Last Week:

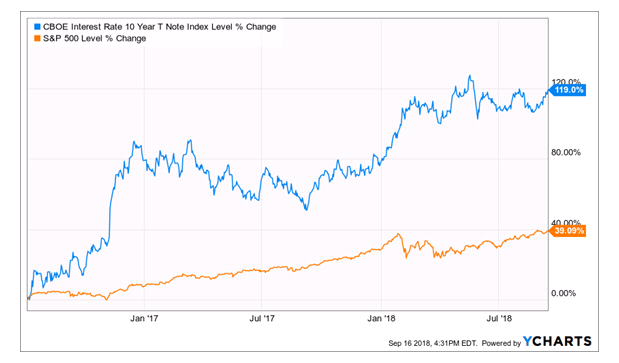

Once again, the market floated higher, with the S&P 500 gaining 1.16%, as the sweet vapors of good economic news filled the air. The September University of Michigan sentiment index rose to its second highest level since 2014, and Index of Business Optimism registered its highest reading ever. Additionally, both CPI and PPI came in lower than expected, at least temporarily quieting the inflation concerns, and perhaps weakening the Fed’s case for additional rate hikes. The “glass is half empty” camp did have some fodder, as Retail Sales were soft, and a trade deal with China (or anyone for that matter) remained elusive. Meanwhile the yield on the Ten-Year Treasury inched higher, closing just under the potentially important 3% level. We view rising interest rates as a significant long-term risk, but probably need to rise above the 3.10% yield reached in May before any alarm bells go off. As the chart below shows, the S&P has advanced handsomely despite the 119% increase in the Ten-Year rate over the last few years.

This Week:

August housing data will dominate the economic calendar, with existing home sales expected to remain at the lowest run rate in over two years. September manufacturing data, on the other hand, is forecasted to show a rebound from the previous month’s somewhat disappointing levels. Trade talks with China will be in focus, as the Wall Street Journal reported over the weekend that President Trump intends to reduce to 10% the next round of tariffs, and delay implementing until after a new negotiating sessions schedule for the end of the month. To say this situation is fluid, is an understatement, so stay tuned.

Stocks on the Move:

Advanced Micro Devices, Inc.(AMD) +19.6%: The Company’s shares continued to surge on heavy volume, with some analysts dramatically increasing their price targets based on the perception that AMD finally is leading INTC in the chip wars. Advanced Micro Devices Inc designs and produces microprocessors and low-power processor solutions for the computer, communications, and consumer electronics industries. AMD is a 6% holding in the North Star Opportunity Fund, and AMD corporate bonds are a 2.7% holding in the North Star Bond Fund.

Alaska Communications Systems Group, Inc. (ALSK) -12.8%: There was no news to account for the decline. The Company’s shares had rallied nicely after posting solid earnings a month ago. Alaska Communications Systems Group provides integrated communications services in Alaska. It provides local, long-distance, and wireless telephone services, Internet access, and data services to residential and business customers. ALSK is a 1.8% holding in the North Star Opportunity Fund.

Blue Bird Corp. (BLBD) +10.4%: The Company announced a tender offer to purchase up to $50 million of their common stock at $28 per share, representing a 20% premium to the recent share price. Blue Bird is an American bus manufacturing company. The company operates its business in two segments; Bus and Parts segment. Its primary business it to manufacture and designs school buses. BLBD is a 2.1% holding in the North Star Opportunity Fund, and a 4.4% holding in the North Star Micro Cap Fund.

U.S. Auto Parts Network, Inc. (PRTS) +11.4%: Barrington Research initiated coverage on the Company with a buy rating and a $5 price target. We applaud their analysis, as the shares seem to have been in the penalty box for the last few years despite significant improvements at the Company. U.S. Auto Parts Network is an online provider of automotive aftermarket parts and repair information. Its products are classified into three subcategories: collision parts, engine parts, and performance parts and accessories. PRTS is a 2.0% holding in the North Star Micro Cap Fund.