Humdrum

Geopolitical tensions, hawkish Fedspeak, and lackluster earnings combined to produce humdrum financial markets.

It was geopolitics on Monday with the U.S. shooting down a Chinese spy balloon over the coast of South Carolina. Several more flying objects were shot down as the week progressed. The recent increase in geopolitical tensions suggests a modest, but meaningful, allocation to precious metals such as gold is prudent.

As was to be expected following the extremely strong jobs report the previous Friday, there was a cacophony of hawkish Fedspeak, with Minnesota Fed President Neel Kashkari leading the chorus calling for higher rates. We think that the downward trend in inflation over the last 6 months suggests that the rate hike cycle is probably very near its conclusion.

Earnings season remained lackluster, although the blended earnings decline for the fourth quarter did improve to -4.9% from -5.4% during the week. In Communication Services, positive EPS surprises reported by Walt Disney ($0.99 vs. $0.78), Activision Blizzard ($1.87 vs. $1.52), and Lumen Technologies ($0.43 vs. $0.19) were significant contributors to the improvement during the week. Despite those results, the Communication Services sector is experiencing a difficult quarter with a -23.8% earnings decline.

It was risk-off action in the equity markets with the S&P 500 slipping 1.1%, the Nasdaq dropping 2.4%, and the Russell 2000 sliding 3.4%. Crude oil rallied, and the Oil and Gas sector once again was the top performer; in fact, with a gain of 4.7% it was the only sector to finish in positive territory. The yield on the 10-year Treasury jumped 21 basis points to 3.74% and match its highest level of 2023.

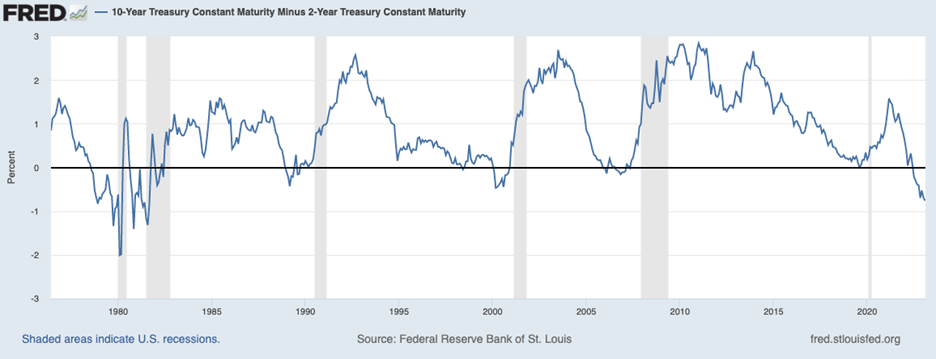

One silver lining was the University of Michigan Consumer Sentiment Index for February, which increased to 66.4 from 64.9 in January, representing the best reading since January 2021 when the index read 67.2. Given the persistent concerns of an impending recession, we are encouraged by data that supports the resilience of the U.S. economy. We would be more confident that the U.S. can avoid some recessionary phase if confirmed by upward movement in the oft-cited 10-year minus 2-year spread, which remains near historically negative levels, suggesting a recession is likely.

The Kansas City Chiefs kicked a field goal with 8 seconds left to win Super Bowl LVII by a score of 38-35. The Chicago Bears last victory was 113 days ago, leaving sentiment for die-hard Bears fans deep in recession territory.

Hot or Cold?

Inflation data will be in focus. The Consumer Price Index report for January on Tuesday is forecasted to show a 0.5% month-over-month increase with the year-over-year inflation reading expected to drop to +6.2% from +6.5% in December. Food prices and Energy are seen bumping up from December, while some cooling with air fares and lodging is anticipated.

The inflation report will be accompanied by a heavy slate of Federal Reserve speakers. It will be interesting to see if the CPI report changes the narrative by running hotter or colder than expected.

61 S&P 500 companies will be reporting results for the fourth quarter as earnings season winds down.

Stocks on the Move

Stocks with news…

-25.7% The Container Store Group, Inc. (TCS) operates as a retailer of storage and organization products and solutions in the United States. The Company also designs, manufactures, and sells custom closet solutions via its Elfa and Closet Works segments. On Tuesday, The Container Store reported Q3FY22 earnings per share of $0.08 and revenue of $252.2M. While retail store sales suffered modest declines, the company’s online sales grew 4.6% in the period. Additionally, the company’s fourth quarter outlook came slightly less than expected with sales between $255M-$265M and EPS between $0.10-$0.20.

-12.8% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Super Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. Last week, Superior Group announced the retirement of Chief Operating Officer Andrew Demott, Jr., effective March 31, 2023.

-10.9% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. Last week, BTIG penned a positive review of Boot Barn (BOOT), another footwear company and North Star stock. The report gave some lift to similar consumer stocks. Additionally, BTIG assumed coverage of RCKY at a Hold rating.

-10.0% PetMed Express Inc (PETS), doing business as 1-800-PetMeds, operates as a pet pharmaceutical company. The Company provides prescription and non-prescription pet medications, as well as health and nutritional supplements. Q3FY2023 earnings from PETS came in lower than expected on slightly lower sales and higher G&A related to payroll expense. The company saw 9% growth in its customer base during the period, the first increase in net new customers since Q1FY2021.

+13.4% Madison Square Garden Entertainment Corp (MSGE) produces, presents, and hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, in its venues including New York’s Madison Square Garden, Hulu Theater, Radio City Music Hall, the Beacon Theater, and The Chicago Theater. The Company also operates entertainment dining and nightlife venues in New York City, Las Vegas, Los Angeles, Chicago, Singapore, and Australia under the Tao, Marquee, Lavo, Avenue, Beauty & Essex, and Cathédrale brand names. MSGE reported FQ2 earnings of $1.95 per share and revenue of $642.2M for the period. Major strategic initiatives are moving forward including the proposed spin-off of the live entertainment business, and the construction of the MSG Sphere in Las Vegas.

+19.9% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations. BLBD reported FQ1 $(0.30) loss per share on revenue of $235.7M, up over 80% y/y. Management commentary was very upbeat, citing a 5,300-unit backlog worth over $675M, aggressive cost and pricing actions, and a 130% increase in EV unit sales. Additionally, the Company raised its guidance to over a $1B in revenue and full year adjusted EBITDA of $40M-$60M vs $35M-$45M previously.

Stocks with no news…

-10.8% 1-800-Flowers.com Inc (FLWS) is an e-commerce provider of floral products and gifts. The Company’s product offerings include fresh-cut and seasonal flowers, plants, floral arrangements, home and garden merchandise, and gift baskets. There was no specific company news last week; however, the North Star Research team met with the company to get a sense of margin restoration initiatives and more color on the recent acquisition of Things Remembered, a custom engravable business.

-12.9% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices.

-14.5% DallasNews Corporation (DALN) is the Dallas-based holding company of The Dallas Morning News and Medium Giant. The Dallas Morning News is Texas’ leading daily newspaper with a strong journalistic reputation, intense regional focus, and close community ties. Medium Giant is a media and marketing agency of divergent thinkers who devise strategies that deepen connections, expand influence, and scale success for clients nationwide.

-11.4% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.