Last Week:

We concluded our June 8th commentary with “Perhaps the glass is half full?” noting the surprising strong jobs report and the 43% bounce in the S&P 500 from its March 23 lows. On Monday the S&P 500 broke even for the year, and the Nasdaq Composite hit a record high. The mood shifted towards the middle of the week, with a nearly 7% decline on Thursday. A Friday afternoon rally cut the losses; nevertheless, it was the worst week since March with the S&P 500 dropping 4.78% and the Russell 2000 slumping 7.93%. It is worth noting that the Russell 2000 is down 16.83% for the year, as concerns persist over the financial strength of smaller companies to survive the current economic upheaval.

The sell-off was blamed on Federal Reserve Chairman Jerome Powell’s somber forecast for the economy as well as a rise in COVID-19 cases in a number of states. Specifically, the Fed Chair called the poor state of small businesses “alarming”. In my opinion it was more likely just traders taking their profits after the rally got overextended. Anyone who was surprised by either Chairman Powell’s comments or by the rise in new cases after the reopening of all 50 states must have felt the glass was not only full but overflowing.

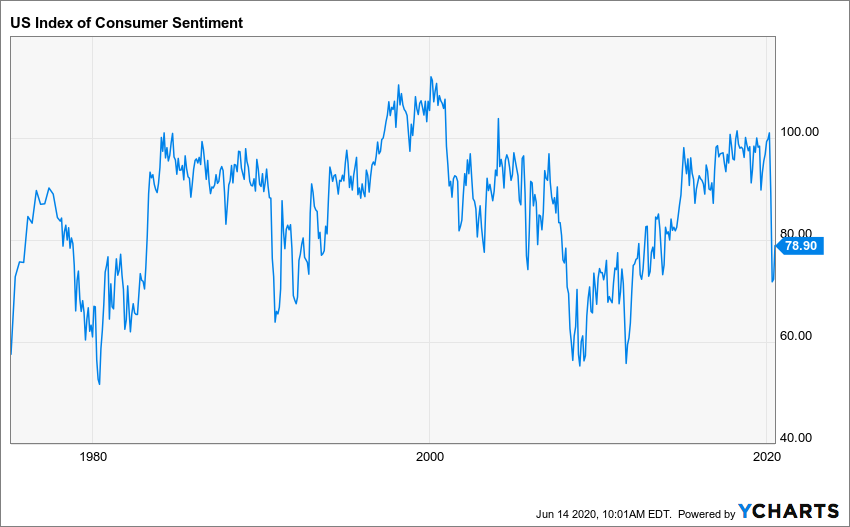

Speaking of confidence, The University of Michigan’s consumer sentiment for the U.S. rose to 78.9 in June 2020 from 72.3 in the previous month and above market expectations of 75, a preliminary estimate showed. The reopening of the economy spurred the optimism, with more consumers expecting declines in the jobless rate than at any other time in the history of the survey. Whereas the reading is still substantially below its pre-COVID-19 level, it is also higher than it was many times over the last 35 years.

More often than not Consumer Sentiment has rebounded swiftly from sharp downturns, although often it takes many years to return to fully recover.

Oil posted its first weekly loss since late April, with Crude dropping 8.3% and Oil & Gas stocks shedding 13.4% of their value. Gold tacked on 3.2% while the yield on the Ten-Year Treasury and the dollar were both more or less unchanged. The silver lining of Chairman Powell’s economic assessment is that short-term interest rates are likely to remain close to zero for a prolonged period.

This Week:

The economic calendar is light, with focus likely on Tuesday’s report on May retail sales with the consensus forecast for a 6.3% increase following a 16.2% decline in April. Additionally on Tuesday the NAHB Housing Market Index for June will be released, and on Wednesday housing starts for May is on the schedule. The housing market is expected to be a relative bright spot in an otherwise very challenged economic environment.

Once again, we are skating on thin ice with the pandemic, the most challenged economy in over 80 years, uncertain relations with China (as well as with pretty much every other nation), and the greatest civil unrest since the 1960s. Let’s be careful out there (1970s TV reference).

Stocks on the Move:

Our two biggest gainers from the previous week were were biggest decliners this week. Meredith Corp.(MDP) dropped 23.4% following its 42.3% rise and Boot Barn Holdings fell 20.8% after having advanced 35.2%. There was no company specific news on either company, but both are are very levered to the health of the U.S. economy.

Lakeland Industries, Inc. (LAKE) shares surged 34.4% after reporting financial results that exceeded expectations. Lakeland CEO Charles Roberson commented that, “Our fiscal 2021 first quarter performance was extraordinary with record setting financial results that validate our belief that owning our own manufacturing and having a resilient supply chain are essential to being a global leader in the PPE (personal protection equipment) market.”