Tepid Start

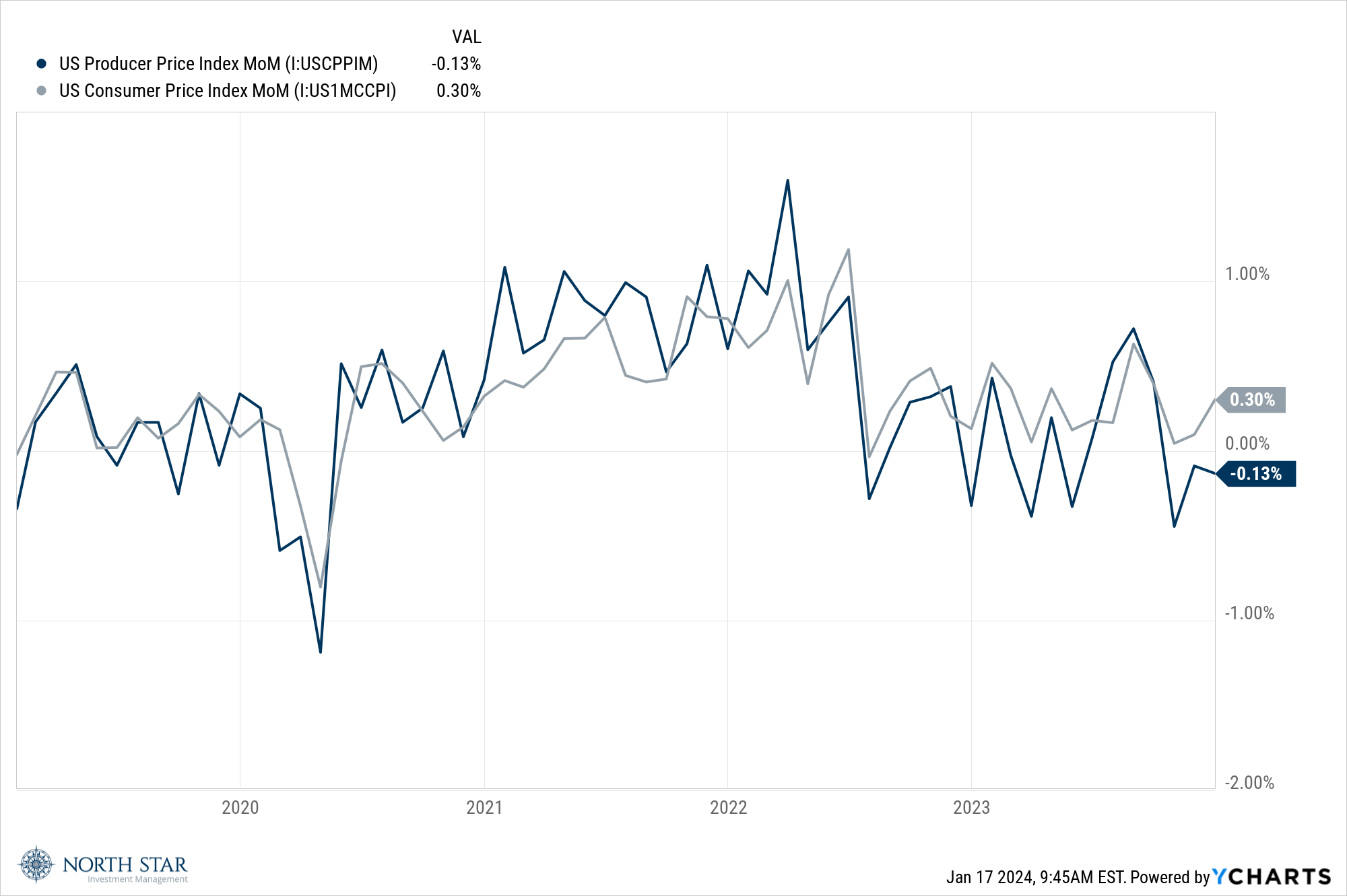

Stocks edged higher for the week as tame inflation reports drove bond yields lower and restored investor confidence that the Fed would soon be cutting interest rates. The PPI fell 0.1% in December amid declining costs for goods such as diesel fuel and food. Producer prices, which tend to lead consumer prices, are now only up 1% over the last 12 months. The CPI was less encouraging, showing a 0.3% monthly increase, but a good chunk of the increase came from the “shelter” component, specifically the “owners’ equivalent rent” (OER) portion. The OER is the amount of rent that would have to be paid to substitute a currently owned house as a rental property. Actual rents fell, so we believe the CPI was overstated. PPI trends in early 2022 drove our contrarian stance that inflationary trends were not transitory. Therefore, we believe the recent cooling in PPI is more telling of current and emerging inflationary trends than the recent CPI report. In response, the 2-year Treasury yield tumbled 24 basis points to its lowest levels since May, and the 10-year Treasury dropped nine basis points to 3.95%.

Earnings season got off to a tepid start, with bank stocks posting mixed results. A few consistent trends in bank earnings showed up among the major banks that reported (1) rising credit card delinquencies, (2) rising commercial real estate losses, and (3) mixed reserving policies among the major banks, suggesting some see recent credit deterioration as temporary while others are bracing for possible further deterioration. Following a rash of downward revisions, estimates now suggest that S&P 500 composite earnings will be in the breakeven neighborhood for the quarter. History suggests that actual results will exceed that estimate, as has been the case in 37 of the last 40 quarters, probably by about 4%. Furthermore, earnings growth is expected to accelerate as 2024 progresses. The equity markets advanced for the ninth out of the last ten weeks, as the S&P 500 gained 1.8%, the Nasdaq jumped 3.1%, while the Russell 2000 was unchanged. Advancing issues modestly outpaced declining issues, with little change in the dollar, gold, or crude oil, despite some volatility during the week.

The University of Chicago Maroons basketball team received votes in the national polls but then dropped successive home games to the University of Rochester Yellowjackets and Emory Eagles.

Earnings Ramp Up

The week is off to a difficult start with escalating geopolitical tensions and the return of a more hawkish tone from central bankers combining to tame investors’ enthusiasm.

The rising tensions in the Middle East could turn investor attention to the Energy sector. Thus far, crude prices have not responded to the unrest, and the XLE (the Energy sector ETF) has declined approximately 7% over the last three months, leaving its constituents (think Exxon and Chevron) at 10x earnings with 4% dividend yields. Whereas we prefer clean energy for long-term investments and the planet’s health, we note the bargain levels of many traditional energy sector stocks. Earnings season will also ramp up during the holiday-shortened week, with 23 S&P 500 companies reporting results led by financial companies. The economic calendar is light, with retail sales on Wednesday and consumer sentiment on Friday likely to support the slow and steady Goldilocks narrative.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.