Last Week:

The economic data was fairly consistent with expectations, as the Bureau of Economic Analysis estimate of fourth-quarter GDP increased to 4.3% from the last estimate in February of 4.1%. Personal Income declined 7.1% month over month, after jumping 10% in January, and Spending declined 1% after increasing 2.4% the previous month. The weekly initial claims for unemployment came in at 684,000, a decrease of 97,000 from the previous week’s revised level. A year ago, with the onset of the pandemic, there were a record 2.3 million initial claims. The rebound in employment is underway and will be a key driving factor for the anticipated economic recovery.

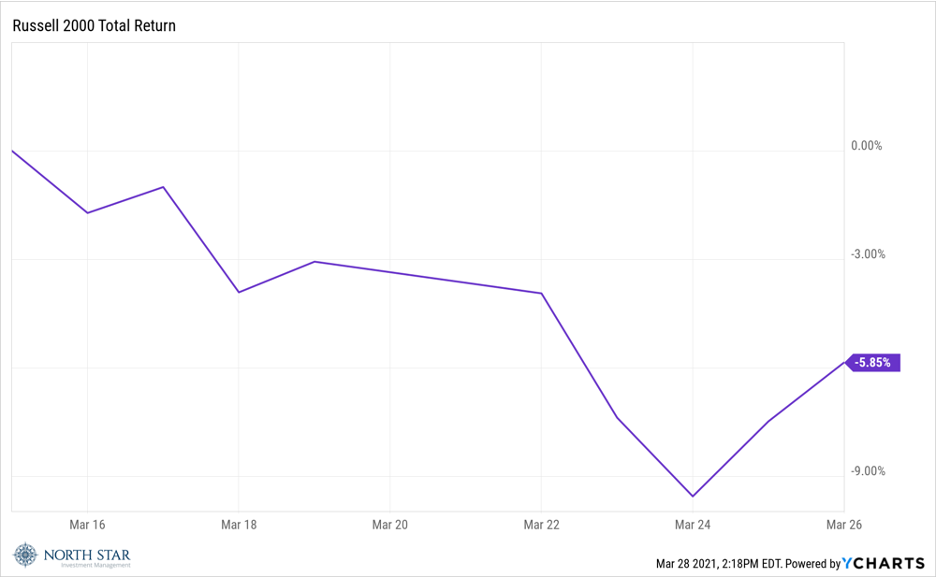

It was another unusual week in the markets, with the S&P 500 gaining 1.57%, while the Nasdaq Composite declined 0.58% and the Russell 2000 fell for the fifth time in the past six weeks, losing 2.8%. Small cap stocks lost almost 10% of their value in the previous 5 trading days before rallying on Friday. The volatility and high degree of correlation (all gaining or all losing depending on which way the wind is blowing) suggests institutional basket trading, rather than company-specific investment decisions being made.

We attempt to use these swings to add to our favorite positions if they are “on sale” for reasons unrelated to the fundamentals of the companies.

On the other hand, we advise investors to exercise extra caution in some securities. The long period of near-zero interest rate policies has created a web of opaque counter-party schemes to leverage returns on popular momentum strategies. Hedge funds and margin traders would be wise to heed the cautionary words of Benjamin Franklin from 225 years ago, “Remember that credit is money”. It is my understanding that a hedge fund can control up to $20 billion with $1 billion of equity. Additionally, those hedge funds are clever enough to not have to report their holdings in a relevant time frame, if at all. As the momentum continues, other investors jump on board for the ride pushing prices substantially beyond levels supported by traditional valuation measures. When the momentum is broken and share prices decline, margin calls cascade and multiple banks race each other to the exit to protect their own capital that was used to finance these leveraged strategies. The market experienced a sample of how swift and unpleasant the unwind ride can be late last week as shares of Chinese tech giants and U.S. media conglomerates plummeted on block trades by Goldman Sachs and Morgan Stanley. These trades are reported to have been liquidating the holdings of Archegos Capital and others. Whereas we believe the risks are single stock or strategy specific rather than systematic of the overall market, we caution that the web of such stocks and strategies is vast, complex and likely non-replicable, reinforcing our long-held preference for value investing over momentum trading or other short-term schemes.

The yield on the Ten-Year Treasury dropped 7 basis points to 1.66%. The dollar remained firm, while gold was essentially unchanged. We believe there are significant imbalances in the currency and fixed income markets, and as such continue to recommend very short inflation hedged bonds and gold as hedges for portfolios.

This Week:

Traders will be glued to their screens early in the week in anticipation of continued volatile action in certain equities. More margin selling pain, or a big bounce back? Stay tuned.

The rising tide in the Suez Canal might re-float the massive containership Ever Given, unblocking the world’s supply chain after a week of disruption.

The jobs report for March on Friday will be in focus, with the consensus forecast that the economy added 525,000 nonfarm payrolls. The market will be closed in observation of Good Friday, therefore the impact of that report will be felt the following week.

COVID-19 vaccinations are on the rise, but so are coronavirus cases. Unfortunately, it is likely there will be an increase in related deaths this week. We hope people show good common sense as the race between the vaccinations and variants unfolds.

Stocks on the Move:

Companies with news…

-49.9% ViacomCBS Inc (VIAC) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Last week, investors turned bearish on ViacomCBS amid a $3 billion equity offering. News broke over the weekend that the biggest seller was Archegos Capital, the family office run by infamous trader Bill Hwang, which was pressured to liquidate more than $20 billion of stocks on Friday, March 26th.

VIAC is a 2.1% position in the North Star Opportunity Fund.

+15.4% AstroNova Inc (ALOT) designs, develops, manufactures, and distributes a broad range of specialty printers and data acquisition and analysis systems, including both hardware and software. Its target markets are apparel, automotive, avionics, chemicals, computer peripherals, and communications. Last week, AstroNova released Q4-2020 earnings of $0.12 per share and revenue of $29.4M. Highlights from the press release included ongoing headwinds from the grounding of the Boeing 737 MAX offset by the highest number of color printer shipments posted in two years.

ALOT is a 0.6% position in the North Star Micro Cap Fund.

+16.3% Movado Group Inc (MOV) designs, manufactures, retails, and distributes watches, as well as jewelry, tabletop, and accessory products. Its brands include Movado, Hugo Boss, Lacoste, Ferrari, Coach, and Tommy Hilfiger. Last week, Movado released Q4-2020 earnings of $0.84 per share and revenue of $178.33M which beat by $14.33M. Management expressed excitement about the upcoming January 2022 jewelry and watch collaboration with Calvin Klein, as well as reminded shareholders of the strong Company balance sheet that boasts almost $224 million in cash.

MOV is a 0.5% position in the North Star Micro Cap Fund.

Companies without news…

-11.8% Orion Energy Systems Inc (OESX) designs, manufactures, and implements energy management systems for commercial and industrial customers. The Company’s management system is comprised of high intensity fluorescent lighting systems, InteLite intelligent lighting controls, and Apollo Light Pipes. There was no significant company news last week.

OESX is a 3.2% position in the North Star Micro Cap Fund and a 3.9% position in the North Star Opportunity Fund.

-10.9% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

PRTS is a 3.6% position in the North Star Micro Cap Fund and a 2.3% position in the North Star Opportunity Fund.

-10.5% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals. There was no significant company news last week.

SII is a 1.7% position in the North Star Dividend Fund and a 1.5% position in the North Star Opportunity Fund.

-14.6% Pitney Bowes Inc (PBI) sells, finances, rents, and services integrated mail and document management systems. The Company offers a full suite of equipment, supplies, software, and services for end-to-end mail stream solutions. There was no significant company news last week.

PBI is a 0.9% position in the North Star Dividend Fund.

-10.8% 1-800-Flowers.Com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no significant company news last week.

FLWS is a 2.6% position in the North Star Micro Cap Fund.

-10.6% Hamilton Beach Brands Holding Company (HBB), through its subsidiaries, markets and designs electric household and specialty houseware appliances, as well as commercial products for restaurants, bars, and hotels. There was no significant company news last week.

HBB is a 0.9% position in the North Star Micro Cap Fund.

+10.6% Stride Inc (LRN) is a technology-based education company. Its curriculum is offered to public and private schools, blended schools, and individuals who seek to continue their education through supplemental training programs. There was no significant company news last week.

LRN is a 1.6% position in the North Star Micro Cap Fund.

-12.4% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Super Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. There was no significant company news last week.

SGC is a 2.0% position in the North Star Micro Cap Fund.