Corporate Earnings Going for Gold; Economic Data Reaches for Silver

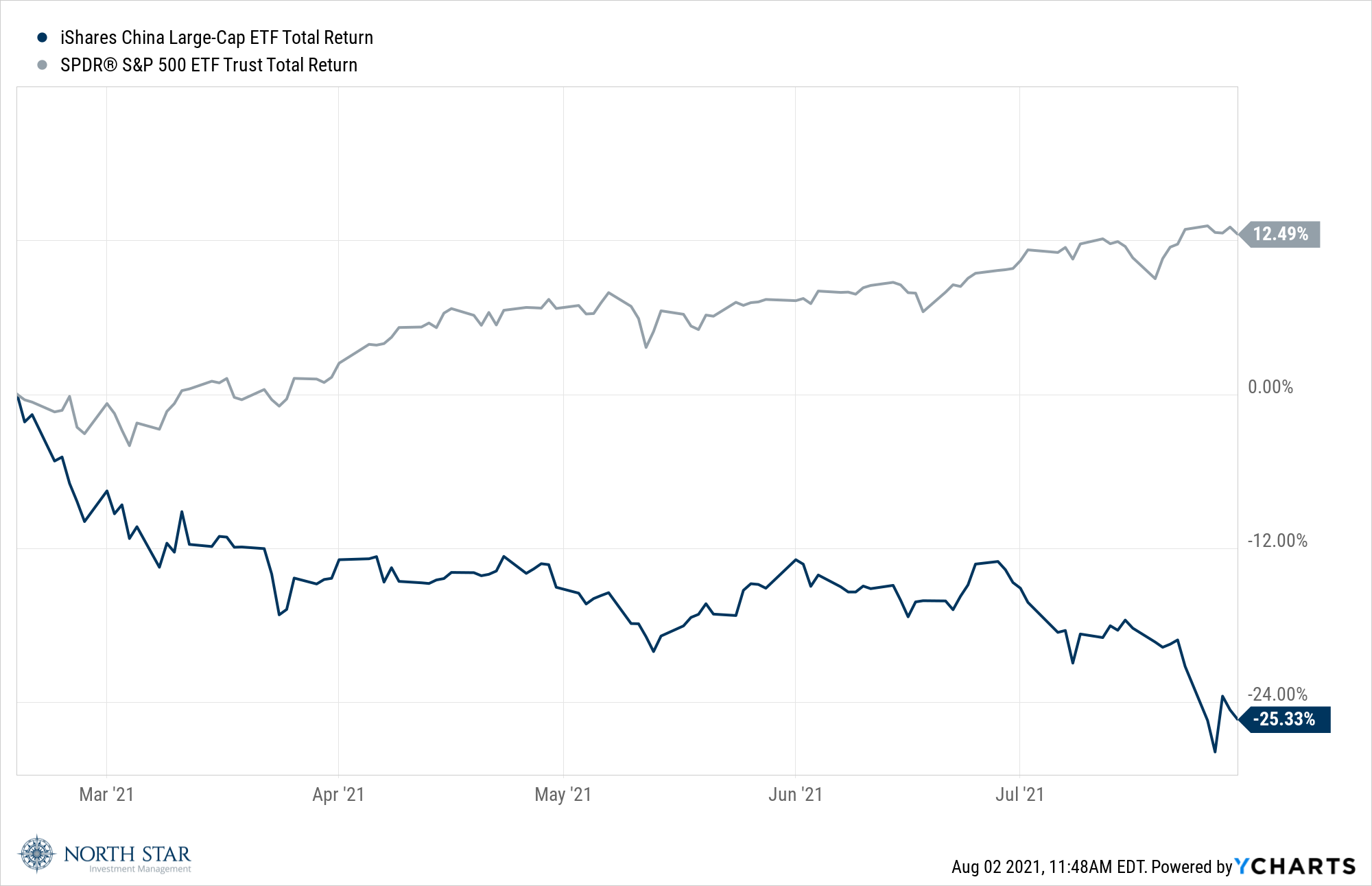

February 17th is a special day; in that, it is the birthday of both Michael Jordan and my wife. It also marked the top of the Chinese stock market, which has subsequently nosedived over 25%, including 8.72% last week. The S&P 500 has gained 12.49% during that time frame. As these nations compete for gold medals in the Olympics, they also compete for global economic leadership, making this performance disparity significant as it suggests that foreign capital continues to favor the U.S. markets for investment. The most recent downturn was triggered by China’s decision to have its $100 billion private-tutoring industry operate as nonprofits and have no foreign ownership. In addition to the Chinese stock market, most of the other speculative bubbles, such as SPACs, Cryptocurrencies, and Meme stocks also seem to be deflating rather than popping.

The major indexes remain near record levels, but last week there was a modest decline in the market, or perhaps it is more accurate to say there was a decline in Amazon, Apple, Facebook, and Microsoft, as the entire 0.4% decline in the S&P 500 can be attributed to those 4 companies. In fact, The S&P Mid-Cap and Small-Cap indexes rose 1.16% and 1.72% respectively, while advancing issues outnumbered declining issues 2026 to 1469.

Corporate earnings continued to dramatically exceed estimates, including the reports from those Mega-Caps. With almost 60% of companies having reported, a record 88% have beaten estimates by an incredible 17.2%. The blended earnings growth rate for the second quarter is 85.1% today, compared to an earnings growth rate of 74.1% last week and an earnings growth rate of 63.1% at the end of the second quarter (June 30th). These enormous increases are versus the pandemic devastating results from the year-ago quarter but are still approximately 15% higher than the results for the second quarter of 2019.

The economic data during the week came in slightly softer than anticipated, with GDP +6.5%, which was nearly 2% below estimates. The surge in the Delta variant also poured some cold water on the growth outlook, with increasing restrictions on economic activity in hot spot areas. This potential near-term slowdown bolstered the Fed’s case for keeping rates lower longer, with no new hints of tightening coming out of the FOMC meeting on Wednesday. The yield on the Ten-Year Treasury slipped 5 basis points to 1.24%, while gold inched up and the dollar weakened fractionally.

The big news in Chicago was that the White Sox acquired closer Craig Kimbrel from the Cubs. For those not following baseball, Kimbrel is an eight-time All-Star and two-times Reliever of the year. I believe we will get to see Kimbrel in action during the 2021 World Series. (This statement is not a guarantee of future performance and undue reliance should not be placed on it.)

Bustling Earnings Season Buzzes Along

It is the busiest week of earnings season, with 148 S&P 500 companies reporting results for the second quarter. Investors will be paying particular attention to the forward guidance and any color provided on the cost pressures and pricing power that companies are disclosing.

The economic calendar is also full, with reports due out include updates on construction spending, factory orders and durable goods orders early in the week, and the July employment report on Friday. The consensus forecast for the jobs report is an 800,000 rise in non-farm payrolls. Any surprise to the upside or downside could reset the thinking on the timing of normalizing monetary policy. The jobs reports have been wildly volatile recently, and one must wonder whether the ship has sailed for “normal” monetary policy anyway.

After months of negotiations, the U.S Senate will be voting on a $550 billion infrastructure bill that would provide $110 billion in new spending for roads and bridges, $73 billion of power grid upgrades, $66 billion for rail and Amtrak, and $65 billion for broadband expansion.

Stocks on the Move

+15.2% Advanced Micro Devices Inc (AMD) operates as a worldwide semiconductor company that provides microprocessors as an accelerated processing unit, chipsets, discrete and integrated graphics processing units, data center and professional units, and custom development services. It services original equipment manufacturers, public cloud service providers, system integrators, independent distributors, online retailers, and add-in-board manufacturers. Last week, Advanced Micro Devices reported very strong Q2 earnings of $0.63 per share and revenue of $3.85B, or 99% year-over-year and 12% quarter-over-quarter. The Computing and Graphics segment results were driven by higher client and graphics processor sales, while the Enterprise, Embedded, and Semi-Custom segment results were driven by higher EPYC revenues and semi-custom product sales.

AMD is a 3.4% position in the North Star Opportunity Fund.

+11.1% ACCO Brands Corporation (ACCO) manufactures office products, gaming accessories, and wellness products. The Company produces headsets, staplers, daily scheduling diaries, shredders, laminating equipment, presentation boards, and air purifiers. Last week, ACCO Brands reported Q2 results of $0.43 per share and revenue of $517.8M with the recent PowerA acquisition contributing over $50.7M in sales. These exceptional earnings were driven by organic growth in all segments and significant end-market recovery.

ACCO is a 2.1% position in the North Star Micro Cap Fund and a 3.1% position in the North Star Dividend Fund.

+13.0% PetMed Express Inc (PETS), doing business as 1-800-PetMeds, operates as a pet pharmaceutical company. The Company provides prescription and non-prescription pet medications, as well as health and nutritional supplements. Last week, PETS reported Q1 GAAP EPS of $0.22 and $79.3M in revenues. Results were impacted by a return to normal consumer activity, particularly in cases where pet-owners resumed veterinary visits and ordered medications directly from their vet providers. The Company also incurred a one-time $717,000 charge related to the CEO’s separation agreement.

PETS is a 1.1% position in the North Star Micro Cap Fund and a 2.8% position in the North Star Dividend Fund.

-12.0% Consolidated Communications Holdings Inc (CNSL) offers telecommunications services. The Company offers local and long-distance telephone, high-speed internet access, and digital television services to individuals and businesses in the States of Illinois, Pennsylvania, and Texas. Last week, CNSL reported Q2 Non-GAAP earnings of $0.22 per share and revenue of $320.4M. According to the Company, the fiber upgrade plan is on track with 76,000 upgrades completed in the second quarter, and consumer broadband revenue grew by 3.7%.

CNSL is a 1.2% position in the North Star Micro Cap Fund.

+11.3% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals. Last week, WHG reported strong quarterly earnings of $0.35 for Q2, and revenue of $17.48M, up 10.1% year-over-year. The Company’s Large-Cap Value, Small-Cap Value, Total Return, High Income, and Alternative Income strategies all beat their primary benchmarks for the quarter and Westwood declared a special cash dividend of $2.50 per share payable August 16, 2021.

WHG is a 1.3% position in the North Star Micro Cap Fund.