Last Week

It was chips without any dips as the market snapped its two-week losing streak.

The party started Monday anticipating the annual GTC conference hosted by Nvidia, Wall Street’s AI chip darling. The company did not disappoint investors with a highly upbeat forecast highlighting a potential trillion-dollar market opportunity. The good news continued Wednesday from the FOMC meeting, in which the Fed indicated that the recent strength in the economy did not materially change the path towards lower interest rates and less restrictive monetary policy. The dot plot showed three interest rate cuts in 2024, and the “higher for longer” theme song was largely muted. Given the hawkish Fedspeak tone over the last 18 months, investors were relieved by Fed Chair Jerome Powell’s slightly more relaxed attitude towards the recent somewhat hot inflation reports. The S&P 500 advanced +2.3%, its best week of the year, while the Nasdaq Composite climbed +2.9%, and the Russell 2000 gained 1.6%.

The yield on the 10-year Treasury declined eight basis points to 4.22%, with the yield on the 2-year falling 11 basis points. The dollar rallied almost 1%, while the gold and oil markets were stable.

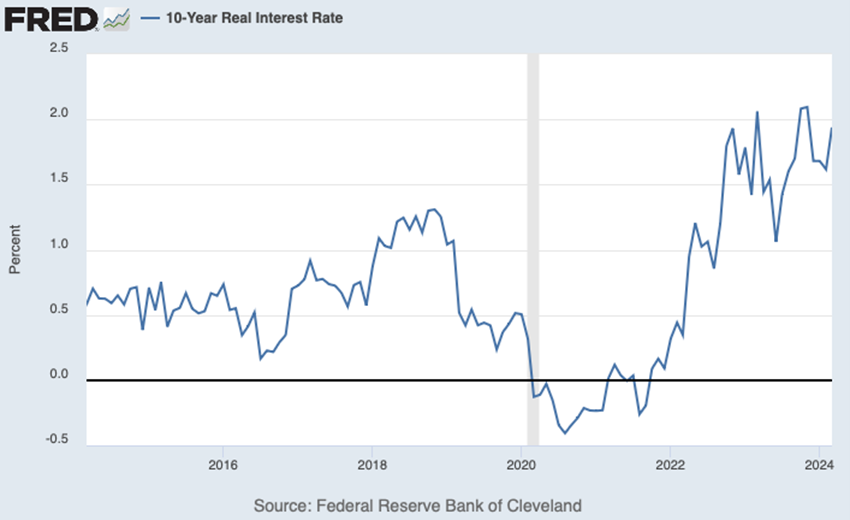

We concur with Fed Chairman Powell’s statements that interest rate cuts are warranted so long as real interest rates remain near 10-year highs. In our view, the current Fed Funds Target Rate of 5.50% should be at least 1.50% lower such that the 10-year Real Interest Rate would be closer to the 10-year average of approximately 0.5% (see graph below). Such cuts to the Fed Funds Target rate would likely drive lower yields on U.S. Treasury securities and corresponding lower discount rates (higher multiples) on equities, leading to higher stock prices. In particular, small-cap stocks should benefit significantly as discount rates decline and their businesses experience lower borrowing costs on bank lines and other floating-rate debt common to small companies.

This Week

The markets will be closed on Friday in observance of Good Friday.

The focus will likely continue on monetary policy, with Federal Reserve governors on speaking tours during the week after returning from a blackout following the latest FOMC meeting. Those appearances will be capped off at the end of the week by Fed chair Jerome Powell participating in a moderated discussion at a San Francisco Fed conference.

The key economic data will come on Friday, as the BEA will release the Fed’s preferred inflation gauge – the personal consumption expenditures price index. There will also be data on consumer confidence and durable goods orders.

All eyes will be on the Fighting Illini on Thursday in their quest to secure the national championship in college basketball.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.