Last Week

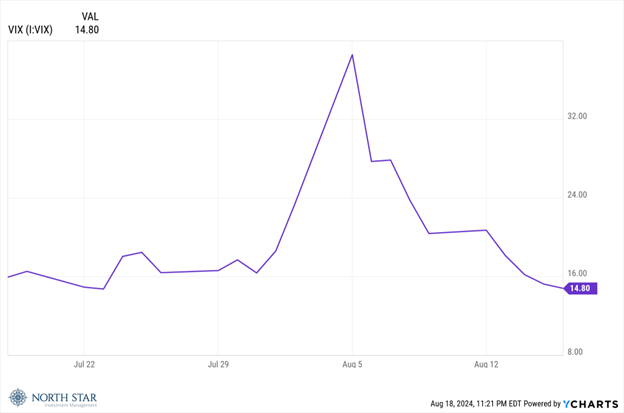

Early in August, the combination of soft economic data and a stubbornly hawkish-sounding Fed stirred fear in investors of a recession or “hard landing.” A flurry of data since then has reinforced the not-too-hot and not-too-cold Goldilocks scenario, sent “Fear” packing (see below chart), and rallied equities to their best week of the year and back towards record highs. Specifically, retail sales increased in July by the most since early 2023, and initial claims for unemployment benefits were at the lowest level since early July. Additionally, Walmart posted solid earnings and had positive commentary about the consumer activities they are experiencing.

It was a case of “meet the new boss, same as the old boss,” as tech stocks led the surge, with the Nasdaq Composite rocketing 5.3%. The S&P 500 snapped a four-week losing streak by gaining 3.9% and is now just 2% below its record close. Small caps also participated with a 2.9% increase in the Russell 2000, while advancing issues outnumbered declining issues by a factor of almost 4-1. Gold rallied 2% as the dollar weakened modestly. The bond market stabilized with the yield on the 10-year Treasury ticking down 2-basis points to 3.89%.

The party continued over the weekend for Chicago-based investors and sports fans, as the Bears dominated the Cincinnati Bengals at Soldier Field on Sunday. We know it’s preseason, but we are exploring ticket prices for this year’s Super Bowl. Bear Down!

This Week

The economic calendar is light, and earnings season is essentially over. Investors’ attention will be focused on the Fed, with the FOMC minutes from the late-July meeting being released on Wednesday and the annual Monetary Policy Symposium in Jackson Hole kicking off on Thursday. The cover story in this week’s Barron’s is “Powell’s Big Moment”. Let’s hope he rises to the occasion and highlights that the time has come to bring interest rates back down to a neutral level with the significant decline in the inflation rate, and a slow and steady economy.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.