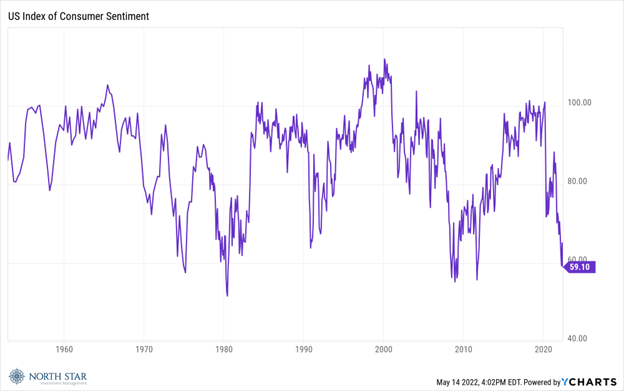

Consumer Sentiment Crash

It was no surprise to anyone watching the news over the last month that the University of Michigan Consumer Sentiment Index for May nosedived back to the lowest levels in eight-years, and approached the nadir reached in the financial crisis and in the early 1980s.

U.S consumers and investors are clearly confronting troubled waters as the stiff winds of the pandemic, the war, and inflation continue to blow them off the financial stability course. We would like to lay down some observations that might help ease a worried mind. Whereas Covid-19 cases are once again rising, between vaccines and therapeutics we now have powerful tools to combat the disease. As a result, the economic impact should become increasingly muted. Stated differently, we have adapted to living with the existence of the virus. Even though it is hard to say anything positive about the war, Putin did not escalate the rhetoric on “Victory Day”, as was feared. Looking at inflation, the CPI and PPI reports both showed slight slowdowns, albeit still at a torrid pace, perhaps suggesting a peak in the rate of prices increases. We would also highlight that historically this level of pessimism has represented a bottom, followed in relatively short order by buoyant rebounds in sentiment.

In the face of all this pessimism, the stock market sell-off continued for a seventh consecutive week as the S&P 500 lost 2.4%, the Nasdaq dropped 2.8%, and the Russell 2000 shed 2.6%. The dollar continued to reach new multi-year highs, while bond yields eased about 20 basis points from their highest levels since 2018, and gold shed almost 4%.

Barron’s offers a “Bear Market Primer”, suggesting it is “Time to Stay Calm-And Start Shopping”. We applaud their advice to avoid doubling down on broken momentum stocks, and instead to focus on “plenty of good deals to be found among companies with sturdy cash flows, healthy growth, and even decent dividends.” They further suggest to not “skimp on small companies” noting their price/earnings ratios are 20% lower than their historical average and 30% lower than those of large caps. We believe that the valuation metrics of the companies we follow illustrate that point. Outside of our existing holdings, the number of companies that now show up as potential bargains in our weekly screening has also dramatically increased. Last week, one of our equity screens populated 140 securities versus just 103 at the beginning of 2022, and our second equity screen produced 292 results versus 204 four months ago. We generally have very low turnover in our holdings but are seeing some compelling opportunities to rotate some capital to the highest quality businesses that have declined the most during the recent financial markets decline.

Investors should also take some comfort that for the first time since 2009 there are reasonable yields to be earned on short-term low risk fixed income investments. Even though there have been some price declines, we still favor the Vanguard short-term high grade corporate and TIPS funds and ETFs, now paying substantially higher yields than just six months ago.

At the risk of sounding too sanguine in the midst of what has been one of the worst first 4 innings for stocks on record, last week did finish on an upbeat note with the S&P rallying 4.3% between the last hour on Thursday and Friday. That advance into the weekend might foreshadow calmer waters ahead.

Honing in on the Homebuilders

On Tuesday the National Association of Home Builders release its Housing Market Index for May. The Index is based on a survey that asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes. As a consequence of the rapidly rising mortgage rates, economists forecast a decline to an eight-month low. We recently added XHB (SPDR S&P Home Builders ETF) to our model equity index strategy, as the significant sell-off in home builders and related companies share prices has resulted in extremely depressed valuations, while the long-term supply/demand dynamics for the sector seem compelling.

Also on Tuesday, the Census Bureau reports retail sales data for April, with expectations of a 0.8% month over month increase. It will be interesting to see to what extent the plunge in consumer sentiment translated to buying behavior.

Stocks on the Move

-15.5% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. Last week, Blue Bird reported FQ2 Non-GAAP EPS of -$0.31, which missed consensus estimates by $0.21, and revenue of $207.7M, which beat consensus estimates by $57.05M. The Company highlighted their record backlog of 6,600 buses, worth approximately $700M, and its 25% price increase since June 2021. Despite strong demand, Blue Bird revised its FY22 guidance to reflect persisting supply chain challenges.

-12.1% Madison Square Garden Entertainment Corp (MSGE) produces, presents, and hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, in its venues including New York’s Madison Square Garden, Hulu Theater, Radio City Music Hall, the Beacon Theater, and The Chicago Theater. The Company also operates entertainment dining and nightlife venues in New York City, Las Vegas, Los Angeles, Chicago, Singapore, and Australia under the Tao, Marquee, Lavo, Avenue, Beauty & Essex, and Cathédrale brand names. Last week, MSGE reported Q3 GAAP EPS of -$0.51 and revenue of $460.13M, up 114.7% Y/Y. Although events and sports games have rebounded, the Company’s TV networks revenues dropped about 6% during the period.

-11.1% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. Last week, The Eastern Company reported Q1 non-GAAP EPS of $0.46 and revenue of $69.01M, up 11.7% Y/Y. EML expects demand for returnable transport packaging to increase throughout the remainder of the year as new vehicles are launched.

-13.6% Johnson Outdoors Inc (JOUT) designs, manufactures, and markets outdoor recreational products. The Company offers products including outdoor clothing, tents, canoes, compasses, sailboats, flotation devices, diving equipment, and motors. Johnson Outdoors reported Q2 GAAP EPS of $0.97 and revenue of $189.6M, down 8.0% from the previous year’s quarter. The decline in revenue was led by a 19% dip in fishing product sales as supply chain disruptions prevented the company capitalizing on sustained heightened demand. To combat these challenges, the Company will be buying more inventory and taking future pricing actions.

-10.4% Sharps Compliance Corp (SMED) operates as a provider of waste management services. The Company offers containment, transportation, treatment, and tracking of medical waste, and the disposal of unused medications as well as other used health care materials. Following a management transition, SMED announced its Q3 earnings last week of -$0.01 per share and revenue of $17.58M. The weakness was attributed to light mailback billings due to lower COVID-19 related immunizations.

-10.4% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

-22.0% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals. There was no significant company news last week.

-10.2% UMH Properties Inc (UMH) is a real estate investment trust that owns and manages more than 120 manufactured home communities in New Jersey, Ohio, and Pennsylvania. There was no significant company news last week.

-11.1% ARC Document Solutions Inc (ARC) provides large format document reproduction and printing services, mainly to architectural, engineering, building operator, and construction firms. There was no significant company news last week.

-13.4% Century Casinos Inc (CNTY) operates as an entertainment company. The Company owns casinos, hotels, and luxury cruise vessels. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.