Technical Turnaround

All was quiet on the Wall Street front until mid-morning Thursday when suddenly a nasty selling assault was unleashed in all the equity markets.

The S&P 500 decline from Thursday’s high to Friday’s close was a brutal 4.7%, resulting in a loss of 3.1% for the week. There was no place to hide as the Nasdaq sank -3.83%, the Russell 2000 -2.49%, with the DJIA faring the best with a loss of 1.86%. Bonds sold off as well, as the yield on the 10-year Treasury advanced 10 basis points to reach its highest level since November 2018 at 2.91%. Gold dropped 2.3%, and even the darling of 2022, crude oil, experienced a decline of almost 5%, while the dollar continued to reach multi-year highs.

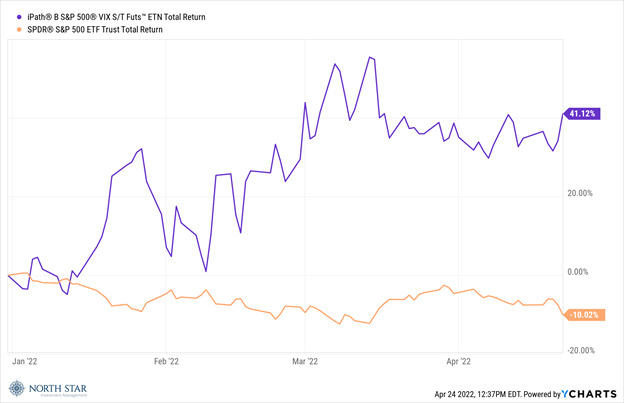

The lack of price sensitivity of sellers on Friday was noticeable and reflected in the almost 25% spike in the CBOE Volatility Index (the “VIX”) which many investors consider a reliable indicator of levels of fear in the markets; VIX watchers will certainly be vocal if this indicator rises further toward the highs of earlier this year – the VIX closed just above 28 on Friday, while the 2022 low was 16.6 on January 3 and the 2022 high was almost 36.5 on March 7. To us as non-technical investors who pay attention to technical market commentary for context in our portfolio management process, we have noticed that most VIX spikes are followed by upward movements in equity markets. For example, from the VIX high of 36.5 on March 7 to the next low on April 4, the S&P 500 Index rose 9%.

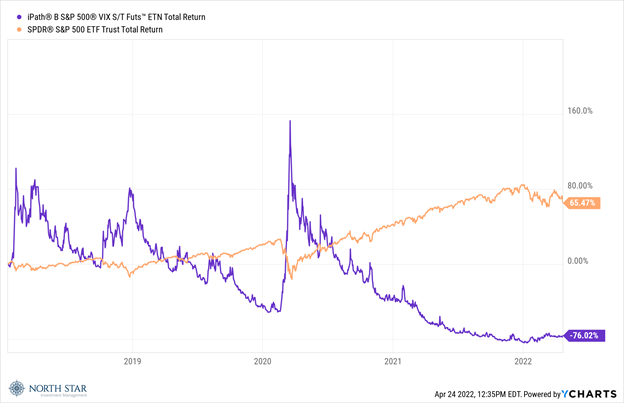

The same pattern of spikes in the VIX being followed by market rallies has been evident over longer periods of time, as illustrated in the chart below over the last five years.

So, what happened Thursday morning that soured the mood of traders, driving a VIX spike and a financial markets sell-off that included nearly every asset class (bonds, equities, precious metals, industrial commodities, etc.)? Whether it was cause or coincidence, the screens turned from green to red following Fed Chairman Jerome Powell’s statement during an International Monetary Fund panel: “It is appropriate in my view to be moving a little more quickly (to raise interest rates)…I also think there is something to be said for front-end loading any accommodation one thinks is appropriate…I would say 50 basis points will be on the table for the May meeting.”

Based on the recent inflation data and what has seemed to be never-ending interviews with and published quotes from Fed officials, it is hard to believe that Powell’s comments Thursday were a surprise to market watchers. Nevertheless, the selling was relentless for the rest of the trading week. The consistent selling and seeming lack of price sensitivity of sellers suggested that at least some market participants believed there was some newness in Fed Chairman’s comments about the pace and magnitude of upcoming rate increases. We disagree, but that is in fact what makes a market!

Corporate earnings reports generally painted a rosier picture, as the estimate for S&P 500 first quarter composite earnings grew to 6.6% from 5.1% the week earlier. Positive earnings surprises reported by companies in multiple sectors were responsible for the improvement in the earnings growth rate over the past week. Positive earnings surprises reported by companies in the Financials and Communication Services sectors and upward revisions to EPS estimates for companies in the Energy sector were the largest contributors to the increase in the earnings projections. Despite highlighting the continued macroeconomic headwinds, forward projections on balance have remained stable or even slightly increased.

The economic data was benign during the week with weekly jobless claims remaining very low, and the Purchasing Managers’ Index still well above the 50 level indicating a growing economy. The big positive surprise came from the 1.8 million annualized housing starts in March – the highest since 2006 – driven by strong demand. Concerns over rising mortgage rates has resulted in a steep sell-off in the housing related stocks, which we believe has created a terrific entry point into the sector and have added SPDR S&P Homebuilders Index (XHB) to our ETF model in response.

Ukrainian forces continued to battle as Russia stepped up a new offensive on the Donbas front. We commented a few months ago that the Ruble had turned to rubble, but it actually quickly and curiously rebounded to the range it was trading versus the dollar prior to the invasion and economic sanctions. We continue to believe that a negotiated peace agreement in the war and a subsiding of the latest Covid-19 outbreak in China would be significant positive catalysts for the global economies and financial markets. Unfortunately, the opposite also holds true that a prolonged war and additional Covid-19 outbreaks would present continued headwinds.

Earnings-Palooza!

It will be earnings-palooza with 175 S&P 500 companies reporting results for the first quarter including Apple (AAPL), Alphabet (GOOGL), and Microsoft (MSFT).

On Tuesday, the Conference Board releases it Consumer Confidence Index for April with the consensus estimate for a slight improvement from the March figure. The Index is broken down into Present Situations and Expectations Six months hence. We view the Expectations component, which has been suppressed, as having some short-term predictive value on stock prices. On Friday, the market will be focusing on the PCE report, which is the Fed’s favorite inflation measure. The consensus is for a year-over-year increase in March of 5.3%, which would be slightly lower than February’s increase.

It is a bit ironic that our love for music contrasts with our propensity to sound like a broken record. But there are several themes that we feel are worth repeating. The impact of the war in Ukraine, Covid-19, and tightening monetary policy, all present volatility inducing headwinds. During these challenging periods investing opportunities are created, and at North Star we steadfastly continue to seek, find, and invest in businesses that offer earnings yields (the inverse of P/E ratios) well above the current risk-free 10-year U.S. Treasury yield. This is one of our favorite “broken records.” In fact, many of our equity investments offer earnings yields that are multiples of the risk-free rate, and several have dividend yields above the current 3% risk-free rate. Finally, we feel that the economy is strong and that it is the imbalance of pent-up demand outstripping the supply of goods and services that is stoking the inflationary fires. In fact, one of the reasons that the U.S. Federal Reserve can increase interest rates and eliminate quantitative easing is because of the strength in the U.S. economy. We believe that the combination of interest rates moving toward a more free-market level and increasing supply among products will be the most likely and sustained solution to the current inflationary fires.

Stocks on the Move

+12.0% Healthcare Services Group Inc (HCSG) provides housekeeping, laundry, linen, facility maintenance, and food services. The Company offers its services to the healthcare industry, including nursing homes, retirement complexes, rehabilitation centers, and hospitals. HCSG reported Q1 2022 earnings of $0.15 per share, which beat analyst estimates by $0.09, and quarterly revenue of $426.21M, up 4.7% Y/Y. Like the rest of the industry, the company has struggled recently, but is regaining some footing by implementing more efficient labor management and passing along food inflation costs through newly negotiated contracts.

-28.2% Value Line Inc (VALU) produces investment related periodical publications. The Company also provides investment advisory services to mutual funds, institutions, and individual clients. All total, Value Line collects data and provides analysis on around 7,000 stocks, 18,000 mutual fund and 200,000 options. Value Line sank last week after reaching an all-time high on Wednesday and announcing its quarterly dividend would be increased by 14%. We anticipate the sell-off was the result of profit-taking.

-14.7% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Streaming stocks dipped last week after an earnings miss from Netflix.

+35.4% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. SEV announced its FY2021 results last week which included more details on securing a manufacturing partner, fueling order generation, and progressing engineering capabilities.

-11.3% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

-12.2% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.