Last Week

The songs remained the same, with mega-cap momentum stocks blasting another round of “We Are the Champions,” while the small and mid-caps lamented in “When Will I Be Loved.” The dissonance between the economic data and the FOMC statement was as deafening as the chorus of the 17-year cicada infestation. On Wednesday, Chairman Powell and his merry band of Fed Governors kept the funds rate unchanged for the 7th straight meeting at a range of 5.25%-5.5%, despite a consumer price index reading for May that came in flat in what was its first unchanged reading since July 2022. The Federal Reserve not only kept interest rates steady at a 23-year-high but also signaled an expectation of only one 25 basis point cut in 2024 from a prior forecast of three cuts. The next day the producer price index came in -0.2% for the month, its lowest reading in seven months. Compared with a year ago, the PPI rose just 2.2%. Perhaps most revealing about how these high interest rates are affecting the average American was Friday’s reading that showed consumer sentiment nosedived in June, once again approaching the depths seen during the height of the pandemic in 2020 and amid the 2008-2009 financial crisis.

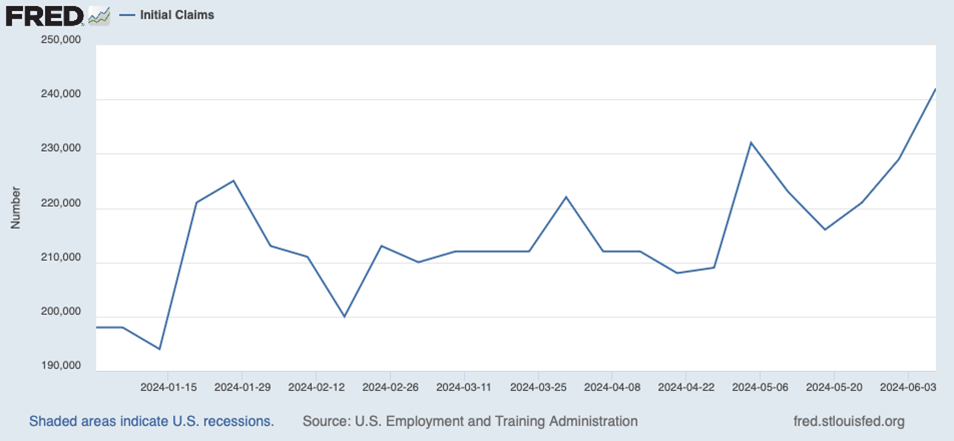

As if those economic reports do not paint a clear picture of a rapidly cooling U.S. Economy, the weekly jobless claims report on Thursday showed that the job market is likely weakening (see year-to-date initial unemployment claims graph below). The Fed’s current economic outlook, which is driving the consensus view for just one interest rate cut in 2024, assumes that unemployment remains around 4% throughout 2024; if we have more weeks of economic data like last week, the Fed’s unemployment forecast could be way off. In that case, more interest rate cuts would be warranted, and we would expect small-cap equities and real estate and precious metals to see strong investor interest.

The bond market embraced the economic data, with the yield on the 10-year Treasury sinking 23 basis points to 4.21%. The lower rates and the general atmosphere of AI euphoria drove the S&P 500 up 1.6% and the Nasdaq Composite 3.2% higher. The Technology sector rocketed 5.5% and Consumer Services eked out a small gain, but every other sector finished in the red. Small caps fared the worst, being cheated and mistreated, as the Russell 2000 shed 1%. Declining issues overwhelmed advancing issues by a factor of 1.8 to 1 on fairly heavy trading volume. The dollar and gold inched higher, while crude oil bounced up 4% from recent lows.

Speaking of being mistreated, Chicago sports fans suffered through another week in which all the teams lost more than they won.

This Week

The financial markets will be closed on Wednesday in observance of Juneteenth.

Retail sales data for May will be released on Monday. The consensus estimate is for a modest gain following flat results in April.

On Friday, S&P Global will release its June manufacturing and services Purchasing Managers’ Indexes, which will provide another look at the health of the U.S. economy.

North Star’s Summer Interns will be starting soon. Feel free to email us with any questions about the state of the economy or world that you would be interested in hearing the opinions of this group of intelligent young adults answer.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.