales rose 7 percent to $177.7 million in the current fiscal second quarter compared to $165.8 million in the prior year quarter, driven by positive momentum in the Company’s Fishing and Diving groups. Net income of $21.9 million, or $2.18 per diluted share, in the fiscal second quarter improved slightly versus the previous fiscal year’s second quarter. JOUT is a 4.11% holding in the North Star Micro Cap Fund.

Portfolio holdings are subject to change and should not be considered investment advice.

North Star Investment Management Corp. is the Advisor for the North Star Family Mutual Funds.