Walmart Sales Up, Gas Prices Down

The stock market rally ran out of steam, as the S&P dropped 1.2%, the Nasdaq declined 2.6%, and the Russell 2000 slid 2.9%. Most of the damage was on Friday, without any specific news to account for the mood swing. Of note, the market didn’t react on Wednesday when the minutes from the Fed’s July meeting showed that officials expected to continue to hike rates, albeit at a slower pace. Rather than listing the possible causes for the sell-off (especially on Fridays during these summer doldrums weeks), we will borrow William Shakespeare’s concept that “brevity is the soul of wit” and leave it simply that it was a Friday fizzle. The bond market didn’t fare much better, as the yield on the 10-year Treasury jumped 14 basis points to 2.9%, with all the damage done on Friday as well.

Probably the biggest stock-specific headline of the week was in the retail sector, where Walmart (WMT) indicated that its recent quarter sales accelerated in the final weeks of their quarter. This most likely occurred due to the falling gas prices we have been writing about for a few months. The downturn in retail gasoline prices continued last week. According to AAA, by the end of the week, the national average price was $3.90, down from $3.96 a week prior and $4.44 one month ago.

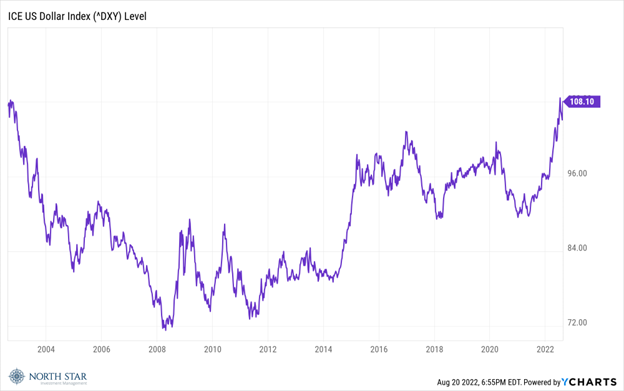

The dollar surged over 2% to approach its highest level in twenty years. We believe a strong currency reflects a healthy economy that is attracting foreign investment. Those concerned about the strength in the dollar are quick to suggest it fosters trade deficits and lowers the reported earnings for U.S. corporations from their international operations. However, a strong currency also benefits domestic consumers, and ultimately currencies self-correct and find equilibrium through international trade as domestically produced goods become more expensive to foreign buyers and foreign goods become more attractive to domestic consumers; this self-correcting mechanism occurs because of the required currency exchanges as businesses pay their employees and other expenses in their domestic currencies. In the short run, a strengthening U.S. dollar can squeeze foreign governments that may borrow in U.S. dollars, as has been well-publicized in the case of Sri Lanka.

Given the dollar strength, it is no surprise that both gold and crude oil declined over 1%. Despite the decline in the underlying commodity prices, the Oil & Gas sector gained 0.9% for the week, with only Utility stocks faring better.

The wildest action was in the shares of struggling retailer Bed Bath & Beyond (BBBY), the latest meme stock. The Company’s share price was under $5/share on July 1 following a disastrous earnings report, and with its bonds trading at distressed levels. On Wednesday the share price hit $30, before the game of musical chairs ended and the stock lost 2/3 of its value. “Though this be madness, yet there is method in it.” While it is easy to feel “left out” of the excitement of meme stock manias as they soar upward, our discounted cash flow and price target disciplines are quite comforting when the inevitable downside rears its ugly head.

Preparing for Powell

The market opened down sharply Monday morning with concerns over future Fed tightening once again dominating the narrative. The Federal Reserve members will be meeting at Jackson Hole for their annual symposium. Chairman Powell will continue the delicate dance of tightening monetary policy enough to tame inflation, without harming the economy. Market participants have been focusing on the nuances of the Fed’s policies, because the other underlying causes of inflation, namely all the disruptions created by the pandemic and the war, are far less predictable.

Economic reports include updates due out on durable goods orders, home prices, PMI readings and the closely watched PCE price gauge.

Stocks on the Move

+18.2% LSI Industries Inc (LYTS) designs, manufactures, and markets a variety of lighting fixtures, menu board systems, and graphic products. The Company sells its products to the petroleum and convenience store market, the multi-site retail market such as restaurants and automobile dealerships, and the commercial and industrial lighting market. LYTS reported FQ4 non-GAAP earnings of $0.21 per share and revenue of $127.5M which beat by $0.08 per share and $13.46M, respectively. The Company attributed the results to its strategic inventory and supply chain management, strong demand in all verticals, as well as disciplined cost management – three pillars that have been LSI’s blueprint for the last three years. Management’s outlook continues to be favorable for FY2023 and beyond.

-12.4% EPR Properties (EPR) operates as a REIT focused on places to play and learn. The REIT owns movie megaplex theaters and theater-anchored entertainment retail centers around the US and Canada. EPR shares plunged last week after news that one of its largest tenants, Cineworld, is preparing to file for bankruptcy. Cineworld made up almost 15% of EPR’s revenue for the first half of 2022.

-11.0% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. GRBK was downgraded by JMP Securities to Market Perform from Market Outperform last week given the recent weakness in the underlying housing market.

-50.4% Truett-Hurst, Inc (THST) produces, sells, and markets wine. With over 14 acres of land, the Company produces a range of varietals, including Pinot Noir, Chardonnay, Sauvignon Blanc, Merlot, Cabernet Sauvignon, and Zinfandel. THST retreated from the previous week’s rally on news of a new CEO.

-10.2% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. There was no significant company news last week.

-10.5% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

-10.2% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. There was no significant company news last week.

+12.7% Westwood Holdings Group Inc (WHG) provides investment advisory services to a broad range of institutional clients. The Company also offers trust and custodial services to institutions and high-net-worth individuals. There was no significant company news last week.

+14.2% AstroNova Inc (ALOT) designs, develops, manufactures, and distributes a broad range of specialty printers and data acquisition and analysis systems, including both hardware and software. Its target markets are apparel, automotive, avionics, chemicals, computer peripherals, and communications. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.