Last Week

There were only bulls, no bears, lambs, or lions to be found on Wall Street in March, as the stock market came out as it came in, charging forward.

The S&P 500 closed the holiday-shortened week at another record high, and the rally continued to broaden as small and mid-cap stocks both outperformed. Advancing issues outnumbered declining issues by more than 2-1, while only the technology sector finished in the red. It also marked the end of a fantastic first quarter for Wall Street, with the S&P 500 surging over 10% and the Nasdaq Composite and the MidCap 400 almost keeping pace. The Russell 2000 gained 4.8% during the quarter, largely thanks to a stellar 2.5% weekly performance last week. The S&P 500 moved 0.4% higher during the week, setting its 22nd record close, although the tech-heavy Nasdaq Composite slipped -0.3%.

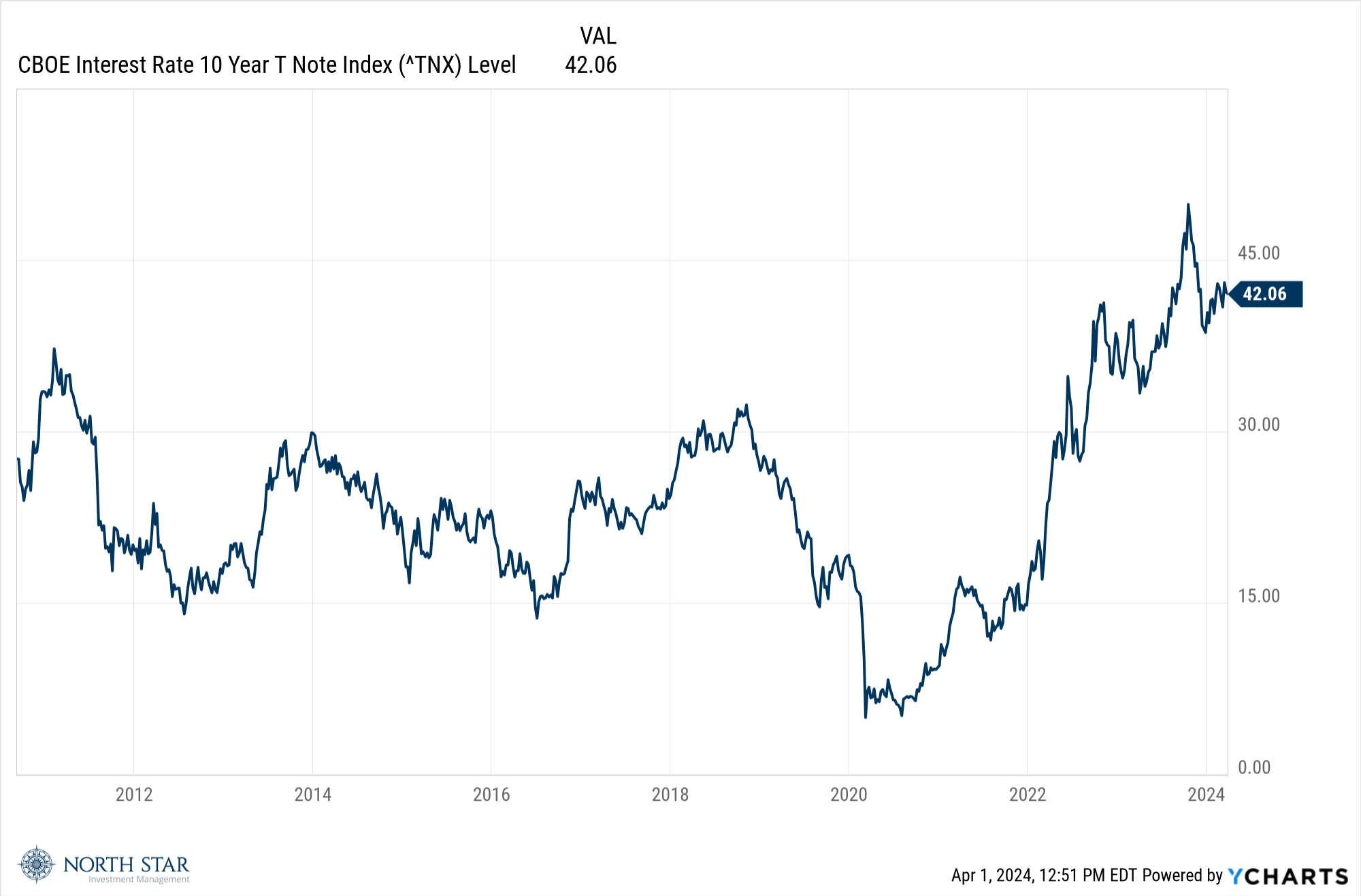

We encourage investors to consider a reasonable allocation to small caps, as the sector remains “on-sale” versus other equities, following the extended period of underperformance during the Fed tightening cycle. We believe the current Fed Funds Target Rate of 5.50% should be at least 1.50% lower to reflect a more normal spread of 0.5%-1.0% over the inflation rate. Such cuts to the Fed Funds Target rate would likely drive lower yields on U.S. Treasury securities and corresponding lower discount rates (higher multiples) on equities, leading to higher stock prices. In particular, small-cap stocks should benefit significantly as discount rates decline and their businesses experience lower borrowing costs on bank lines and other floating-rate debt common to small companies. As the chart below illustrates, the yield on the 10-year Treasury has dropped 75 basis points from its high, finishing the week down six basis points at 4.2%, exactly the same level from 18 months ago. We expect a similar decline in short-term rates to follow.

There was more good news on Friday when the financial markets were closed. U.S. consumer sentiment rose unexpectedly in March to the highest in nearly three years, partly thanks to growing confidence that inflation will keep softening. Additionally, the personal consumption expenditures, or PCE, price index rose 0.3% in February, below the 0.4% forecasts. The core inflation, which strips out volatile food and energy prices, rose 0.3% in February and 2.8% year-over-year.

There was no good news for Chicago sports fans, as all the professional teams suffered embarrassing losses, and the Fighting Illini were decimated by the UConn Huskies in the NCAA Elite Eight.

This Week

The economic calendar is light, with the BLS release of the jobs report for March on Friday likely in focus, with economists expecting an addition of 216K jobs in March. That would mark a deceleration from the 275K additions in February. Whereas the employment picture remains strong, it certainly has cooled off over the past year, which is especially evident in the much more moderate wage growth. Additionally, the JOLTS report (Jobs Openings Labor Turnover Survey), which will be released on Tuesday, has recently been showing under 9 million job openings, versus 12.2 million at the peak in March 2022.

Earnings season is on deck, and estimates have remained stable, calling for growth of approximately 3.4% for the S&P 500.

March Stocks on the Move

+38.8% Hamilton Beach Brands Holding Company (HBB) posted earnings earlier in March that highlighted significant margin expansion (GM +290bps), record levels of cash generation, and strong product innovation in “high demand” categories (40 new product platforms in the year).

+36.6% The Eastern Company (EML) reported Q423 earnings in mid-March of $0.57 per share vs $0.03 per share in the prior year period. Results were driven by supply chain regulation, working capital/balance sheet improvements, and more disciplined operations.

+28.2% WK Kellogg Co (KLG), the breakfast and cereal-brand-focused spin-off of Kellanova, was up last month on no significant company news. Investors may be increasing exposure to consumer staples to offset broader market volatility.

+25.5% Allient Inc (ALNT) posted better-than-expected Q423 earnings earlier in March, with beats on both the top and bottom lines. Investors noted ALNT’s “Simplify to Accelerate” initiative, which involves rationalizing its operations as the business is more complex after completing eight acquisitions in the last several years.

+24.8% Build-A-Bear Workshop Inc (BBW) was up last month after releasing solid fourth-quarter earnings, including initiating a quarterly dividend. The press release also included a promising growth outlook for FY24 driven by the company’s international expansion of third-party retail locations.

+21.5% Mitek Systems Inc (MITK) was up last month after posting in-line earnings and noting the company expects to be up to date with its quarterly filings by mid-April.

+21.3% V2X Inc (VVX) rose in March on news of record revenue and backlog in the fourth quarter of 2023 due to increased domestic and foreign military spending.

+20.4% Helix Energy Solutions Group Inc (HLX) posted gains last month alongside the broader Energy sector.

+15.0% Superior Group of Companies Inc (SGC) released fourth quarter 2023 earnings that showed impressive year-over-year improvements in profitability and cash flow driven by more favorable business conditions and a normalizing Healthcare Apparel end market.

-36.4% CarParts.com Inc (PRTS) was down last month after releasing fourth quarter 2023 earnings that were mainly in line but were dragged down by margin compression as the company is experiencing significant price deflation. To combat these challenges, PRTS will reduce its headcount by 150 people and will remain cautious yet agile throughout FY24.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.