Inflationary Data vs. Deflationary Outlook

The S&P 500 turned sharply lower, wiping out the previous week’s 3.7% gain plus another 1%, with a loss of 4.8% for the five-day session. The Nasdaq fared even worse, suffering a 5.5% decline, the Russell 2000 shed 4.5%, and all eleven sectors finished in the red. Most of the damage was done on Tuesday after a hotter-than-anticipated CPI report, with the headline print for August rising 8.3% from a year ago. Even though the month-over-month increase in CPI was only 0.1%, U.S stocks lost almost $4 trillion of market value in one day. Looking more carefully at the breakdown of the cost increases, it was almost entirely in food and shelter, while many other costs declined. Additionally, it was the smallest monthly increase in food costs this year, suggesting a positive trend.

Supporting our view that inflation has begun to retreat, evidence of the economic slowdown came on Friday when FedEx Corp (FDX) pulled its full-year guidance and warned it will implement cost-cutting initiatives to contend with soft global shipment volumes due to what it sees as a significantly worsening global economy. The market didn’t like that news either, as stocks traded deep in the red all day, with a likely short-covering rally during the last hour somewhat lessening the pain.

On other fronts, the Dollar continued to climb, while Crude Oil and Gold both declined. The yield on the 10-year Treasury increased 8-basis points to 3.45%, its highest level in over a decade. The yield curve remained inverted, with 2-year rates about 40 basis points higher than the 10-year rate. Whereas 3.5% or 4% seems high during the last 14 years of government coordinated artificially low rates, 8% rates were common through the 80s, and 6% plus rates throughout the 90s, and 4-5% rates prior to the Financial Crisis of 2008.

North Star Senior Research Analyst Jim Lane monitors a wide variety of economic data points that are relevant to our portfolio holdings. Based on that analysis, we believe that the Fed is once again behind the curve, fighting the battle against inflation a year too late, and with evidence that the inflation rate might drop precipitously in the near-term. His analysis follows:

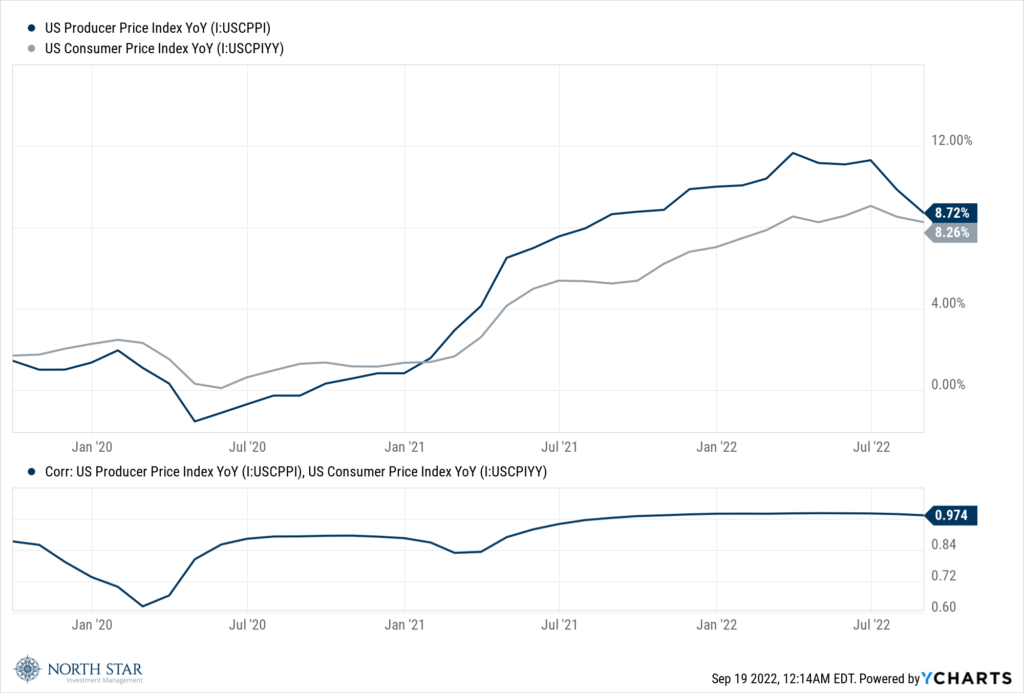

Financial market participants certainly seemed to take the Tuesday inflation data as confirmation of a long runaway of upward interest rates for the foreseeable future. But…not so fast. While some of the 20-or-so PPI components we track, such as “Tires for Trucks and Buses” and “Leather, Hides, Skins, and Related Products for Footwear,” continue to increase at high rates, others are beginning to decelerate, such as “Office Supplies” and “Luxury Hotels.” In fact, on Wednesday, September 14th, the Bureau of Labor Statistics (BLS) reported that the “Goods” component of the PPI declined 1.2% while overall PPI was 8.7% year-over-year versus 9.8% in July and 11.2% in June 2022. The two straight months of PPI deceleration is the first time that has happened since March 2020. As we stated in March of 2021 when our research showed PPI accelerating in many verticals prior to such inflation showing up in the Consumer Price Index (CPI), we believe PPI is more predictive than CPI. In our view, PPI readings will likely surprise lower-than-expected in coming months.

The recent PPI deceleration is consistent with recent news from corporations that provide real economy-based market data points rather than survey-based calculations that the BLS supplies in CPI and PPI; until recently, corporate earnings disappointments in 2022 were largely margin-related due to rising input costs. But this past week along-came-a-spider called FedEx Corp (FDX); this was the highest profile company to announce slowing sales and unit volumes. Similarly, just this week, the Wall Street Journal highlighted the over-production and over-supply of goods that Scotts Miracle-Gro (SMG) is wrestling with; SMG is struggling to clear excess inventory that resulted from expanding production during the peak of yardwork and gardening that the Covid-19 pandemic shutdowns triggered. From our conversations with corporations and our research, SMG is not alone. The SMG situation mirrors that at Newell Rubbermaid (NWL), which the prior week announced a sales shortfall. In that announcement on September 6th, Newell Rubbermaid lowered its sales guidance, explaining “we have experienced a significantly greater than expected pullback in retailer orders.” Based on these recent trends from FDX, SMG and NWL and our discussions with other companies, it seems that the Covid-19 induced production and inventory increases were as contagious as the virus. Our research shows similar bloated inventories across a broad range of products in many industries including some medical consumables, recreation products, homebuilding materials, and everyday household items.

In our view, the PPI and CPI survey data that the Fed focuses on lags the real economy market data that corporations provide; that real economy market data is signaling deflationary forces gaining strength. Inventory flushes and production cutbacks that could lead to higher unemployment seem likely. In the short run, the consumer might benefit from less inflation and even some deflation in more and more areas other than just the retail gas prices that have fallen throughout the summer months. We expect gradually more dovish Fed-speak as increasingly recessionary data emerges as most corporations slow production, lower output, and likely reduce employee headcount.

Our discussions and research on earnings trends suggest the Fed is defying the “skate to where the puck is going” advice of the “Great One” Wayne Gretzky as the Fed’s hawkish tone is generated from where prices have been recently, rather than where prices are very likely heading. Last year in 2021, the Fed was late to recognize that inflation was going to be sticky rather than “transitory” and it increasingly looks to us that the Fed may be missing emerging deflationary forces – late yet again. Whenever the Fed does recognize what we are already seeing, equity markets should begin discounting a less hawkish Fed and more positive economic growth prospects. We are not holding our breath given this Fed’s track record, but we are positioned well for such a sentiment pivot.

It was also a tough week for Chicago sports fans, as the Chicago Bears were the only Bears suffering defeat, as Aaron (“I own you”) Rodgers and his Green Bay Packers beat up on them Sunday night at Lambeau Field. Additionally, The White Sox slipped another game behind the Cleveland Guardians in the AL Central.

Another FOMC Meeting

On Wednesday, the Federal Open Market Committee will announce its decision on monetary policy, with a high likelihood of an increase in the Fed Funds rate by 75 basis points to a range of 3%-3.25% We have made clear in this commentary, as well as seemingly every weekly commentary for and the last 15 months, our viewpoint on appropriate monetary policy. Hopefully Chairman Powell will emphasize that future decisions will be data dependent, rather than jawboning the market down and the economy into a recession.

Stocks on the Move

-11.1% United Parcel Service Inc (UPS) delivers packages and documents throughout the United States and in other countries/territories. The Company also provides global supply chain services and less-than-truckload transportation; primarily in the United States, UPS’s business consists of air and group pick-up and delivery networks. UPS was down with the broader market last week and was also sold off in response to FedEx Corp’s (FDX) disappointing earnings pre-announcement where they withdrew guidance and disclosed volumes were down globally due to worsening macroeconomic trends.

-18.3% Steelcase Inc (SCS) designs and manufactures products used to create high performance work environments. The Company offers products such as office furniture, furniture systems, interior architectural products, technology equipment, seating, and related products and services. Steelcase shares fell last week after being downgraded from “Buy” to “Neutral” by Sidoti on concerns of declining office furniture demand and excruciating inflationary pressures from its EMEA markets. The company has continued to increase prices and implement surcharges in response to these cost headwinds.

+21.2% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. There was no significant company news last week.

-22.1% DallasNews Corporation (DALN) is the Dallas-based holding company of The Dallas Morning News and Medium Giant. The Dallas Morning News is Texas’ leading daily newspaper with a strong journalistic reputation, intense regional focus, and close community ties. Medium Giant is a media and marketing agency of divergent thinkers who devise strategies that deepen connections, expand influence, and scale success for clients nationwide. There was no significant company news last week.

-16.3% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. There was no significant company news last week.

-15.3% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

-13.5% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Super Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. There was no significant company news last week.

-12.8% ABM Industries Incorporated (ABM) is a facility services contractor. The Company provides air conditioning, engineering, janitorial, lighting, parking security, and other outsourced facility services to commercial, industrial, and institutional customers. There was no significant company news last week.

-11.4% Orion Energy Systems Inc (OESX) manufactures, sells, installs, and implements energy management systems for commercial office and retail, exterior area lighting, and industrial applications in North America. It offers interior light emitting diode (LED) high bay fixtures; smart building control systems; and LED troffer door retrofit for use in office or retail grid ceilings. In addition, it provides lighting-related energy management services, such as site assessment, utility incentive and government subsidy management, engineering design, project management, and recycling. There was no significant company news last week.

-10.7% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. There was no significant company news last week.

-10.7% 1-800-Flowers.com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no significant company news last week.

-10.5% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. There was no significant company news last week.

-10.1% Allied Motion Technologies Inc (AMOT) designs, manufactures, and sells motion control products into applications that serve various industry sectors. The Company supplies precision motion control components that incorporated into a number of end products, including high-definition printers, barcode scanners, surgical tools, robotic systems, wheelchairs, and weapon systems. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.