Never-Ending Rally Back on Track

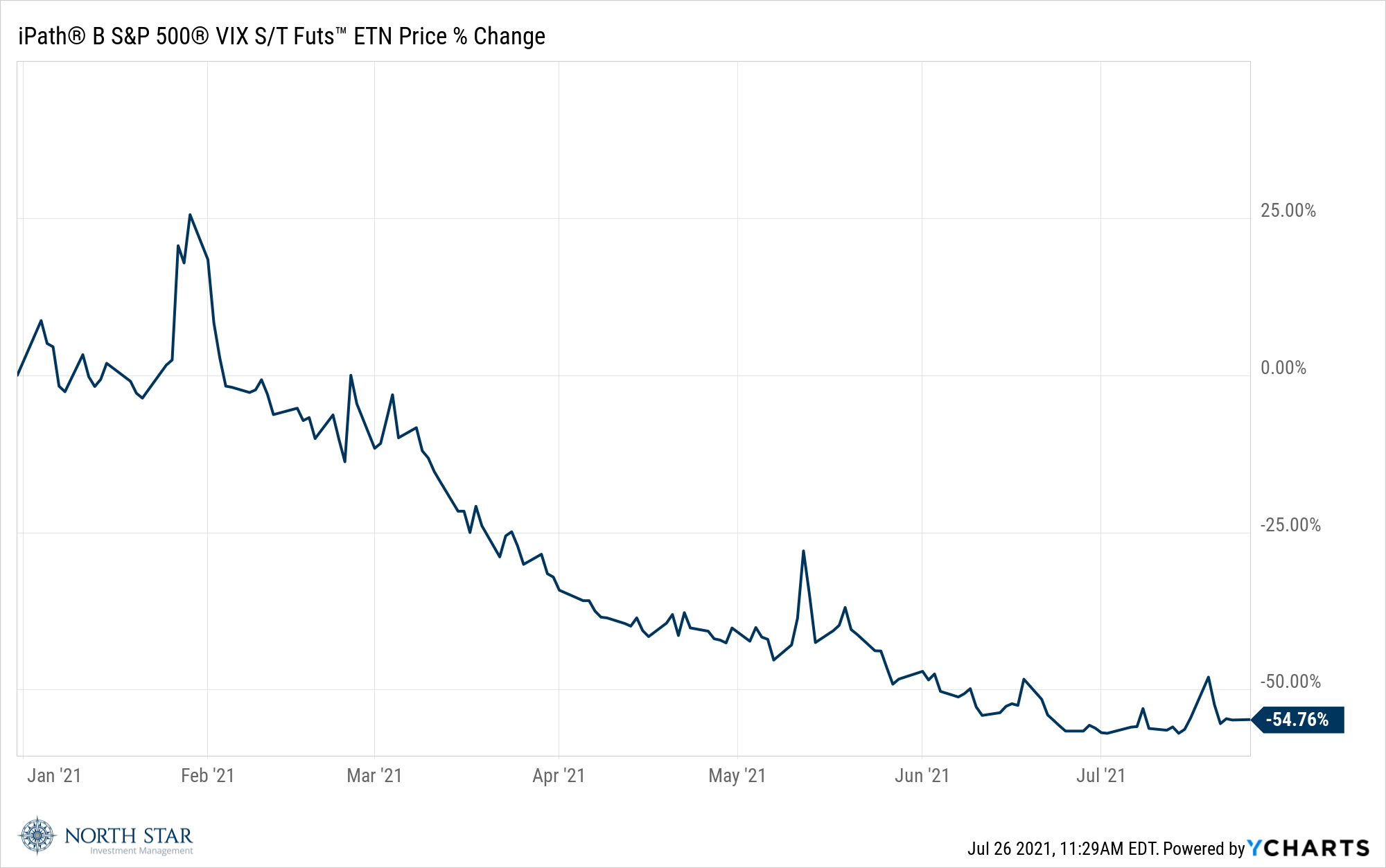

Despite the scary headlines, the “Fear Index” continues to falter.

We concluded last week’s commentary noting that “U.S. stock futures followed the global markets lower over the weekend, and the “Fear Index” (VIX) jumped 6% going into Monday’s trading session.” The Bull Market seemed to show signs of battle fatigue, fighting the stiff headwinds of inflationary pressures and the emergence of the highly contagious Delta variant of the coronavirus. Monday proved to be the worst trading day in over 9 months for equities, with a 2% across the board decline and a 14.3% increase in the Fear Index (VIX). By Tuesday morning, without any positive news, the sell-off was over, and the never-ending rally was back on track. Indeed, by Friday’s close the S&P 500, the Nasdaq Composite, and the DJIA, were all at record highs, and the Fear Index had resumed its downward slope. Speaking of fear, we coined the term FOMOTINATE a few years ago, standing for Fear Of Missing Out There Is No Alternative To Equities. The bottom line seems to be that with interest rates near zero, investors view all declines in the market as buying opportunities. Which begs the question: How long can interest rates remain near zero given recent inflation data and the massive increase in the money supply?

We have asked our summer interns to send us articles from the previous week that they believe are most relevant. Sam Audy, from Indiana University’s Kelley School of Business, focused on the monetary policy experiment. He referenced an article from MarketWatch that highlighted modern monetary theory and its potential danger, providing the following quote: “the transition to MMT may create instability. An exchange rate or inflation shock would affect existing investors and trade. Policymakers may be unable to control the process once set in motion. Where supply constraints are reached, excessive deficit-financed spending would result in inflation, higher rates, and a currency correction.”

To date, the dollar has remained relatively stable, inching up fractionally during the past week. In response to the economic stresses from the pandemic, all the major global economies have adopted extremely accommodating monetary policies, including negative interest rates in some countries. In other words, the key reason the experiment is working is that there are no alternative stronger currencies for international capital flows. We continue to monitor the dollar for signs of weakness and believe gold remains a reasonable hedge against the possible future instability.

The Ten-Year Treasury reached a five-month low yield of 1.12% on Tuesday, before rebounding to 1.28% by the end of the week. The Tech sector was the top performer, gaining 4.01%, and the S&P SmallCap index rose 2.84% versus the + 1.96% posted by the S&P 500.

Investors Aren’t Backing Down

Christian Bryan, one of our interns from the University of Chicago (Go Maroons!), noted “Through what I saw it looks like many people are saying that regardless of if the delta variant becomes more prevalent, America and Europe are unlikely to truly shut down again, meaning that the economic growth pace will not be affected. Investors right now are incredibly optimistic, and it doesn’t seem like anyone really knows what to base their predictions on for the financial markets anymore (inflation scares didn’t work, Delta variant scares didn’t work; Investors this year aren’t backing down to anything.) Amazon, Alphabet, Microsoft, and Facebook will all be reporting earnings next week, so we will see if that will have any effect on how the market moves.”

Indeed, it will be a big week for earnings releases, with 180 S&P 500 companies reporting second-quarter results. So far, the earnings season has been nothing short of spectacular, with composite earnings on track to post a 74.2% increase over the pandemic devastated quarter from a year ago.

The economic calendar is also busy, with New Home Sales on Monday, Durable Goods and Consumer Confidence on Tuesday, GDP on Thursday, and Personal Income on Friday. Perhaps the most important event of the week will be the FOMC monetary policy decision on Wednesday, with expectations that the central bank will announce a timeline for reducing its bond purchases, current at $120 billion a month.

Stocks on the Move

-11.4% Healthcare Services Group Inc (HCSG) provides housekeeping, laundry, linen, facility maintenance, and food services. The Company offers its services to the healthcare industry, including nursing homes, retirement complexes, rehabilitation centers, and hospitals. Last week, Healthcare Services Group reported weaker than expected Q2 2021 earnings of $0.13/share and revenue of $389.17M. The North Star team of analysts view the subsequent share weakness as warranted but also an opportunity; repricing adjustments, significant customer transaction activity, and a one-time SEC settlement are temporary headwinds distracting from ongoing dividend increases and new food service agreements with existing customers that should result in a $50 million increase of annualized revenue over the next quarter. $5 billion in government funding for nursing home operators as well as the mass retirement of the youngest members in the baby boomer generation should also benefit the company long-term.

HCSG is a 2.9% position in the North Star Dividend Fund.

+18.2% Resources Connection Inc (RGP) is a professional services firm. The Company provides accounting and finance, human resources management, and information technology professionals to clients on a project-by-project basis. Resources assists its clients with discrete projects requiring specialized expertise, compensation program designs, and transitions of management information systems. Last week, Resources Connection reported FQ4 2021 results of $0.80/share (beat by $0.57) and revenue of $172.3M (beat by $6.62M). Kate Duchene, the CEO, cited pent-up demand for digital transformation offerings, improved operational execution, and favorable macro trends as the main contributors to the top line recovery.

RGP is a 0.6% position in the North Star Dividend Fund.

+12.1% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

PRTS is a 4.6% position in the North Star Micro Cap Fund and a 2.6% position in the North Star Opportunity Fund.

+11.3% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, and licensed brand Michelin. There was no significant company news last week.

RCKY is a 3.9% position in the North Star Micro Cap Fund.