Last Week

“Wake Me Up When September Ends” is a song from Green Day’s 2004 “American Idiot” album. It also captures the mood of investors following brutal holiday-shortened trading, in which the market suffered its worst first week of September since 1946. The Technology sector was the bottom performer, with a decline of almost 7%, followed by the Oil & Gas sector, which skidded nearly 6%. Small caps sank 5.7%, Mid caps lost 4.9%, and the S&P 500 dropped 4.3%. Declining issues more than doubled advancing issues, with the defensive sectors such as Utilities, Telecommunications, and Consumer Goods, accounting for most companies finishing in the green or breaking even. Just a few weeks ago, one of the most frequent phrases among market pundits was “soft-landing” because the consensus view was that the Federal Reserve could lower interest rates at a pace that would avoid recessionary economic consequences. More recent economic reports have put that consensus view in question, suggesting the possibility of a bumpy landing. However, as discussed below, the selling pressure in some sectors could cause a rotation into other sectors. In this case, yield-producing assets such as those in the Real Estate and Utilities sectors will benefit.

The somber mood seemed eerily reminiscent of the beginning of August when recession concerns spiked volatility for a most unpleasant four trading days. Once again, it was concern about whether the Federal Reserve waited too long to begin decreasing contractionary monetary policy of the Fed Funds Rate exceeding prevailing inflation rates. Specific economic data drove this concern and included the lowest JOLTS (Jobs Opening Labor Turnover Survey) reading in three years, the August jobs report showing a tepid 140,000 increase in payrolls, and significant downward revisions to the previously reported June and July payroll reports.

On the other hand, there were some bright spots in the labor market, with the lowest reading in the last few months in the weekly initial claims for unemployment insurance and a decline in the unemployment rate to 4.2% from 4.3% the month earlier.

The other big market-moving story of the week was the quarterly earnings from Broadcom Inc (AVGO), which delivered excellent results but provided guidance for the next quarter that disappointed traders. Broadcom is a top pick in the AI craze and one of the most actively traded companies on the Nasdaq. Broadcom’s shares plunged 10.3% on Friday, and most other AI-related companies stocks followed suit. Momentum is indeed a double-edged sword.

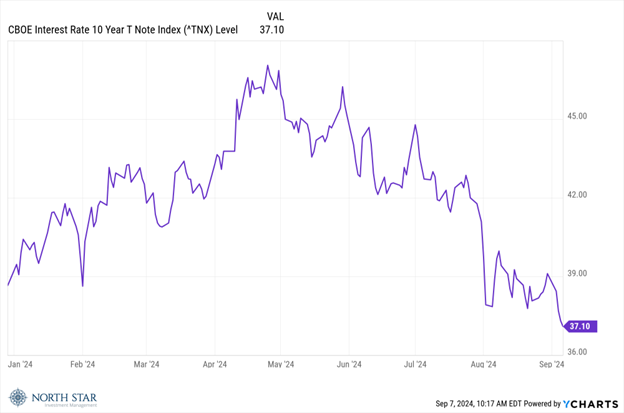

Bond market investors rejoiced in the economic slowdown narrative as the yield on the 10-year Treasury nosedived 20 basis points to reach its lowest level of 2024 at 3.71%.

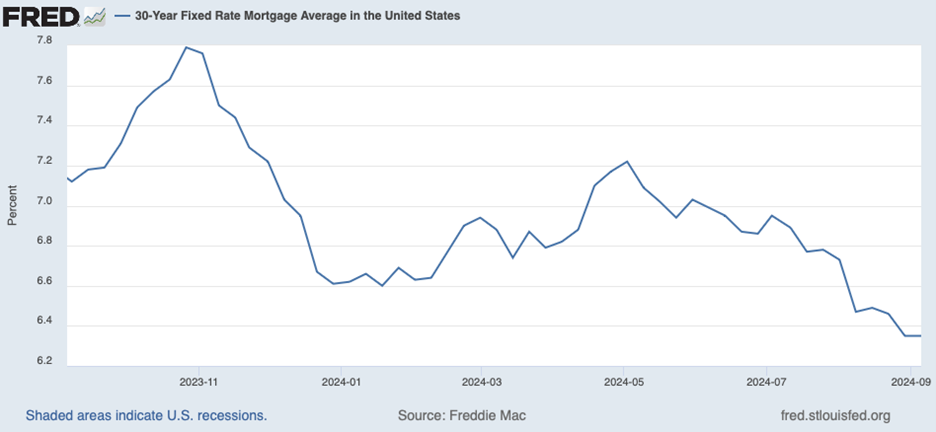

Short-term rates matched that decline, with the 2-year rate, which touched 5% a few months ago, reaching 3.65%. Similarly, as shown in the graph below, prevailing residential mortgage interest rates have been in a reasonably consistent wiggle-down for the past year, from almost 8% in late 2023 to slightly above 6% at the end of late week. This may bode well for investors’ interest in yield-oriented assets such as REITs and related companies such as home builders and construction materials businesses. The widely-followed Home Builder exchange-traded fund (ETF) with the ticker symbol ITB traded 0.5% higher during the greater-than-1% sell-off in the broad market indices. Other Real Estate ETFs, such as IYR and VNQ, traded lower but significantly outperformed the broader markets.

Turning to the Chicago Sports Scene, in baseball, it looks like it’s “wake me up when the season is done” as our enthusiasm over the Cubs playoff chances proved short-lived, and the White Sox continue to rack up losses at a record-setting pace. Meanwhile, the Bears kicked off the season with a thrilling come-from-behind victory at Soldier Field versus the Titans. Bears Down!

This Week

Wednesday’s release of the consumer price index for August will be in focus, with the consensus estimate calling for a 2.6% year-over-year increase. The CPI release is the last significant data point before the upcoming FOMC meeting on September 17-18. If you are wondering why Fed Funds rates have been maintained at twice the inflation rate, then join the growing club.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.