Last Week

Trading volume was extremely heavy thanks to Friday’s “triple witching,” with a massive $5.5 trillion of options expiring. Additional activity was driven by the annual index rebalancing, in which increased weightings reward the top-performing stocks from the previous 52 weeks while the bottom performer’s weightings are decreased or eliminated. Corporate news flow was light, with most companies in their “quiet periods” as business for the second quarter wraps up. The economic data continued to paint a picture of a steady but slowing economy, with soft retail sales, existing home sales, and the Purchasing Managers Index. Against that backdrop, the S&P 500 advanced 0.6% to set its 31st record high of 2024. Modest profit-taking in tech stocks left the Nasdaq Composite unchanged. At the same time, the much-maligned small caps topped the leaderboard with a 0.8% increase (not surprising given a recent Fedspeak tone trend away from hawkish – see comments below). Winners outnumbered losers by a factor of 4-3, with only the Utility and Tech sectors finishing slightly in the red. The dollar and the bond market were both steady, with the yield on the 10-year Treasury trading in a tight nine basis point range while inching up five basis points to 4.26%.

The din of the cicadas in Chicago and Fedspeak around the country was elevated. The cicadas should be quieting down soon, but the monetary policy symphony will likely continue for the foreseeable future. We detect a more dovish tone developing, so let’s look at the recent Fedspeak verses.

While financial markets sentiment shifts daily, and sometimes even intraday, Fedspeak language seems to more slowly ‘develop’ or ‘evolve.’ We like what appears to be evolving recently. During the past two weeks, we have noticed a Fedspeak tone that is clearly less hawkish – we call this the ‘dovish drift.’ As recently as the Fed’s policy meeting in mid-May, some Fed officials were suggesting rate hikes may be needed. For example, in an interview on CNBC, the Minneapolis Federal Reserve President Neel Kashkari emphasized that there was no need to hurry into rate cuts but rather that the Fed should “…take our time and get it right.” He stated that he wanted “many more months” of easing inflation before supporting Fed easing, and he even suggested that further Fed tightening may be needed. More recently, his comments indicate that such easing inflation data is upon us, emphasizing last week on Face the Nation that the Fed is now seeing evidence that the economy is slowing. Unemployment will possibly tick up in the near term.

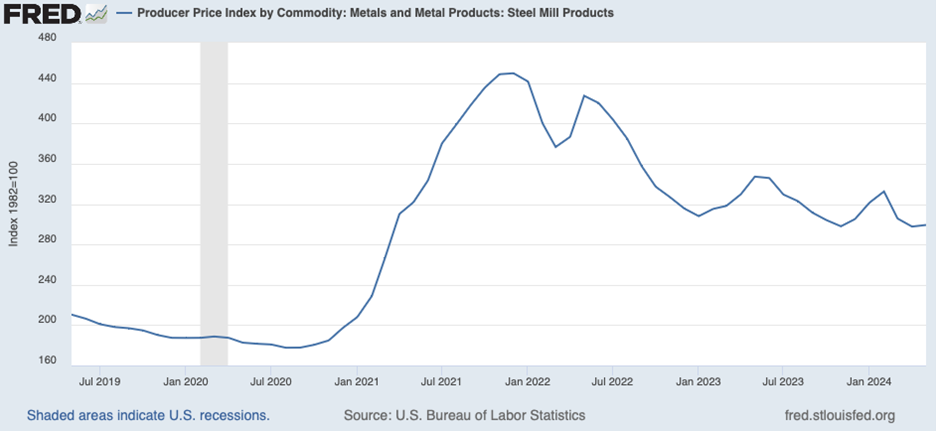

Governor Kashkari’s recent change in sentiment was not an isolated view among Fed officials. This past Tuesday, Federal Reserve Governor Adriana Kugler emphasized that her research showed slowing price trends and even price reductions: “What I have heard in my own conversations with business contacts is that consumers are ‘trading down’ to lower-cost products and that firms are responding with more discounting, and some large retailers have publicly spoken about cutting prices in the face of resistant consumers.” We see similar disinflationary data evolving; just as PPI provided an early indicator of accelerating inflation in mid-2021, some input-related prices, such as steel (see chart below), show clear signs of weakening. This PPI data for steel is particularly encouraging because the year-ago data also showed a decline, so the very recent declines are against difficult comparisons.

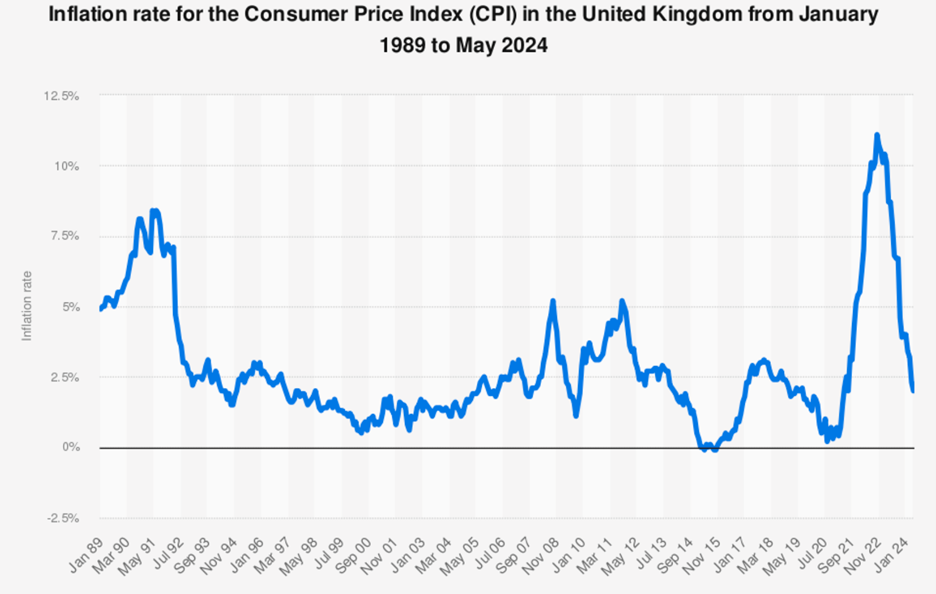

Another factor that may encourage Fed policy toward easing is that foreign central banks have already either (1) met their inflation target through restrictive policy or (2) begun easing already. First, the Bank of England (BOE) recently signaled that a rate cut in August or September was possible, given that England’s inflation rate had cooled to the BOE’s 2% target after peaking at 11% in October 2022 (see chart below). Second, both the European Central Bank (ECB) and the Bank of Switzerland cut interest rates by 25 basis points in the past two weeks. We don’t think the U.S. Federal Reserve would cut due to peer pressure. Instead, we highlight foreign central bank actions because such actions generally strengthen the U.S. dollar versus foreign currencies, which is an additional disinflationary force in the U.S. economy.

There was no sign of the Chicago Sports scene pain easing though. The news remained bleak, with all the teams continuing to lose and the Bulls trading Alex Caruso, our favorite player, to Oklahoma City.

This Week

The calendar is very light, with Friday’s PCE price index release from the BEA in focus. The consensus is for a 2.6% year-over-year increase, one-tenth less than in April. The financial markets will be sensitive to surprises, as the Fed views the PCE as its preferred inflation gauge.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.