Laundry List

There has been a laundry list of factors that have heavily influenced the trends in the financial markets over the past few years. Topping that list would be the COVID-19 pandemic and related supply-chain disruptions, closely followed by the increasingly unstable and violent geopolitical and deteriorating domestic political landscapes. Meanwhile, the tone of short-term trading last week (and quite frequently) has been set by the Fed seesaw. The Central bank swayed from too loose to too tight, taking the markets for a wild ride. The Moody Blues lyrics describe how monetary policy has affected investors:

My world is spinning around,

Everything is lost that I found.

People run, come ride with me,

Let’s find another place that’s free.

Ride, ride my seesaw.

Steady but softening economic data has recently bolstered the case that the end of the rate hiking cycle is upon us – with a growing likelihood of rate cuts on the horizon – leading to a handsome rally in the stock and bond markets. Indeed, the S&P 500 was riding an eight-day winning streak, before Fed Chairman Jerome Powell made his usual hawkish comments to bring the see-saw back down on Thursday. The seesaw swung back up on Friday, following a very weak reading on consumer sentiment from the University of Michigan, which counterbalanced Chairman Powell’s jawboning.

On the surface, it was a strong week for equities, with the tech-heavy Nasdaq Composite jumping 2.4%, buoyed by strong monthly sales data from Taiwan Semiconductor, and a report that a Chinese artificial intelligence startup had made a major purchase of Nvidia’s chips. Tech stocks also fueled a 1.3% advance in the S&P 500, but declining issues outnumbered advancing issues by a factor of 2-1, and the Russell 2000 slid 3.2%. The Oil & Gas sector suffered a 4.2% decline as crude sank an equal amount to $77.17 per barrel. The damage in the bond market was on the short-end, where the 2-year rate jumped 23 basis points to 5.07%, while the 10-year Treasury rate inched up just 7 basis points to 4.63%. Gold was weak last week, supposedly driven by less concern over geopolitical turmoil; but, that explanation from several news outlets seems like a reach given ongoing Middle East violence and speculation of China’s aggression toward Taiwan.

It is worth noting that the 30-year Treasury bond auction went poorly. The massive government deficit means lots of Treasury issuance is on deck, at a time when the Fed is also shrinking its holdings and foreign buyers (China) have shown limited interest. The reception to future bond auctions will be important to the overall financial markets.

Contrasting Pictures

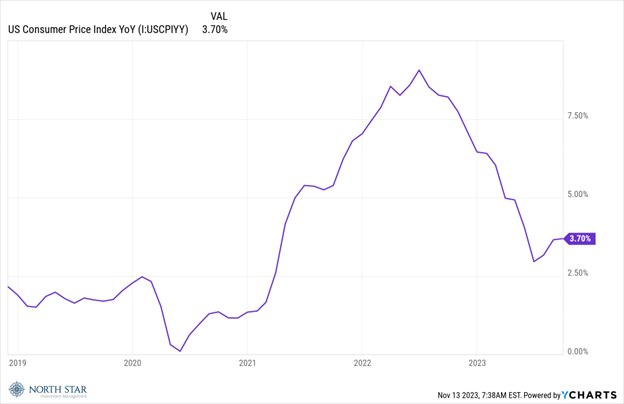

The consumer price index report for October on Tuesday will be the key event, with the consensus calling for a 3.3% year-over-year increase. Markets are pricing in less than a 20% probability of a December rate increase, but a hot CPI report would undoubtedly put us on the downside of the Fed see-saw. The graph below shows the significant progress already made on one measure of core CPI since this measure peaked in late 2022 and early 2023; further progress could help renew the recent rally in equities and bonds.

The health of the consumer will also be in focus as the earnings calendar includes reports from retail giants Walmart, Target, and Home Depot. A major contributor to the strong economy has been retail sales, as consumer behavior and sentiment have painted contrasting pictures.

Whereas on the surface there are 3 declining issues (Bears, Bulls, Blackhawks) and no advancing issues on the Chicago sports scene, Tyson Bagent does looks pretty good for a rookie quarterback.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.