Correction Territory

With Halloween approaching, there were few treats and lots of nasty tricks as the S&P 500 retreated 2.53%, posting losses in four out of five sessions. The market is now in correction territory, with Friday’s closing price marking a 10% drop from the S&P’s 52-week closing high on July 31. Ten of the 11 S&P sectors ended in the red, with only Utilities gaining. The biggest losers were the Energy sector -6%, and the Communications sector -5%, with steep declines following earnings reports from individual companies taking their peer groups lower. The Nasdaq Composite and the Russell 2000 suffered losses of approximately 2.5%, and declining issues outnumbered advancing issues by a factor of 2.5 to 1.

The bond market benefitted from the risk-off flight to safety mood, as the yield on the 10-year Treasury dropped 8-basis points to 4.84%. The 2-year Treasury slipped an equal amount to finish at 5.01%, leaving the 10-2 curve inversion at 17-basis points, its smallest inversion level since July 2022. This much-cited recession-predicting indicator might have proven to be a false signal, as the economic data remained steady, with third-quarter GDP registering at +4.9%. The caveat to the continued strength in the economy is that much of the personal spending is coming from savings rather than income, which is not sustainable. Hopefully, the Fed understands that dynamic.

The declines in the stock market came despite overall strong earnings results, which resulted in composite earnings now on track to grow +2.7% versus a projected decline of -0.4% the previous week. If that earnings trend continues, it will break a streak of 3 consecutive quarters of declining results. Prospects for accelerating earnings growth in the fourth quarter and into 2024, combined with easier monetary policy, remain the bull case for equities. If that prospect plays out, gold – which rose approximately 1% for the week and is now up 10% year-to-date versus the approximate 8% gain in the S&P 500 – would likely perform well. Geopolitical turmoil is likely driving the recent strength in gold prices, along with the significant volume of new U.S. Treasury debt offerings to fund ongoing deficits that can pressure the value of the U.S. dollar.

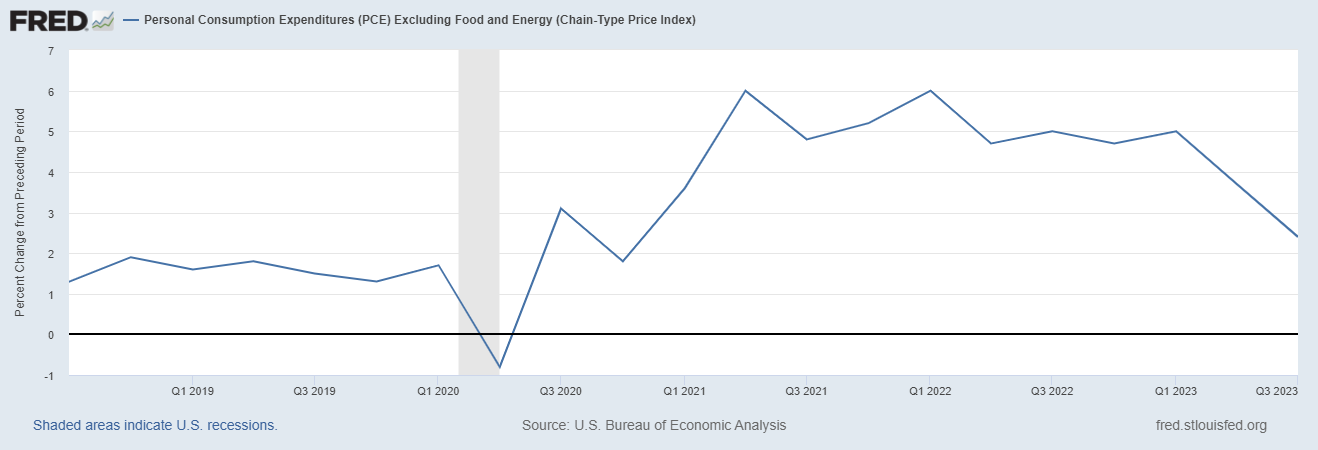

Progress on the Fed’s preferred inflation statistical series, the core PCE Index excluding food and energy, continued. On Friday, the Bureau of Economic Analysis (BEA) reported the stat at 0.3% for September, which was an acceleration from 0.1% in August. However, progress on a year-over-year basis is clear, as September was 3.7% versus 3.8% in August and 4.3% in July and June. We also believe it is important to look at this stat on a quarterly basis, which tends to smooth out shorter-term noise. As the below chart from the St. Louis Federal Reserve Bank “FRED” database shows, progress on reducing inflation is clear, and therefore, we see the current “higher for longer” consensus view on Fed monetary policy outlooks as quite vulnerable. Risk assets would certainly benefit if the consensus on Fed interest rate policy view shifts to higher-than-necessary view.

The resolution of the multi-week drama of filling the Speaker of the House position in Congress was overwhelmed by the escalation of geopolitical turmoil as the U.S. struck military targets in Syria, and the conflict in Israel escalated. Thus, the increasingly volatile geopolitical landscape certainly weighed heavily on investor sentiment. We can only hope and pray that resolutions can be found to end the bloodshed.

Shine Through

Investors face another potentially volatile week ahead, with the Federal Reserve expected to leave the target federal funds rate unchanged at 5.25%-5.5% following its meeting on Wednesday. Any softening in the relentless “higher for longer” rhetoric from Fed Chair Powell would both welcome and appropriate.

Employment numbers will also be in focus, with the ADP jobs update and the JOLTS report during the week leading to the non-farm payroll data on Friday. Expectations are for solid yet softening trends from all those economic indicators.

Apple and 161 other S&P 500 companies will be reporting quarterly results. Let’s see if the trend for positive surprises can remain on track.

The grim geopolitical landscape will continue to cast a shadow on the financial markets. Let’s hope we have seen the worst of humanity already and that the best of humanity starts to shine through.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.