Last Week:

Another record high for the stock market, with the S&P 500 gaining 0.93% and the Russell 2000 0.87%. There wasn’t much news, fake or otherwise, driving the action, and volume was light in the pre-holiday week trading. One might say the song remains the same, or perhaps the songs remain the same, as clearly there are two tunes in the air. The momentum investors continue to dance to Sly and the Family Stone’s “I want to take you higher”, as the Tech sector soars another 2.16% during the week. The competing soundtrack is “Spinning Wheel” from Blood Sweat & Tears, warning “what goes up, must come down”, perhaps applicable to the inflated multiples sported by those momentum stocks. In this low interest rate environment, the appetite for growth remain ravenous, and provides support for the 25 plus P/E multiples that the NASDAQ 100 sports. The party will end badly for those companies either when there is a company specific stumble (as possibly currently being experienced by Tesla, Facebook, and Netflix), or when interest rates rise more significantly, or perhaps because of a destabilizing financial or military geopolitical event.

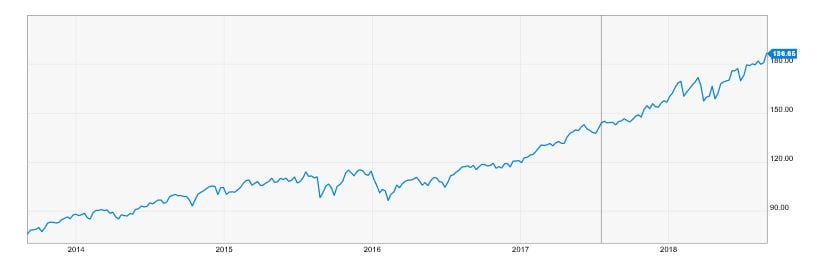

In the meantime, dance to the music momentum investors! The graph below from YCharts shows the 5-year performance of the NASDAQ 100, with 47.5% of that index being comprised of Apple, Amazon, Alphabet, Microsoft, and Facebook.

One thing that isn’t going higher, or spinning around for that matter, is the yield on the Ten-Year Treasury, which has been between 2.82% and 2.89% for three weeks and closed at 2.85% on Friday. This stability is a key ingredient of the rising stock market.

This Week:

Trade talks will be front and center, as President Trump intends to move forward as early as Thursday with 25% tariffs on an additional $200 billion of goods from China, and NAFTA talks resume with a soft October 1 deadline for a new pact to be submitted to Congress. The highlight of the economic calendar is the August employment report on Friday. Economists expect an increase of 187,000 in nonfarm payrolls, with average hourly wages rising 2.8% year over year. The big sell-off in February was triggered by a higher than expected jump in hourly wages, so that data point will be under scrutiny. That February surprise was only a few tenths of a percent higher wage increase than expected, followed by a breakout upside move in the Ten-Year Treasury towards 3% and a 10% decline in the S&P 500.

Stocks on the Move:

BG Staffing, Inc. (BGSF) -12%: The market responded poorly to a series of SEC form 4 filings indicating sales by several insiders. BG Staffing provides temporary staffing services in the U.S. in Multifamily, Professional, and Commercial. Its temporary staffing services consist of on-demand or short-term staffing assignments, contract staffing, & on-site management administration. BGSF is a 2.7% holding in the North Star Dividend Fund.

Boot Barn Holdings, Inc. (BOOT) +12.2%: Shares continued their rally, that started with a strong earnings release on August 7. Boot Barn Holdings operates specialty retail stores that sell western and work boots and related apparel and accessories. The Company operates retail locations throughout the U.S. and sells its merchandise via the Internet. BOOT is a 2.7% holding in the North Star Micro Cap Fund.

Brooks Automation Inc (BRKS) +32.9%: Announced that it has entered into a definitive agreement to sell its semiconductor cryogenics business to Edwards Vacuum LLC (a member of the Atlas Copco Group) for $675 million in cash. Steve Schwartz, President and CEO of Brooks, stated,” The CTI cryogenic vacuum and Polycold product lines and technology have provided technology solutions to the semiconductor industry and have been stable and profitable elements of Brooks’ portfolio for the past 13 years. “We plan to use the proceeds of this transaction to further the transformation of our Brooks portfolio as we remain focused on our long-standing strategy to increase shareholder value by accelerating the growth of our Life Sciences business with further acquisitions, and strengthening our Semiconductor Automation business with opportunistic acquisitions.” Brooks Automation is a provider of automation and cryogenic solutions for multiple applications and markets. The company serves the semiconductor capital equipment market and sample management market for life sciences. BRKS is a 2.1% holding in the North Star Dividend Fund.

Collectors Universe Inc (CLCT) +12.5%: Revenues in the fourth quarter of fiscal 2018 were $17.1 million, down 5% from the record fourth quarter revenues of $18.0 million in fiscal 2017. Operating income was $2.2 million as compared to $1.2 million in the year earlier period. The Company’s cash position as of June 30, 2018 was $10.6 million, as compared to $9.8 million at June 30, 2017. Joseph J. Orlando, Chief Executive Officer, stated, “In Q4, parts of the business rebounded, while other areas set quarterly records. After two down quarters, our PCGS US vintage services rebounded to around the same level achieved in Q4 of 2017, which represented a record fourth quarter performance for the service. Hong Kong and Paris established new record quarterly and annual revenues and total international coin service revenue, which also includes our Shanghai office, achieved record levels for the year. Furthermore, PSA and PSA/DNA finished with another record performance for the quarter and year, making fiscal 2018 its eighth consecutive year of top and bottom line growth.” Collectors Universe Inc provides authentication and grading services to dealers and collectors of high-value coins, trading cards, event tickets, autographs and memorabilia. CLCT is a 2.1% holding in the North Star Dividend Fund and a 1.2% holding in the North Star Micro Cap Fund.

Movado Group Inc (MOV) -16.4%: Announced that second quarter net sales increased 11.9% to $144.1 million, or 10.5%, and that adjusted diluted EPS were $0.45 compared to $0.43 in prior year period. Efraim Grinberg, Chairman and Chief Executive Officer, stated, “We are pleased to report another strong quarter with double-digit increases in both sales and operating income combined with significant progress against the priorities we set at the start of the year. Sales growth had notable strength internationally in Europe and Latin America, as our uniquely designed timepieces and sought-after brands continue to resonate with consumers around the world. Olivia Burton, which we acquired last July, continues to perform very well, and we are extremely excited about the upcoming addition of another brand that connects with millennials, the direct-to-consumer brand, MVMT. We have an exciting product pipeline for the second half of the year and believe we are well positioned to capitalize on the upcoming holiday season. Our balance sheet remains strong with $175.6 million of cash and no debt before the MVMT acquisition, which is expected to close on or about October 1, 2018. Given the strong results we’ve seen year-to-date and the pending acquisition of MVMT, we are raising our annual outlook.” Movado Group designs, sources, markets and distributes fine watches. Its brands include Coach Watches, Concord, Ebel, ESQ Movado, Scuderia Ferrari Watches, HUGO BOSS Watches, Juicy Couture Watches, Lacoste Watches, Movado, and Tommy Hilfiger Watches. MOV is a 3.4% holding in the North Star Micro Cap Fund.