Last Week

Happy Days are here again! The skies above are clear again. The Fed is cutting rates again. Let us sing a song of cheer again.

On Wednesday, the Fed announced a 50-basis point cut in the fed funds rate, marking the end of an extended period of extremely tight monetary policy. The equity markets surged, with small caps leading the charge with a 2.1% increase, closely followed by 1.5% increases in the S&P 500 and the Nasdaq Composite. Advancing issues outnumbered declining issues by a factor of 2-1. Gold continued to reach new highs, and crude oil rallied almost 5%, leading to a similar rise in the Oil & Gas sector stocks.

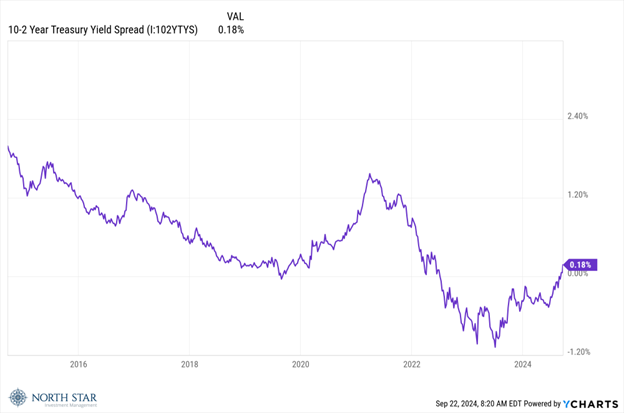

The bond market also got the message, as the yield on the 10-year Treasury inched up 8-basis points, while the 10-2 spread continued its long journey back to an upward slope.

The message is a partially sunny forecast for the U.S. economy, otherwise known as the soft-landing scenario.

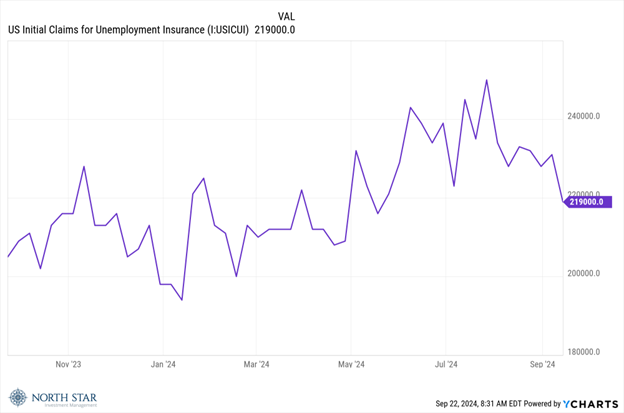

A sharp drop in the weekly initial claims for unemployment reinforced that Goldilocks is back in town.

It was not happy days for Chicago sports fans, as the Bears suffered another painful loss, the Cubs and Sky both failed to make the playoffs, and the White Sox matched the 1962 Mets record of 120 losses in a season.

This Week

More Fedspeak is on deck, as Fed chair Jerome Powell will give opening remarks at the U.S. Treasury Market Conference on Thursday.

The economic calendar includes the September flash PMIs and the core personal consumption expenditures price index for August.

Hopefully, the cloudy gray times of recession & inflation headlines will remain a thing of the past.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.