‘Stunning Loss of Confidence’

So far 2021 has provided an incredibly smooth ride for investors, but the news flow last week suggested some turbulence on the horizon.

The Delta Covid-19 variant cases and deaths surged, both consumer and producer prices spiked, consumer confidence plunged, and political wrangling in the U.S. House of Representatives cast doubt on the passage of the infrastructure bill.

The U.S. is now averaging 124,000 new cases a day, up 86% over the past 14 days, while deaths are up 75% over the same period. We have found Dr. Scott Gottlieb’s analysis of the virus to be insightful since the onset of the pandemic. He believes that this wave could be the last, commenting on CNBC that “I don’t think Covid is going to be epidemic all through the fall and winter. We’re going to reach some level of population-wide exposure to this virus, either through vaccination or through prior infection, that it’s going to stop circulating at this level.”

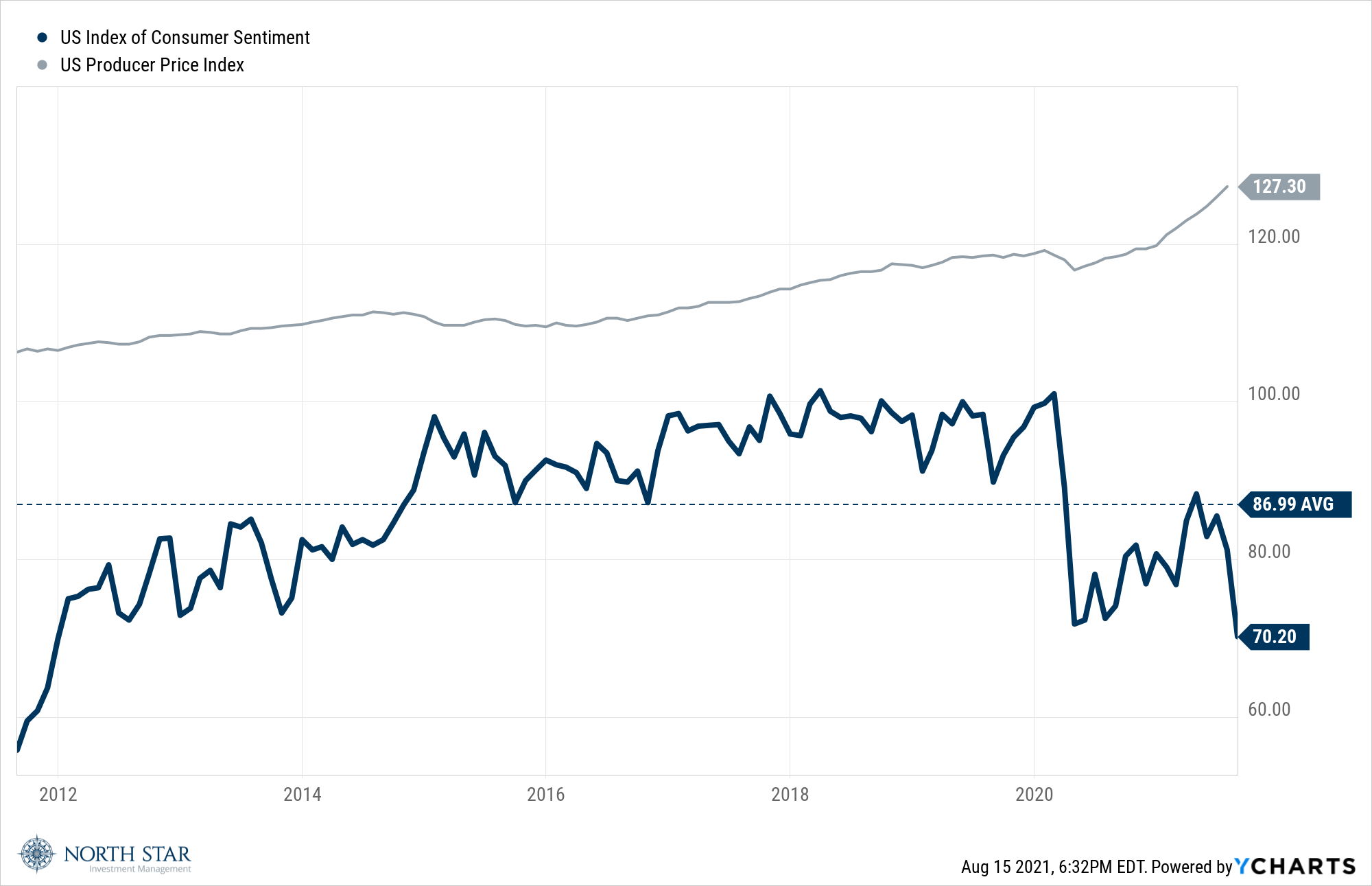

Consumer prices rose by 5.4% in July as the reopening of the economy kept inflation elevated at levels that, according to the Labor Department’s CPI report on Wednesday, matched the prior month’s increase. The gains moderated on a monthly basis, but inflation remains much faster than it was before the pandemic. Producer prices increased even more rapidly; the Labor Department said on Thursday that the PPI jumped 7.8%, a record high since the measure was introduced in 2010. Producer price increases typically lead to higher consumer prices, so we anticipate that the consumer will continue to feel the inflationary pressures over the next few months.

The U.S. consumer showed signs of fatigue from confronting the combination of the resurgence of the virus and higher prices, as the University of Michigan’s gauge of consumer sentiment plunged in August to a reading of 70.2 from a final July reading of 81.2.

Economists polled by the Wall Street Journal had expected an August reading of 81.3. It marked the lowest reading since December 2011, below any level in the beginning of the pandemic last year. According to the report, a gauge of consumers’ views on current conditions fell to 77.9 in August from 84.5 in the prior month, while a barometer of their expectations tumbled to 65.2 from 79 in July. We believe this reading is significant, because we view consumer sentiment, particularly the expectations component, as an important forward-looking indicator for the economy and the equity market.

The U.S. Senate on Tuesday passed a $1 trillion infrastructure bill and immediately kicked off debate on a $3.5 trillion spending blueprint for President Joe Biden’s key priorities on climate change, universal preschool, and affordable housing. Whereas there is strong bipartisan support for infrastructure spending, there is a great divide on the rest of the spending, leaving a challenging path to approval.

The S&P 500 gained 0.71% for the week to set another new record high on Friday, but small-cap stocks suffered a 1.1% decline. Small-cap stocks have experienced much greater volatility driven by investors’ perception of the health of the U.S. economy. The yield on the Ten-Year Treasury was unchanged at 1.29%, while the dollar inched lower, and gold gained fractionally.

On a positive note, Tim Anderson’s walk-off home run led the White Sox to a 9-8 thrilling victory over the Yankees on Thursday night in the “Field of Dreams” baseball game.

Feeling Spendy?

Speaking of the consumer, earnings reports are due out from Walmart, Target, Lowe’s, and Macy’s. Additionally, on Tuesday retail sales for July is forecasted to show a 0.2% decline from the June tally. On Wednesday, the release of Fed minutes will offer insights into the varying viewpoints on bond buying tapering and inflation. Given the near-term challenges highlighted earlier, it is a relatively safe assumption that monetary policy will remain extremely accommodating.

It seems unlikely that there will be any progress on the spending bill from Congress, and likely that the COVID-19 news will get worse. We believe that the recent and any further weakness creates bargains in selective small-cap stocks. Our general preference remains towards growing businesses that have survived previous business cycles and that are valued attractively relative to the historical average of the yield on the so-called “risk-free” 10-year U.S. Treasury securities. We find and invest in these often but love to hear new ideas from our followers and investors.

Stocks on the Move

+15.16% Global Water Resources Inc (GWRS) operates as a water resource management company in the State of Arizona. The Company owns and operates regulated water and wastewater utilities, as well as promotes water-saving and usage practices. Last week, the Company reported Q2 earnings of $0.09 per share and quarterly revenue of $10.9M, up 10.2% year-over-year. During the period, the company continued to benefit from Arizona population growth, an updated water infrastructure design, as well as a new master utility agreement to serve the Nikola manufacturing facility.

GWRS is a 3.4% position in the North Star Dividend Fund.

+10.23% Ethan Allen Interiors Inc (ETD) designs, manufactures, sources, sells and distributes a range of home furnishings and accessories. Through its portfolio of ten furniture factories, one sawmill, one lumber yard, as well as 300 Ethan Allen Stores, the Company offers a variety of products including beds, dressers, tables, chairs, buffets, entertainment units, home office furniture, and wooden accents. Last week, the Company reported Q4 earnings of $0.74/share and revenue of $178.3M, up 94.7% year-over-year. In an interview with CNBC on August 10th, CEO Farooq Kathwari attributed the strong results to investments in 3D and virtual reality, as well as announced the Company’s new ticker, ETD. The change was an effort to emphasize the Company’s focus on design as well as distinguish Ethan Allen from blockchain technology company Ethereum.

ETD is a 1.5% position in the North Star Micro Cap Fund and a 1.0% position in the North Star Dividend Fund.

-10.08% The Eastern Company (EML) manufactures and markets a variety of locks and other specialty industrial hardware. The Company primarily offers locks and latches for truck bodies, computers, office equipment, and various applications for the electrical, automotive, and construction industries. Last week, EML reported earnings of -$0.71 which included a one-time charge associated with a discontinued business unit. Earnings from continuing operations were $0.33/share, a 33% increase quarter-over-quarter. Revenue grew 55% year-over-year to $61.25M. Although EML is experiencing supply chain-related headwinds, any costs will be passed on. Additionally, the Company is focusing on higher-margin engineered solutions. Given the North Star Research Team’s conviction in this name, we view the share price decline as an entry point.

EML is a 3.1% position in the North Star Micro Cap Fund.

+10.11% Movado Group Inc (MOV) designs, manufactures, retails, and distributes watches, as well as jewelry, tabletop, and accessory products. Its brands include Movado, MVMT, Hugo Boss, Lacoste, Ferrari, Coach, and Tommy Hilfiger. There was no significant company news last week.

NSMVX is a 0.5% position in the North Star Micro Cap Fund.

-10.21% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

PRTS is a 4.4% position in the North Star Micro Cap Fund and a 2.7% position in the North Star Opportunity Fund.