Steep and Cheap

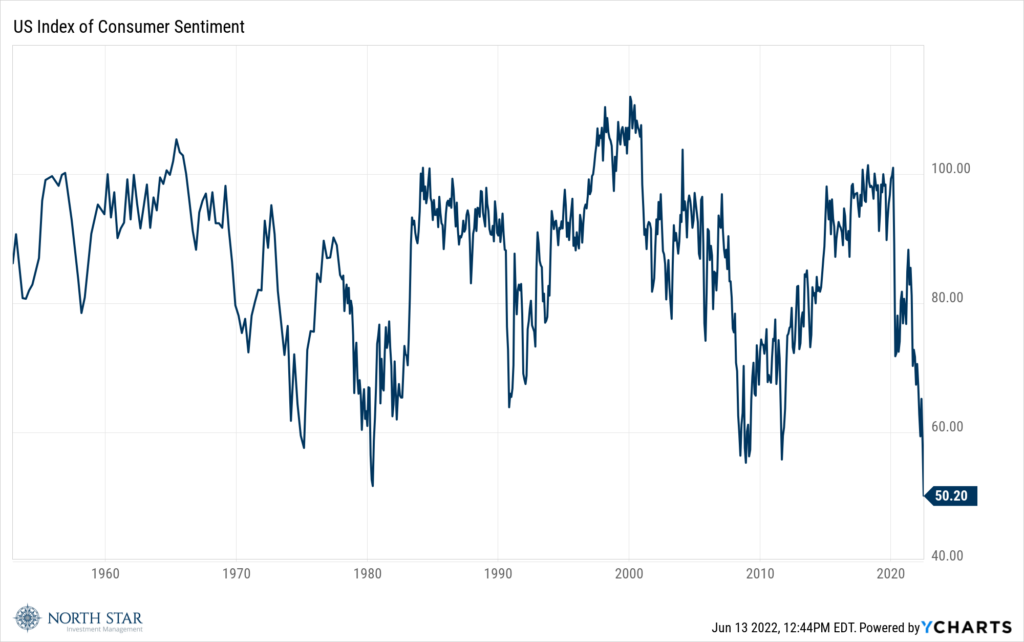

At 3pm ET on Thursday afternoon, apparently some traders gained conviction that the highly anticipated economic releases the following morning were going to paint a bleak picture. Unfortunately, that intuition proved correct, as the CPI report for May showed the largest annual increase since 1981, while consumer sentiment registered at its lowest level on record. During that final hour of trading Thursday and Friday’s trading session the market tumbled terribly, leading to the steepest weekly loss since January. Every sector experienced declines with Financials, Consumer Services, and Technology faring the worst. The S&P 500 shed 5.1%, the Nasdaq slid 5.6%, and the Russell 2000 skidded 4.4%. The dollar, gold, and crude oil all rallied, while the yield on the 10-Year Treasury jumped 20 basis points to 3.16%.

While being acutely aware of the challenges presented by the pandemic, the war, and tightening monetary policy, the level of pessimism is nevertheless surprising. Corporate profits are at record levels, interest rates are still at historically very low levels, household wealth is very high, and the jobs market is extremely healthy.

Are these really the darkest skies we have faced in the last seven decades? However, there is one definite economic factor that is at an all-time troubling level: gasoline. Last week, the national average price exceeded $5 per gallon for the first time ever. While this is only a fractional component of household expenses, it is a highly in-your-face component of household expenses – gas prices per gallon as posted at gas stations on every road might be the most visible example of the rising cost of living nationwide. As such, the historically-low consumer sentiment reading is likely somewhat tied to retail gas prices – if so, any relief in retail gas prices would likely lift consumer sentiment and related economic trends.

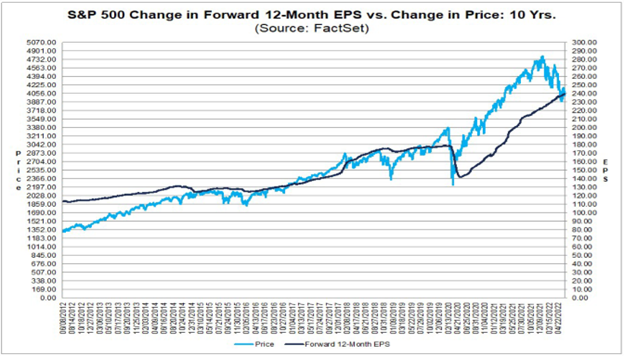

Following the approximate 20% decline and at 16.8x projected forward earnings, has the stock market fully adjusted to a new interest rate environment? The chart below suggests that equities are no longer overvalued, and future returns will likely mirror the growth in earnings. If inflation and interest rates peak later this summer, then strong free cash flow businesses that pay a reasonable portion of cash flow out as dividend may become very attractive. As the calendar advances further toward the easier comparisons versus the late 2021 and 2022 inflation surges, then equity markets volatility will likely decline and the growth in earnings should accelerate.

Paying the Price of COVID-Era Policy

Inflationary pressures will remain in focus as on Tuesday the BLS will release the producer price index for May. As we pointed out in March 2020 when numerous industry-specific PPI statistics began accelerating consistently, rising producer prices tend to lead to higher consumer prices, so any significant deviation from the 10.8% annual rise forecasted could move markets dramatically; any deceleration in PPI could trigger panic buying while any PPI surprise above the consensus would likely increase expectations for Fed rate increase increments. The key events of the week will come the following day, with the FOMC rate announcement and subsequent press conference with Fed Chairman Jerome Powell. The fed is widely anticipated to raise rates 50-basis points , although the odds for a 75-point rate hike jumped to 20% from 5% following last week’s CPI report. While we support the notion that the Fed needs to return to more normal monetary policies, we are in the camp that believes that the Fed cannot solve the supply chain problems and materials shortages by raising interest rates. We would like to see other aggressive programs to address those shortages, rather than just waiting for the pandemic to subside and the war to end.

Unfortunately, the weekend repose did not improve the blue mood of investors. The selling pressure resumed Monday morning across most asset classes, with weakness in digital assets such as cryptocurrencies particularly pronounced. In the past we have found that “risk-off” results in “bargains-on” for investors with a long-term value focus.

Stocks on the Move

-10.8% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. AMD, along with the broader semiconductor industry, sunk last week as rumors circulated that Intel Corp’s executives spoke at an investor conference and sounded “incrementally more cautious.”

-15.4% ABM Industries Incorporated (ABM) is a facility services contractor. The Company provides air conditioning, engineering, janitorial, lighting, parking security, and other outsourced facility services to commercial, industrial, and institutional customers. ABM’s stock fell last week despite reporting FQ2 earnings of $0.89 and revenue of $1.9B that beat consensus estimates by $0.05 and $20M, respectively. CEO Scott Salmirs commented on the company’s outlook: “…continued favorable market demand trends for core janitorial services as well as solutions that enable clients to achieve sustainability initiatives…” The stock’s decline may have been a result of the company’s struggles with labor availability and wage inflation, two headwinds that are not expected to subside for the next couple of quarters.

-22.1% Sharps Compliance Corp (SMED) operates as a provider of waste management services. The Company offers containment, transportation, treatment, and tracking of medical waste, and the disposal of unused medications as well as other used health care materials. Last week, SMED was deleted from the Russell 3000 Index.

-10.4% Amazon.com Inc (AMZN) is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous others. Amazon is also the dominant cloud services provider (through Amazon Web Services, or AWS), an influential entertainment company through its video streaming operations, a force to be reckoned with in grocery with its ownership of Whole Foods, and a leader in digital personal assistant devices (Alexa and Echo). There was no significant company news last week.

-11.3% The Blackstone Group Inc (BX) operates as an investment company. The Company focuses on real estate, hedge funds, private equity, leveraged lending, senior debts, and rescue financing. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.