Last Week:

“Help!” Apparently, our representatives in Washington were unable to “Come Together” and pass a bill to provide the needed funds to give the economy a desperately needed shot in the arm. The damage was reflected in applications for U.S. state unemployment benefits which unexpectedly jumped to the highest level in three months, suggesting the labor market’s recovery is faltering amid the surge in Covid-19 cases and widening business restrictions. Anecdotally, one of our favorite local restaurants announced it was closing and asked for help finding employment for their loyal workers. On Wednesday the Federal Reserve released its statement reinforcing that it was committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals. The statement noted that the “ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Moving from figurative the literal shots in the arm, the first doses of Pfizer/BioNTech’s vaccine were administered in the U.S. on Monday. There is light at the end of the tunnel, but there remain distribution challenges, as the government has pushed back its estimate of 20 million doses being administered by a few weeks. There were a record number of new cases and deaths during the week, with 251,000 new cases and 3611 deaths in just one day. I spent most of the week in self-quarantine, having been notified on Tuesday and Friday by friends who had tested positive. Winter is officially here, and whereas it is likely to be harsh, it could be that spring 2021 will be most joyous.

The market also set new records, with the S&P 500 up + 1.25%, both the Nasdaq and the Russell 2000 surging 3.05%. The U.S. dollar reached a new multi-year low, while gold gained 2.5%, and the yield on the Ten-Year Treasury increased 6 basis points to 0.95%.

This Week:

The Virus and stimulus will remain the dominant narratives in holiday-shortened trading, and there were major developments on both fronts over the weekend. A new COVID-19 mutation in the U.K. resulted in a tough lockdown in London and southeast England and led a number of countries to block travel from Britain. The mutant variant, dubbed B117, could be up to 70% more transmissible than COVID-19 and has already been detected in the Netherlands, Denmark, and Australia. Back in Washington, lawmakers from both parties announced Sunday night that they finally reached an agreement on a $900B coronavirus spending package to bolster the U.S. economy. It would be one of the largest economic relief bills in the nation’s history, second only to the $2.2T CARES Act passed back in March. The House is expected to vote on the bill today, followed by the Senate, then President Trump will need to sign it.

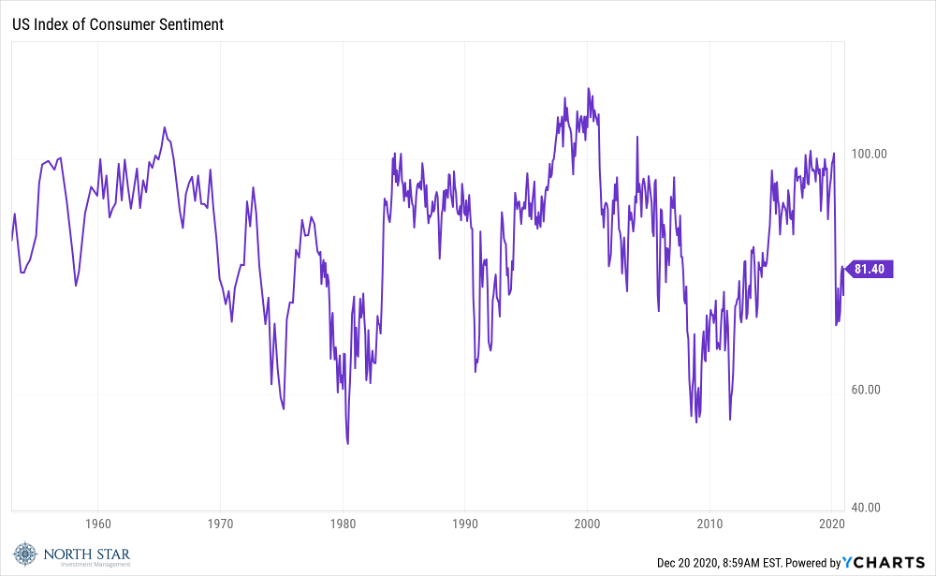

Shipments of the second coronavirus vaccine approved by health regulators are set to arrive in states Monday as the battle against COVID-19 goes on the offensive. Big banks look set for a strong week after the Federal Reserve gave the green light for buybacks and dividends. In response, J.P Morgan immediately announced a $30 billion stock buyback program. The consumer will be the focus of the economic releases, with The Conference Board releasing its Consumer Confidence Survey on Tuesday. Expectations are for the reading to register at 97 for December, up from November’s 96.1. Consumer sentiment is one of the macroeconomic inputs that we monitor at North Star, as we believe it can provide some insight into the stability of the stock market. It is worth noting that the U.S. consumer remained significantly more optimistic during the COVID-19 pandemic than during the financial crisis of 2008-2009.

Stocks on the Move:

Stocks on the Move:

-12.4% CarParts.Com Inc (PRTS) retails automobile parts online. The Company offers mirror, engine, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other auto body parts. Last week, there was no significant company news. PRTS is a 4.5% holding in the North Star Micro Cap Fund and a 2.2% holding in the North Star Opportunity Fund.

+23.6% Turtle Beach Corp (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices. There was no significant news last week. HEAR is a 6.1% holding in the North Star Micro Cap fund and a 2.2% holding in the North Star Opportunity Fund

+11.4% Monmouth Real Estate Investment Corp (MNR) is a real estate investment trust specializing in net leased industrial properties in the States of New Jersey, New York, Mississippi, Missouri, Massachusetts, Iowa, North Carolina, Kansas, Pennsylvania and Virginia. This morning, Monmouth got an offer from one of its largest shareholders, Blackwells Capital, to acquire the Company for $18 per share in cash. The transaction is valued around $3.8B. MNR is a 4.1% holding in the North Star Dividend Fund.

+17.2% Innovative Industrial Properties Inc (IIPR) owns and leases industrial real estate assets. The Company focuses on the acquisition, disposition, construction, development, and management of industrial facilities leased to tenants in the regulated medical-use cannabis industry. Last week, IIPR raised its dividend to $1.24/share, entered into a lease amendment with PharmaCann in New York making $31M in funding available for property upgrades, and entered into a new long-term lease with 4Front Ventures. IIPR is a 3.5% holding in the North Star Dividend Fund.

+15.4% 1-800-Flowers.com Inc (FLWS) is an e-commerce provider of floral products and gifts. There was no significant company news last week. FLWS is a 3.2% holding in the North Star Micro Cap fund.

Finally, from John, Yoko, and all of us at North Star:

A very Merry Christmas

And a happy New Year

Let’s hope it’s a good one

Without any fear