Last Week:

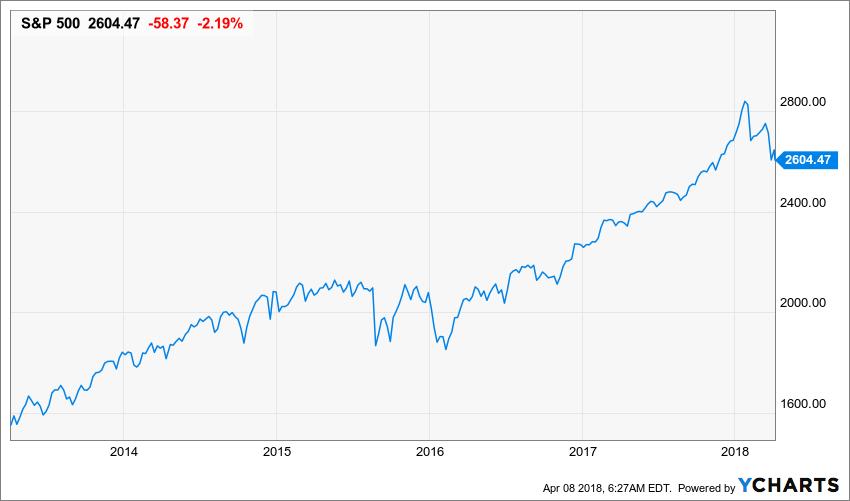

It was a turbulent week in what is developing into a volatile year in the stock market. In fact, we have already had more than three times as many days of 1% or more changes in the S&P 500 this year than we had in all of 2017. Additionally, all the major indices are in the red year to date, with the S&P 500 now down 2.59% after declining 1.38% in the last week. There are three high pressure pockets that are contributing to the current bumpy ride. First, there is the trade war rhetoric, which in my opinion is a subset of the general political environment. It is uncertain what results this tariff tweeting strategy will produce. The White House’s directive to find $100 billion worth of Chinese goods to hit with tariffs triggered a round of selling on Friday. The best-case scenario is that some compromises are made which will allow our massive trade deficits to lessen. The worst-case scenario would be a significant inflationary surge combined with a slowdown in exports. Second, there is the impact of rising interest rates on our economy. The Fed is being very clear about its intention to continue to return short-term rates to normal levels, with 2 more hikes planned for 2018. The big sell-off on Friday seemed to have been exacerbated by comments that Fed Chair Jerome Powell made during his interview at the Chicago Economic Club luncheon. Third, there is the possibility that the economy slows down or goes into a contraction. The March jobs report on Friday came in well below expectations, and there has been some modest softening in other economic data.

These periods of uncertainty and volatility are painful, but normal. The last difficult period was the last quarter of 2015 into January of 2016 when energy prices were crashing, and a global recession seemed inevitable. After that turbulence subsided, we had two years of historically low volatility and substantial equity price appreciation.

This Week:

The twists and turns of the trade war story will likely continue to impact the market. President Xi speaks on Tuesday at the Boao Forum in China and should provide additional insight into the state of Washington-Beijing trade negotiations. On Wednesday, the Bureau of Labor Statistics reports inflation data for March. Keep in mind that the Federal Reserve is raising rates to prevent an escalation in inflation, so any significant deviation from the expected 2.3% increase could impact the markets. First quarter earnings reports will start to trickle in, with seven S&P 500 companies schedule to report results. The earnings growth rate for the S&P 500 is expected to be 17.1% for the quarter, which would mark the highest growth rate in 7 years.

Stocks on the Move:

AMC Entertainment Holdings, Inc. (AMC) +17.1%: The Public Investment Fund of Saudi Arabia (PIF) announced that its wholly owned subsidiary, the Development and Investment Entertainment Company, has signed an agreement with AMC to operate AMC Cinemas in the Kingdom. The Development and Investment Entertainment Company jointly with AMC expects to open 30-40 cinemas in approximately 15 cities in Saudi Arabia over the next five years, and a total of 50-100 cinemas in approximately 25 Saudi Arabian cities by the year 2030. AMC and the Development and Investment Entertainment Company have a goal of establishing an approximate 50 percent market share of the Saudi Arabian cinema industry. After a 35-year ban on cinemas in the Kingdom of Saudi Arabia, the Development and Investment Entertainment Company jointly with AMC will open its first theatre in Riyadh in the King Abdullah Financial District on April 18. AMC’s entry into the Kingdom of Saudi Arabia is in concert with a key objective of Vision 2030, which is to grow the entertainment sector in Saudi Arabia. As a result, the cinema industry is expected to grow to around $1 billion in size over the coming years. AMC is engaged in theatrical exhibition. It is principally involved in the theatrical exhibition business and owns, operates or has interests in theatres located in the United States. The North Star Opportunity Fund holds a 1.8% position in AMC and the North Star Bond Fund holds a 2.2% position in AMC corporate bonds.

Myers Industries, Inc. (MYE) +10.9%: The Company’s shares spiked to a 4-year high on heavy volume and no specific news. Meyers manufactures a range of polymer products for industrial, agricultural, automotive, commercial and consumer markets. It also manufactures plastic reusable material handling containers and pallets. The North Star Dividend Fund holds a 3.4% position in MYE.

Pioneer Power Solutions, Inc. (PPSI) -9.8%: The Company announced confusing earnings, as well as a letter of intent to sell its switchgear business the previous week. Pioneer manufactures, sells and services a broad range of specialty electrical transmission, distribution, and on-site power generation equipment for applications in the utility, industrial, commercial and backup power markets. The North Star Opportunity Fund holds a 2.1% position and the North Star Micro Cap Fund holds a 1.2% position in PPSI.

NTN Buzztime, Inc. (NTN) -17.5%: The Company reversed the gains it experienced the previous week that seemingly were sparked by activist investor Sean Gordon’s open letter to the Board of Directors highlighting the numerous opportunities that he thinks the Company should be pursuing. NTN provides interactive entertainment and dining technology to bars and restaurants in North America. Its main products are Buzztime, Playmaker, Mobile Playmaker, BEOND Powered by Buzztime and Play Along. The North Star Micro Cap Fund holds a 1% position in NTN.