Last Week:

Treasury yields rose sharply during the week after signs that U.S. consumer spending remained strong and on receding trade tensions between the U.S. and China. Additionally, both the CPI and PPI showed some signs of inflation. The “Crowd” got caught all-in on the recession trade, long bonds and stocks that were categorized as recession-resistant, and a dramatic rotation into cyclical and value stocks was unleashed. The Russell 2000 Value Index surged 6.42% while the S&P 500 Growth Index slipped 0.35%.

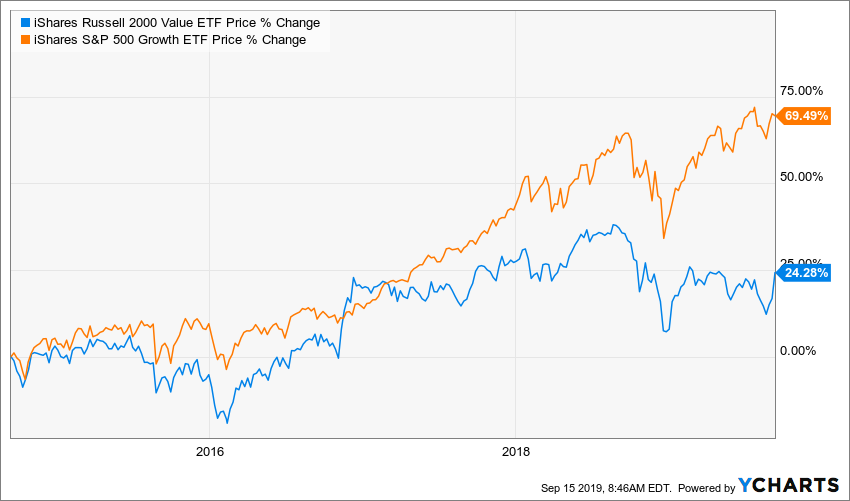

It was a fantastic week for long-suffering value investors after an anomalous 5-year period of underperformance in a methodology that historically has offered the best risk adjusted returns.

The action last week would also reinforce the theory that algorithm-based traders are dictating prices. It seems much more likely that the surge in yields and the reversal of the inversion of the yield curve were inputs into trading models that triggered the rotation, rather than there having been a magical moment where a wave of investors decided to adopt a value-oriented philosophy. To quote Steven G. DeSanctis, Equity Strategist at Jefferies, “The big rotation is upon us: We think this trade has more room to run”. I hope he is right, and certainly agree with his follow-up that “Cheap is still very cheap and momentum marginally less expensive, and higher yields and a steeper curve point to a better economy”.

This Week:

Over the weekend Brent crude surged the most on record (up $11.73 a barrel to the $71.95) after a drone strike on a Saudi Arabian oil facility removed about 5% of global supplies. Energy stocks will likely be in focus as the market identifies winners and losers from this supply shock.

On Wednesday the FOMC will announce its monetary policy decision, with the near certainty of a quarter of a point cut to its federal funds rate. It is expected that the median interest rate “dot” projection will indicate no further easings are expected this year, and that policy rates are expected to be on hold next year as well. The language will likely continue to indicate that the Fed “will continue to monitor” and “will act as appropriate to sustain the expansion.”

The U.S.-China trade talks resume with some optimism for progress as each side has recently offered olive branches. China will send a delegation of trade staffers to Washington this week ahead of the scheduled meetings between principals in early October and the markets now anticipate that the U.S. will agree to hold off on additional tariff increases in exchange for China increasing agricultural imports and improved market access/IP protection.

Stocks on the Move:

It was a “dream” week for our portfolios, as “value” stocks, particularly those companies that are sensitive to the U.S. economy, came to life despite the lack of much company specific news.

(LEE) +14.44%: Lee Enterprises Inc., is a local news publication company in the United States. Its products include daily and Sunday newspapers, weekly newspapers and classified and few other specialty publications. Media stocks across the board enjoyed a nice bounce from depressed levels as part of the rotation into economically sensitive “value” stocks. LEE is a 1.00% holding in the North Star Opportunity Fund and LEE corporate bonds are a 2.75% holding in the North Star Bond Fund.

(OESX) +14.11%: Orion Energy Systems Inc., is a developer, manufacturer, and seller of lighting and energy management systems. There was another acquisition in the industry as Acuity Brands Lighting, Inc. inked a deal to acquire The Luminaires Group (“TLG”) — a leading provider of specification-grade lightening solutions. OESX is a 3.64% holding in the North Star Opportunity Fund.

(WEN) -13.23%: The Wendy’s Co., is a quick-service restaurants franchisor, operating restaurants under the brand name Wendy’s. Wendy’s are known for its hamburger sandwiches in the United States and Canada. The Company announced that it would be invested $20 million to roll-out a nationwide breakfast program. Wendy’s breakfast will feature the Breakfast Baconator, the Frosty-ccino and the Honey Butter Chicken Biscuit. Analysts were skeptical, pointing to the Company’s past failed attempts to break into the breakfast market. WEN is a 1.35% holding in the North Star Opportunity Fund and WEN corporate bonds are a 2.63% holding in the North Star Bond Fund and a 0.81% holding in the North Star Opportunity Fund.

(HCSG) +11.26%: Healthcare Services Group Inc., is a provider of housekeeping and facility-management services to the healthcare industry. The company operates two business segments: housekeeping and dietary. The shares bounced after a sell-off in 2019 cut the price in half to a six-year low. HCSG is a 2.30% holding in the North Star Dividend Fund.

(MYE) +10.01%: Myers Industries Inc., is a plastic manufacturer of returnable packaging, storage and safety products and specialty molding. There was no company specific news to account for the gain. MYE is a 1.41% holding in the North Star Divided Fund.

(PETS) + 15.58%: PetMed Express Inc., along with its and subsidiaries is a leading nationwide pet pharmacy. The company markets prescription and non-prescription pet medications, health products, and supplies for dogs and cats, direct to the consumer. There was no company specific news to account for the gain. PETS is a 1.57% holding in the North Star Divided Fund.

(AMOT) +14.40%: Allied Motion Technologies Inc., designs, manufactures and sells precision and specialty motion control components and systems. The firm primarily caters to the vehicle, medical, aerospace and defense and electronics and industrial, pumps and robotics sectors. There was no company specific news to account for the gain. AMOT is a 1.15% holding in the North Star Micro Cap Fund.

(BSET) +16.09%: Bassett Furniture Industries Inc., is a manufacturer, importer, and retailer of home furnishings products in the United States. Furniture stocks across the board bounced from very depressed levels. BSET is a 1.76% holding in the North Star Micro Cap Fund.

(KBAL) +10.16%: Kimball International Inc., has only one business segment, furniture manufacturing. The company recently consolidated its furniture business and now manufactures office and hospitality furniture exclusively. Another bounce from a furniture company. KBAL is a 1.19% holding in the North Star Micro Cap Fund.

(BOOT) +12.89%: Boot Barn Holdings Inc., operates specialty retail stores. The company sells western and work‑related footwear, apparel and accessories in the United States. BOOT has actually been a “momentum” stock in my opinion, but it also is an economically sensitive company. There was no company specific news. BOOT is a 3.86% holding in the North Star Micro Cap Fund.

(EML) +10.84%: The Eastern Co., is a manufacturer of industrial hardware, security products, and metal castings. It operates in three business segments: Industrial Hardware, Security Products, and Metal Products. The Company announce a significant acquisition the previous week of Big 3 Precision, a leading provider of turnkey packaging solutions. “In acquiring Big 3 Precision, we are adding a substantial new growth business and moving Eastern closer to our long-term goal of generating $100 million in EBITDA. This transaction, our third acquisition in three years, represents another step toward our ambition of building a larger company that has a strong presence with key customers and in key markets,” said August Vlak, President & CEO of Eastern. “Consistent with our disciplined approach, this transaction checks the boxes of our stated acquisition criteria: strong intrinsic economics, including an attractive margin profile and high cash flow generation; a robust business model in attractive niche markets we understand; and a committed and capable management team.” We are meeting with August Vlak this week, so more to come on this company. EML is a 3.91% holding in the North Star Micro Cap Fund.

(LAKE) +11.97%: Lakeland Industries Inc., manufactures and sells safety garments and accessories for industrial protective clothing market. It offers limited use / disposable protective clothing, chemical protective suits, and firefighting and heat protective apparel. The Company reported very solid results for their fiscal second quarter. Christopher J. Ryan, President and Chief Executive Officer of Lakeland Industries, stated, “We delivered solid financial and operating performance progress in the second quarter of fiscal 2020. Quarterly revenues reached the highest level in Company history due in large part to filling backlog orders when not including sales relating to emergency demand. Sales increased across a wide array of product groups, including disposable garments, chemical suits, fire retardant products and high visibility apparel. These products can be made from several of our manufacturing locations around world with diversified supply chains to support our low-cost production practices. LAKE is a 3.38% holding in the North Star Micro Cap Fund.

(SGC) +12.67%: Superior Group Of Companies Inc., is engaged in designing, manufacturing, and distribution of uniforms to major domestic retailers, foodservice chains, transportation, and other service industries. Superior Group Of Companies Inc., is engaged in designing, manufacturing, and distribution of uniforms to major domestic retailers, foodservice chains, transportation, and other service industries. It provides customer-specific uniform eStores, custom Image apparel, corporate identity apparel, career apparel, and accessories including remote staffing solution and call center operations for the medical and health fields also for industrial, commercial, and leisure. There was no company specific news. SGC is a 3.30% holding in the North Star Micro Cap Fund.

(PRTS) +12.00%: U.S. Auto Parts Network Inc., is an online provider of automotive aftermarket parts and repair information. There was no company specific news. PRTS is a 2.88% holding in the North Star Micro Cap Fund.