The Rally Continues

It’s getting better all the time

Better (inflation)

Better (consumer sentiment)

Better (corporate earnings)

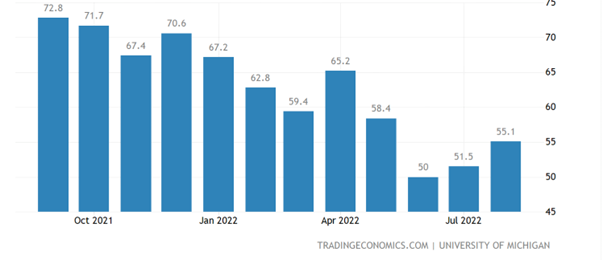

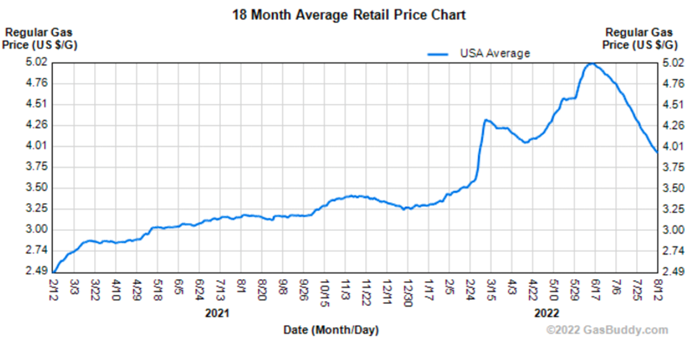

Stocks rallied for the fourth straight week, with the S&P gaining 3.2%, the Nasdaq advancing 3.1%,and the Russell 2000 surging 4.9%. The party got rolling Wednesday after July’s consumer price index report showed a lower than expected 8.5% year-over year increase, suggesting that we may have indeed seen peak inflation. There was more good news on Friday as the monthly report from the University of Michigan showed a surge in consumer confidence, marking the second consecutive gain for the index since its June low. The index increased to 55.1 in August of 2022 from 51.5 in July, the highest in three months and beating market forecasts of 52.5. This improved mood has coincided with a decline in average gasoline prices from a peak of around $5 per share to just below $4. In the spring, oil prices spiked in reaction to Russia’s invasion of Ukraine, leading the national average to a new all-time high. As we have pointed out in the past, for the average U.S. household, at gasoline prices near $5 per gallon, $2,000 of $60,000 in annual income is consumed by paying for gas. That’s 3.3% of annual income, rather than $1,200 when gas prices are around $3 per gallon, and the psychological impact on consumer spending might be even more impactful. The charts below show the strong correlation between the Michigan Consumer Sentiment index and prices at the pump.

University of Michigan Consumer Sentiment Index

Retail Gas Prices

Corporate earnings also got modestly better, with a respectable 6.7% year-over-year growth in profits after roughly 90% of S&P companies have reported results for the second quarter. Meanwhile the number of companies reducing estimates for the next quarter is in-line with historic averages.

Traders in the bond pits seem to be dancing to a less upbeat tune as the yield on the 10-year Treasury was unchanged at 2.85%, while the spread between the 2-year and 10-year yields remained deeply inverted at negative 41 basis points. The inverted yield curve is often considered a harbinger of a recession.

Reversing the recent trends, the dollar weakened, while gold and crude oil both moved higher.

On the Chicago sports scene, the Chicago Sky continued to excel and will be entering the WNBA playoffs as the number 2 seed. The Chicago Bears rookies also looked good against the Chiefs in the preseason opener, and our third string outscored theirs 19-0 in the second half. We will blame the first half performance on Elton John fans for destroying the turf.

Slow and Soft News

Stocks opened lower Monday after China released several soft data points that reflected the economic impact of their zero COVID policies. Industrial production and retail sales growth both fell below analysts’ expectations, manufacturing slowed down, while the decline in real estate investment accelerated. Stocks have since then rallied back early Monday afternoon. The housing market will be in focus with releases on the NAHB Housing Market Index, building permits, housing starts and existing home sales. Earnings season enters its final inning with retailers dominating the line-up as The Home Depot Inc (HD), Lowe’s Cos (LOW), Target Corp (TGT), Walmart Inc (WMT), and Macy’s Inc (M) all report results. The Fed will remain in the headlines with the release on Wednesday of the minutes from the last FOMC meeting.

Stocks on the Move

+20.2% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories. Retail stocks fared well last week on the news of cooling inflation and a tick up in consumer sentiment.

+14.3% Build-A-Bear Workshop Inc (BBW) is an interactive and entertainment mall-based retailer that invites guests of all ages to create their own customized stuffed animals with clothing, shoes, and accessories through a bear-making process. Retail stocks fared well last week on the news of cooling inflation and a tick up in consumer sentiment.

+17.1% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. Retail stocks fared well last week on the news of cooling inflation and a tick up in consumer sentiment.

+23.5% Accuray Inc (ARAY) designs, develops, and sells advanced radiosurgery and radiation therapy systems for the treatment of tumors throughout the body. Last week, ARAY announced FQ4 2022 results with a $(0.04) loss and revenue of $110.02M. The North Star Research Team spoke with the Company last week and believes the improvement in gross margin suggests that the worst of supply chain and component shortages are behind the company. Additionally, Accuray initiated conservative and responsible guidance for FY2023 that includes total revenues between $447M-$455M (+ 4-6% y/y) and adjusted EBITDA between $26M-$30M.

+103.9% Truett-Hurst, Inc (THST) produces, sells, and markets wine. With over 14 acres of land, the Company produces a range of varietals, including Pinot Noir, Chardonnay, Sauvignon Blanc, Merlot, Cabernet Sauvignon, and Zinfandel. Last week, THST named Emilie Eliason to the role of Chief Executive Officer effective August 1, 2022. Ms. Eliason has prior experience in the wine industry as well as over twenty years in roles successfully executing on brand and direct marketing. The stock is highly illiquid which contributed to its triple digit spike on the positive news.

-25.4% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. HEAR shares plunged last week on a Q2 earnings and revenue miss, with guidance being cut and the announcement that the Company was terminating its strategic outreach to find a potential buyer. The North Star Research Team spoke with the company last week and felt encouraged by easing supply chain challenges, realigned inventory management, and new product launches.

-23.3% Superior Group of Companies Inc (SGC) designs apparel products. The Company manufactures and sells a wide range of uniforms, corporate identification, career apparel, and accessories. Super Group of Companies serves hospital and healthcare fields, hotels, fast food and other restaurants, public safety, industrial, transportation, and commercial markets. Last week, SGC announced a second quarter loss of $(1.70) per share on revenue of $148M (+13.2% y/y). The results included a one-time non-cash charges summing around $32.5M related to the termination of pension benefit plans. On an adjusted basis, which excludes the charges, earnings were $0.08 per share for the second quarter. While the business saw strength across the board, its Healthcare Apparel segment sales were down 30% y/y due to carryover from customer stockpiling during COVID.

+14.0% The Walt Disney Company (DIS) is a diversified worldwide entertainment company with operations in the Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences, and Products (DPEP) segments. DMED encompasses the Company’s global film and episodic television content production and distribution activities, including linear networks, Direct-to-Consumer, and Licensing. DPEP includes theme parks, resorts and cruises and merchandising. Last week, Disney announced FQ3 earnings of $1.09 per share on revenue of $21.5B (+26.3% y/y). Theme Park visitor volumes demonstrated recovery across the board, with some lag in cruise and international destinations. Additionally, the Company reported double-digit y/y streaming subscription growth, but also conservatively cut guidance for 2024 subscriber numbers. Lastly, the Company intends to introduce an ad-supported tier for U.S. Disney+ markets later this calendar year.

+17.4% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. There was no significant company news last week.

+11.4% Evolution Petroleum Corporation (EPM) explores for and produces oil and gas. The Company focuses on acquiring established oil and gas fields and applying specialized technology to increase production rates. There was no significant company news last week.

+10.4% Green Brick Partners Inc (GRBK) operates as a homebuilding and land development company. The Company develops residential homes, complexes, and communities. Green Brick Partners invests in a range of real estate investments, as well as provides land and construction financing to its controlled builders. There was no significant company news last week.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.