Last Week

Over the decades many championship basketball teams have been built on a “Big 3” superstars foundation. As Chicago sports fans we would highlight Jordan, Pippen, and Rodman, of the 95-98 Bulls as a prime example although there have been other (less lovable) trios as well.

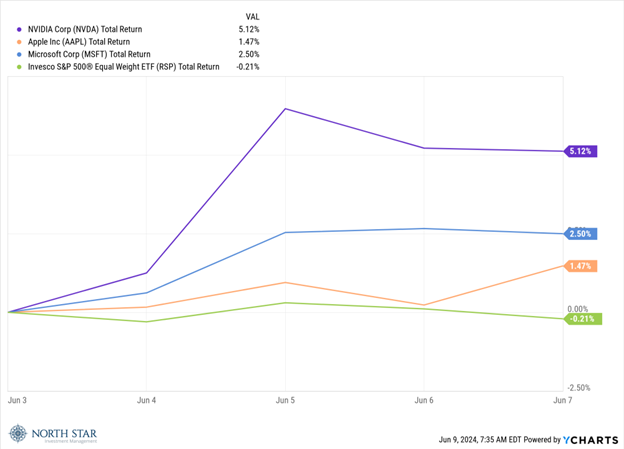

Turning to the stock market, last year’s “Magnificient 7” has morphed into a “Big 3” as Microsoft, Nvidia, and Apple, now comprise over 20% of the total value of the S&P 500. Indeed, for another week, the Big 3 continued to score, while the stats for the rest of the players in league languished.

In fact, during the week there were 70% more declining issues than advancing issues, Mid Caps were down 2.1% and Small Caps were off 2.5%, nevertheless the S&P 500 gained 1.3% for the week. Whereas momentum traders can enjoy the ride, we do caution that trees don’t grow to the sky and that the valuations of the Big 3 are getting very stretched with a combined market cap of $9 trillion and forward P/E multiples in excess of 30x.

The economic data for the week was mixed, with the May ISM Manufacturing report indicating the 2nd consecutive month of contraction, while economic activity in the Services sector grew. The jobs reports were the most confusing with government data showing a surprising surge in jobs growth, but with an increase in the unemployment rate and conflicting data from the household survey suggesting no jobs growth in May. Bond yield dropped on the weak economic reports, but then moved higher on the jobs report, with the yield on the 10-year Treasury still declining 7 basis points during the week to 4.43%. The dollar held steady, while gold and oil prices slipped marginally.

This Week

Wednesday will be the most interesting day, with the FOMC monetary policy announcement and the CPI report both on the schedule. The central bank will undoubtedly leave rates unchanged, but traders will be looking for any nuances in the language of the release and in the economic projections. The CPI is expected to remain stuck in the 3.4% area, any deviation, even one-tenth higher or lower, could move the financial markets.

The “Big 3” will remain in focus as Apple is widely expected to announce a partnership today with ChatGPT maker OpenAI and unveil tools that could reinvigorate iPhone sales. Experts say Apple’s AI capabilities will especially benefit its Siri personal assistant as the company seeks to go beyond what competitors like Samsung and Microsoft have already introduced for their smartphones and computers. Additionally, Envida will be trading post its 10 for 1 stock split which could create even more active trading volume.

European shares were under pressure Monday morning as Far-right parties are projected to win a record number of seats in the European Parliament following voting across the EU’s 27 member states. In France, President Emmanuel Macron dissolved his country’s parliament and called snap elections. Exit polls also showed gains for far-right parties in Germany and Austria, among others, though the mainstream center-right European People’s Party is predicted to remain the largest political grouping in Brussels.

We have generally refrained from commenting about the extremely volatile geopolitical landscape, as the U.S. markets have largely been immune thus far from the various powder kegs around the globe. We hope the resilient markets might be reflecting the probability of conflict resolutions, rather than blind optimism.