Historical Impacts of Military Conflicts on Equity Markets

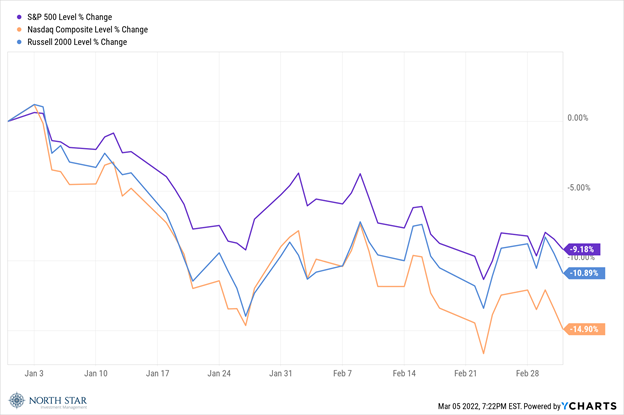

While recognizing that the future of humanity has been permanently altered by Russia’s invasion of Ukraine, our commentary will remain focused on the stock market and economy during this crisis rather than on the tragic human costs. Over the past hundred years, the three most significant stock market declines triggered by acts of aggression were the attack on Pearl Harbor in 1941 (-19.8%), Iraq’s invasion of Kuwait in 1990 (-16.9%) and North Korea’s assault on South Korea in 1950 (-12.9%). The market has always rebounded even while the conflicts raged on, with the losses recouped in 300 days in the case of Pearl Harbor, 189 days after the Kuwait invasion, and only 82 days during the Korean conflict. Following last week’s declines, the S&P 500 and Russell 2000 have lost approximately 10% in 2022, while the Nasdaq has suffered nearly a 15% drop. It is worth noting that about half of those losses were sustained prior to the Ukraine crisis, seemingly triggered by concerns over Fed tightening. In other words, the current situation is complex because in addition to the geopolitical crisis there has also been the headwind of the recent hawkish shift in monetary policy, somewhat offset by the tailwind of the dramatic decline in Covid-19 cases.

The Fed has clearly signaled its intention to “normalize” interest rates given the recent strength in the economy, particularly in employment, coupled with the surge in inflation. The pace of those interest rate increases, and specifically whether the March hike would be 25 or 50 basis points has been hotly debated for the last few months. Last Wednesday Chair Jerome Powell strongly suggested it would be 25 basis points, citing the “highly uncertain” impacts on the U.S. economy from the Ukraine war, while calling the labor market “extremely tight” and inflation “well above” the Fed’s 2% target. Two days later the jobs report February showed an increase in nonfarm payrolls of 678,000, representing the biggest monthly gain since July as employment got closer to its pre-pandemic levels. The unemployment rate dropped to 3.8% and wages were largely unchanged, perhaps a sign that wage inflation could cool off. On the other hand, the inflationary pressures from rising energy costs are intensifying, as crude prices surged over 25% during the week to $115.68 per barrel. The dollar and gold both reached multi-year highs, while the yield on the 10-year Treasury declined 26 basis points to 1.72%. Since the yield on the 2-year Treasury was unchanged, the curve flattened to 24 basis points stoking recessionary concerns. As one might expect given that backdrop, Energy stocks were the top performers and Financials the bottom for the week.

Gold neared its record high level, jumping 4.1% to $1965 an ounce. We still favor gold and TIPS (Treasury inflation protected securities) as hedges in the current environment. Specific attractive investments include VTIP, PHYS, GLD, SII, and NEM. Please contact us at info@nsinvest.com if you want more information on those investments.

The Prospect of Peace

The war in Ukraine will dominate the news and continue to create elevated volatility in all the financial markets. Equities will start the week in the red as the war rages on and additional sanctions against Russia are planned, most notably banning the import of Russian oil and natural gas.

The most significant economic report will be the monthly read on February consumer prices due on Thursday. Economists expect a 0.5% month-over-month rise in the core CPI mark and 7.5% year-over-year increase in consumer prices. Energy and food prices will be watched closely, as will prices for travel-related categories. A reading higher than expectations could put additional pressure on the Fed to raise rates at a faster pace.

Stocks on the Move

+19.9% Paramount Global (PARA) operates as a multimedia company. The Company provides television and radio stations, produces, and syndicates television programs, broadcasting, publishes books, and online content, as well as provides outdoor advertising. Paramount Global ended the first week in March as a top winner in the Communications sector.

+17.0% Barrett Business Services Inc (BBSI) provides outsourced solutions addressing the costs and complexities of employment related issues for businesses. The Company provides payroll processing, employee benefits and administration, worker’s compensation coverage, risk management and workplace safety programs, and human resource administration services. BBSI operates through about 65 branch offices in 10 states. BBSI reported Q4 2021 earnings beating all expectations of $1.40/share and quarterly revenue of $256.57M (+10.0% Y/Y). Gross billings were up 13% year over year with management seeing the labor market healing for its customers.

+16.8% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, and licensed brand Michelin. Rocky posted solid fourth quarter 2021 earnings of $1.86 per share which beat by $0.78 and revenue of $169.45M which beat by $7.5M. Results included strength for Durango, Western, and Georgia. While processing and product allocation challenges will exist through Q3-2022, the company saw record backlog entering 2022 and analysts are encouraged by the prospect of more consistent execution.

+13.3% Sprott Inc (SII) provides investment management services. The Company offers portfolio management, broker-dealer activities, and consulting services to clients. Its offerings primarily involve equity strategies, ETFs, and physical bullion trusts that give institutional and individual investors exposure to precious metals. Last week, Blackrock Silver Corp (BRC.V) completed its non-brokered C$5M private placement with Eric Sprott. Net proceeds will be used for exploration of the company’s portfolio of gold and silver projects in Nevada.

+12.4% Target Corporation (TGT) operates general merchandise discount stores. The Company focuses on merchandising operations which includes general merchandise and food discount stores and a fully integrated online business. Target also offers credit to qualified applicants through its branded proprietary credit cards. Target soared last week after surpassing comparable sales expectations with the release of its fourth quarter earnings. Sales rose 8.9% year-over-year to $31B on top of a 20.5% increase in Q4 2020. The company also announced it will invest up to $5B in 2022 to scale operations through physical stores, digital experiences, fulfillment capabilities, and supply chain capacity. The investment will cover 200 renovations, 30 new small- to mid-size stores, and 250 new shop-in-shop locations by end-2022. Target will also invest in more online ad placement which drove more than $1B in value in 2021.

-20.2% Consolidated Communications Holdings Inc (CNSL) offers telecommunications services. The Company offers local and long-distance telephone, high-speed internet access, and digital television services to individuals and businesses in the States of Illinois, Pennsylvania, and Texas. Consolidated fell after its fourth quarter earnings release where revenues fell 2.3% to $318.5M. The company upgraded 330,000 locations in 2021 and plans to upgrade 400,000 additional locations in 2022. Additionally, the company plans to sell its Kansas City assets with the deal expecting to close in 2H 2022.

-17.9% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. Turtle Beach fell after disappointing earnings and guidance in addition to institutional holder Donerail Group dropping its bid to buy the company and instead announcing the intention to nominate a full slate of directors to the board. Less optimistic analysts suggested the company is trading ahead of its peers such as Corsair (CRSR) and Logitech (LOGI) and see “limited room” for further upside. More optimistic analysts believe expectations have been reset, the company has done a good job at mitigating market pressure through diversifying its revenue mix and expanding product offerings, and that Turtle Beach is well positioned to gain share. The North Star Research Team is speaking with management on Friday, March 11th.

+14.5% ARC Document Solutions Inc (ARC) provides large format document reproduction and printing services, mainly to architectural, engineering, building operator, and construction firms. There was no significant company news last week.

+12.1% Northwest Natural Holding Company (NWN), through its subsidiaries, builds and maintains natural gas distribution systems, as well as invests in natural gas pipeline products. There was no significant company news last week.

-12.4% Flexsteel Industries Inc (FLXS) manufactures and sells wooden and upholstered furniture for the retail, contract, and recreational vehicle (RV) furniture markets. The Company’s products are sold to furniture dealers, department stores, and RV manufacturers. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.

One closing thought about the terrible events in Ukraine. It was over 50 years ago that John Lennon penned the lyrics to “Imagine” that are as meaningful today as ever before:

Imagine there’s no countries

It isn’t hard to do

Nothing to kill or die for

And no religion, too

Imagine all the people

Livin’ life in peace

You may say I’m a dreamer

But I’m not the only one

I hope someday you’ll join us

And the world will be as one