Growth Stocks Slip

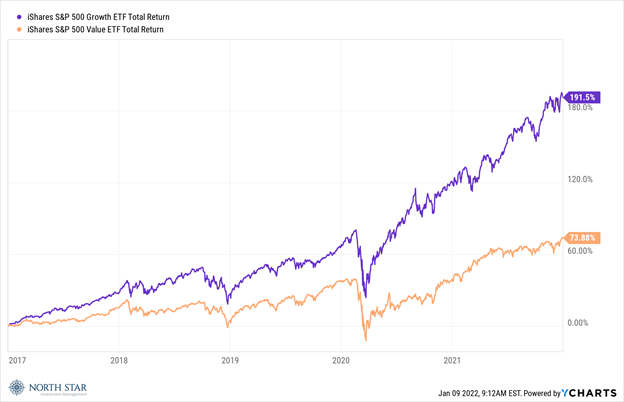

Growth investors have enjoyed a terrific party for the last five years, with the punch bowl spiked with zero percent interest rates and ultra-accommodative fiscal and monetary policy. During that period, the return on the S&P 500 Growth Index was 191.5%, or almost triple the return of the S&P 500 Value Index.

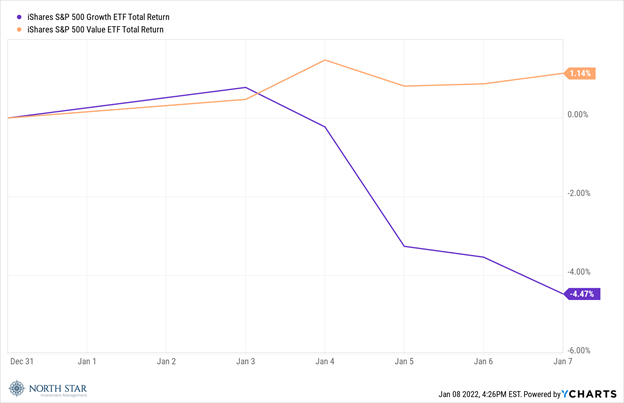

With inflation surging and the labor market strong, the Fed seems ready to “normalize” monetary policy, while at the same time Congress appears reluctant to authorize additional fiscal stimulus. During the first week of the New Year with this shift in the narrative, the market action suggested that the clock might have struck midnight at the Growth Investors Ball, as the S&P Growth Index slid 4.47% while the Value Index notched a 1.14% gain.

The impetus for the shift came on Tuesday when the minutes from the final Federal Open Market Committee (FOMC) meeting of 2021 were released, in which the Fed’s conviction to finally normalizing interest rates was evident. In that meeting, the FOMC indicated that it will ramp up the speed at which it pares its bond purchases, ending the expansion of its balance sheet a few months earlier than expected. Additionally, the minutes suggested that the Fed is now planning to increase the federal funds rate next year as many as three times. The Ten-Year Treasury rate jumped 26 basis points to 1.77%, its highest level since January 2020. The S&P 500 declined 1.8% but managed to close just above its 50-day moving average, a key technical reading that has attracted dip-buying in the past. The Russell 2000 suffered a 2.92% loss, as small caps continued to struggle, although the Russell 2000 Value Index managed a modest gain while the Russell 2000 Growth Index plummeted 5.78%. The North Star Funds are built on the foundation of value investing, so we are well positioned if last week’s rotation signals the kick-off of a multi-year party for Value investors.

Our concern over rising interest rates is not new; in fact, in our commentary from one-year ago we noted, “The yield on the Ten-Year Treasury shot up 20 basis points to 1.1%, its highest level since the pandemic hit. We continue to caution that these rates can go much higher very quickly, and therefore advise keeping your bond maturities short.”

We still believe that advice is timely, and specifically think short-term TIPs (Treasury Inflation Protected Securities) offer good value.

Another constant is that once again the Chicago Bears season ended with a fizzle, this time in Minnesota as the Vikings scored 21 straight points in the fourth quarter to secure a 31-17 victory. As disappointing as this season was for Bears fans, one must wonder how Los Angeles Chargers fans must be feeling this morning as their ticket to the playoffs was punched. The game was about to end in a tie when the Chargers coach inexplicably called a timeout enabling the Raiders to kick a field goal and send them packing.

Buckle Your Seatbelts

On the economic calendar, updates on inflation will be in focus with reports on both consumer prices and producer prices scheduled. The CPI report on Wednesday is expected to show a 7.1% year-over-year rise in December, the largest increase since 1982. Thursday’s release of the PPI is also expected to show continued increases in prices. On Friday, The University of Michigan Consumer Sentiment Index for January is forecasted to register at 70.4, roughly even with December’s reading.

The fourth quarter earnings season kicks off with six S&P 500 members reporting results. The estimated earnings growth rate for the S&P 500 is 21.7% on revenue growth of 12.9%, marking the slowest growth rate of 2021, but still representing the fourth straight quarter of earnings growth above 20%.

COVID-19 developments will continue to be the seemingly never-ending story, as cases continue to spiral out of control. It would seem likely that economic activity will slow down in January, which could influence both fiscal and monetary policy in the near-term.

We rarely discuss geopolitical events but would be remiss in not expressing concern over the situation in the Ukraine, as U.S. and Russian officials will be meeting to hopefully head off possible Russian military action.

As a general principle, many popular investment options that may have been successful in part due to persistently low interest rates, such as cryptocurrencies and businesses growing much faster than market discount rates reflected in US Treasury interest rates, are also significantly more volatile relative to investments with earnings yields well above the long-term mean US Treasury yield (AKA “value” stocks). Buckle your seatbelts, it could be another volatile week, especially for the growth stocks that have experienced tremendous gains and are trading at elevated P/E multiples.

Stocks on the Move

+10.5% Bank of America Corporation (BAC) operates as a bank. The Bank offers saving accounts, deposits, mortgage and construction loans, cash and wealth management, certificates of deposit, investment fund, credit and debit cards, insurance, mobile, and online banking services. The Corporation operates nearly 4,500 branch locations and 17,000 ATMs. Commercial bank stocks traded higher last week as interest rates rose across the curve. Additionally, Bank of America announced the redemption of all $500M of its 3.335% Fixed/Floating Rate Senior Bank Notes originally due January 2023.

BAC is a 2.9% position in the North Star Opportunity Fund.

+17.2% ViacomCBS Inc (VIAC) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Last week, it was reported that WarnerMedia and ViacomCBS are exploring the sale of the CW Network.

VIAC is a 1.5% position in the North Star Opportunity Fund.

-13.5% Zoetis, Inc (ZTS) discovers, develops, manufactures, and commercializes animal health medicines and vaccines, with a focus on both livestock and companion animals. In addition to medications and vaccines, the Company offers diagnostics, genetic tests, biodevices, and a range of services. Last week, CNBC commentator Stephanie Link disclosed in a news segment that she had trimmed her position in Zoetis.

ZTS is a 2.3% position in the North Star Opportunity Fund.

+13.2% Allied Motion Technologies Inc (AMOT) designs, manufactures, and sells motion control products into applications that serve various industry sectors. The Company supplies precision motion control components that incorporated into a number of end products, including high-definition printers, barcode scanners, surgical tools, robotic systems, wheelchairs, and weapon systems. There was no significant company news last week; however, it was announced on December 31st, 2021, that Allied Motion Technologies acquired Spectrum Controls for $70M in a combination cash/stock deal.

AMOT is a 1.2% position in the North Star Micro Cap Fund.

+15.3% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, and licensed brand Michelin. There was no significant company news last week.

RCKY is a 3.7% position in the North Star Micro Cap Fund and a 4.7% position in the North Star Dividend Fund.

+10.0% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals. There was no significant company news last week.

WHG is a 1.0% position in the North Star Micro Cap Fund.

-15.0% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. There was no significant company news last week.

GRBK is a 1.9% position in the North Star Micro Cap Fund.

-10.2% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

SEV is a 0.6% position in the North Star Opportunity Fund.

-10.2% NAPCO Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. There was no significant company news last week.

NSSC is a 2.1% position in the North Star Micro Cap Fund.