Big Bad Fed

The market rallied to kick off the back half of 2022, particularly for Tech stocks, as the key news releases comforted investors recession anxiety and their fear of the Big Bad Fed. The highly anticipated employment report showed that the U.S. economy added a stronger than expected 372,000 jobs in June offset somewhat by downward revisions to the previously reported April and May jobs reports, and the unemployment rate held steady at a healthy 3.6%. Wages only gained 0.3% from May, indicating a cooling of wage pressures on employers. Meanwhile, the minutes from the recent FOMC meeting showed no indication that policy makers favored a 75 basis-point hike at the July meeting later this month, as many market strategists have suggested, instead the minutes stated that “participants judged that an increase of 50 or 75 basis-points would likely be appropriate at the next meeting.” At North Star, we believe that there is a reasonably good chance that the combination of improving supply chains, some consumer demand destruction due to higher costs, and declining energy prices will cool the inflationary pressures and allow the Fed to normalize interest rates without over tightening monetary policy.

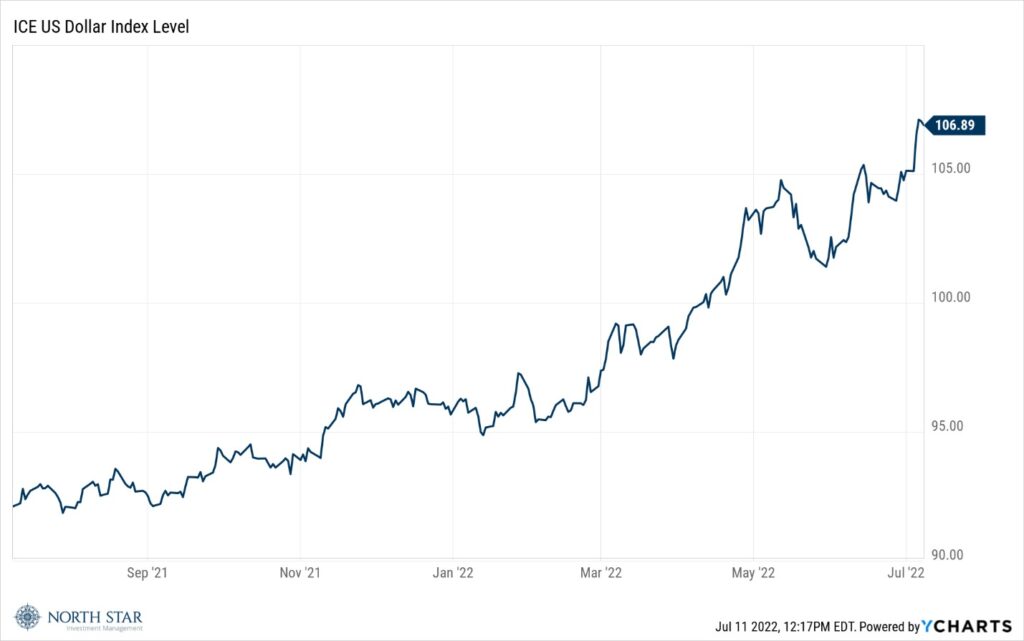

The S&P 500 increased 1.94% for the week, fueled by a 5.7% gain in the Technology sector, with Consumer stocks also performing well, while the Utility, Oil & Gas, Telecommunications, and Basic Materials sectors all posted declines. The Dollar jumped 1.7% to finish very close to its highest level in a decade.

A strong currency is normally associated with a strong economy. The recent strength in the greenback is one variable supporting our cautious optimism in the face of widespread pessimism.

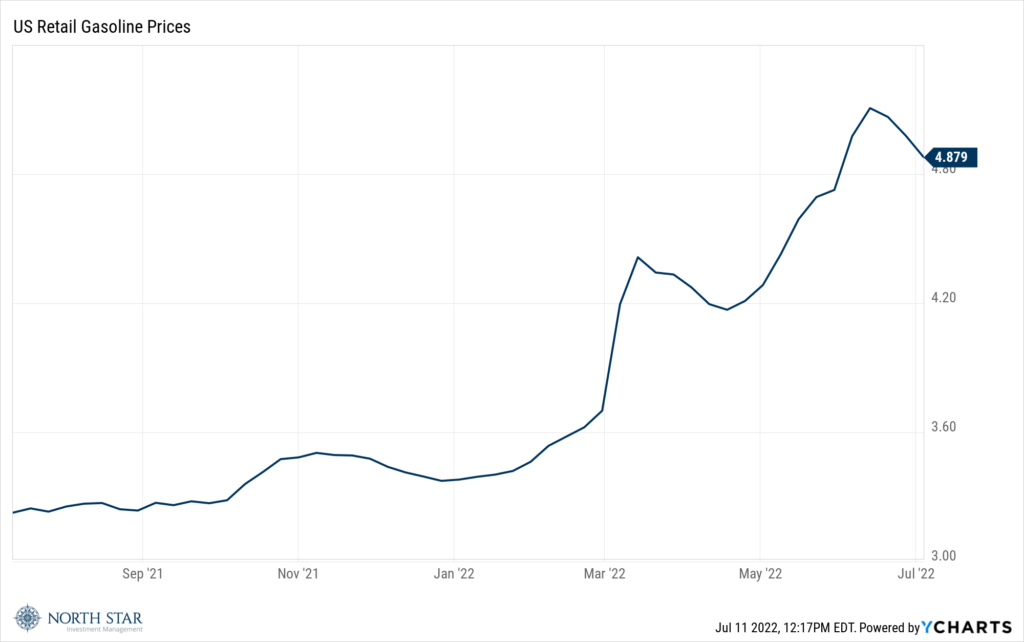

Related to the Dollar’s strength, and easing inflation concerns, commodity prices slid, with Gold and Oil both shedding over 3%. The drop in oil prices is also accompanied by a drop in gasoline prices (see chart below), albeit from a record-high level; retail gas price levels may be a key factor in consumer sentiment trends and certainly are a factor in lower-income and lower-middle-income households spending behavior. As we mentioned in the past few weeks, we see falling retail gas prices as a potential catalyst to more positive investor sentiment as well. The yield on the 10-year Treasury reversed course during the week, first dropping to 2.75% Wednesday morning, before advancing to 3.09% by Friday afternoon.

On a personal note, we had the pleasure of meeting the newest member of the Kuby family, Baby Girl Nora Avery over the weekend. For Nora and all the children, we hope that today’s adults will start taking better care of the world. After all, as Nick Lowe wrote in 1974 (with a fantastic version from Elvis Costello), what’s so funny about peace, love, and understanding?

As I walk through this wicked world

Searchin’ for light in the darkness of insanity

I ask myself, is all hope lost?

Is there only pain and hatred, and misery?

And each time I feel like this inside

There’s one thing I wanna know

What’s so funny ’bout peace, love and understanding?

Let Earnings Season Commence

Equity markets were under pressure Monday morning with headwinds coming from overseas as Macau closed its casinos for a week due to Covid-19 concerns, and China’s State Administration for Market Regulation fined tech giants Alibaba and Tencent for not properly reporting past transactions.

Earnings season will kick into gear with the largest banks announcing results for the second quarter, along with other sector bell-weathers such as PepsiCo (PEP) and UnitedHealth Group (UNH). Analysts’ consensus estimate is for overall S&P earning to rise approximately 5% on 10% revenue growth. The forward guidance will probably be more important than the actual results. Additionally, Taiwan Semiconductor (TSM) is releasing their earnings on Thursday which could influence the broader tech sector.

The BLS consumer price index report for June on Wednesday is going to be in focus, with economists forecasting an 8.8% increase. Core CPI, which excludes food and energy costs, is expected to have cooled to a 5.7% rate from a peak of 6.5% in March.

The University of Michigan Consumer Sentiment Index for July will be released on Friday. The Index is expected to show a reading of 50, equal to the record low set in June. The retail sales data the same day, on the other hand, is forecasted to show a healthy 0.6% rise month over month. The eagerness for the consumer to spend is another reason for our cautious optimism over avoiding a significant economic downturn.

Stocks on the Move

+10.1% Qualcomm Incorporated (QCOM) operates as a multinational semiconductor and telecommunications equipment company. The Company develops and delivers digital wireless communications products and services based on code-division multiple access (CDMA) technology. Chip stocks rose last week after Taiwan Semiconductor pre-announced strong monthly results and STMicroelectronics (STM) and GlobalFoundries (GFS) released plans to build a new chip factory.

+13.5% Accuray Inc (ARAY) designs, develops, and sells advanced radiosurgery and radiation therapy systems for the treatment of tumors throughout the body. There was no significant company news last week. The North Star Research Team is conducting a site visit to Accuray’s headquarters on Wednesday, July 13th.

+12.6% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant company news last week.

+11.5% PetMed Express Inc (PETS), doing business as 1-800-PetMeds, operates as a pet pharmaceutical company. The Company provides prescription and non-prescription pet medications, as well as health and nutritional supplements. There was no significant company news last week.

+10.1% Napco Security Technologies Inc (NSSC) manufactures electronic security devices, fire detection products, access control systems, and digital lock equipment used in residential, commercial, institutional, and industrial installations. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.