Yesterday, a tragedy occurred in Highland Park, IL, the location of North Star’s suburban office. The North Star employees are safe. We want to extend our deepest sympathies to the families of the victims and those affected by this senseless act. As always, we pray for peace and a better world. If you need to talk to a mental health professional or a support group, visit this website.

Sustained Softening

The best thing we can say about the first half of 2022 is that it is over: good riddance! The stock market posted its worst first half performance of any year since 1970 against the backdrop of surging inflation, renewed Covid-19 lockdowns, supply chain disruptions, plummeting consumer confidence, tightening monetary policy, and Russia’s invasion and devastation of Ukraine. The S&P 500 finished the initial six months of 2022 with a 20.6% loss, shedding some $8.5 trillion in market value, the Russell 2000 shed 23.9%, while the tech heavy Nasdaq nosedived 29.5%. The losses continued to pile up through Thursday, although the back half of the year got off to a better start on Friday with a rally of over 1%. Nevertheless, for the week the S&P lost 2.2%, the Nasdaq sank 4.1%, and the Russell 2000 slid 2.1%.The yield on the 10-year Treasury continued its recent decline, finishing down 25 basis points to 2.89%. The 10-2 Treasury yield spread is once again flattening and looking like it might go negative, which is commonly viewed as a signal of an impending recession. The NBER, a private economic research organization, defines an economic recession as: “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” Many strategists are suggesting that we already are in a recession as GDP and real income have taken a hit, but primarily because the mood is so gloomy.

The silver lining of the barrage of bad news is that the dampening of demand, when combined with the increasing supplies as COVID-19 lockdowns in China are relaxed, and the recent downtrends in shipping and energy prices, should all lead to softening inflation in the back half of 2022. The first whiff of that softening will allow the Fed to pivot away from its current hawkish posture, which in turn could significantly improve investor sentiment.

Still Combatting Inflation

The markets were closed on Monday in celebration of the Independence Day holiday.

Despite all the gloom and doom, the data scheduled for release this week will likely reflect a healthy economy. On Tuesday, the final report factory orders for May, is estimated to show an increase of 0.6% from the previous month. The JOLTS (Job Openings and Labor Turnover Survey) release on Wednesday is expected to show that there remains nearly twice as many job openings as unemployed people. The highly anticipated monthly BLS employment report for July on Friday is forecasted to show that the U.S. economy added 250K jobs in June with wages rising 5.2%, and the unemployment rate holding near historic lows at 3.6%.

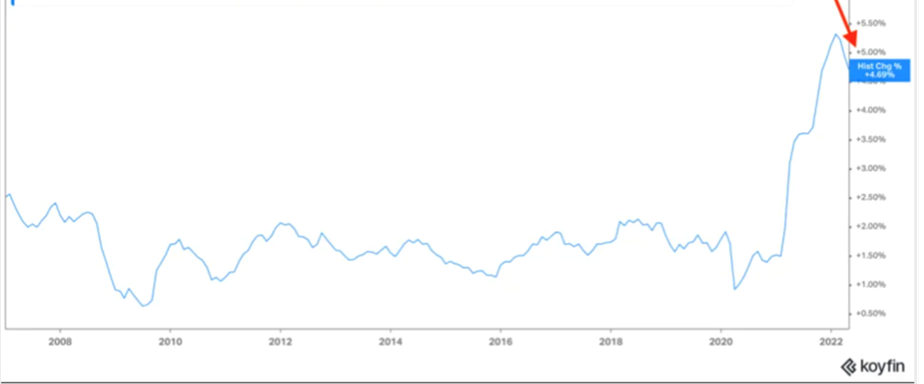

The dissonance will come from the Fed, as the FOMC minutes will be released on Wednesday, and multiple Fed speakers will be on the speaking circuit discussing the challenge of combatting inflation without creating a recession. While we do not anticipate any dovish commentary from the Fed this week, there are some signs that inflation may be peaking for the near-term. The Fed’s preferred inflation statistic, the core PCE price index slowed to 4.7% in May from 4.9% in April, 5.2% in March and 5.3% in February. This slowing in no way enables the Fed to declare victory on inflation but does dampen some of the most dire warnings about potential worsening of inflation. Perhaps the Fed speak committing to tame inflation and Fed interest rate hikes are already restoring price stability as the Fed mandate demands?

Personal Consumption Expenditures Excluding Food and Energy

Historical Change % (1Y)

Stocks on the Move

There was no news for stocks that declined double digits.

-14.5% Advanced Micro Devices Inc (AMD) operates as a semiconductor company worldwide. Its products include microprocessors, chipsets, discrete and integrated GPUs, data center and professional GPUS, and development services. Semiconductor stocks declined amid recession concerns.

-10.6% Boot Barn Holdings Inc (BOOT) sells western and work gear for individuals and families. The Company sells boots, jeans, shirts, hats, belts, jewelry, and other accessories.

-13.4% Blue Bird Corporation (BLBD) designs and manufactures school buses and commercial buses for school districts, large national fleets, businesses, government agencies, and non-profit organizations.

-11.7% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs.

-11.9% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices.

-11.1% Sharps Compliance Corp (SMED) operates as a provider of waste management services. The Company offers containment, transportation, treatment, and tracking of medical waste, and the disposal of unused medications as well as other used health care materials.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.