North Star’s Premise Proven

Investors finally got a taste of money, tasting much sweeter than wine, as rising corporate earnings and declining interest rates gave the markets a kiss. The bond market benefitted from slightly soft employment data, particularly Friday’s non-farm payrolls report that showed a much lesser-than-anticipated addition of jobs in October, and modest downward revisions to the prior two months. The reading further bolstered the case following Wednesday’s FOMC meeting that the Fed was done hiking rates. The 10-year Treasury yield dropped 29 basis points to 4.56%, erasing the entire October increase. As we suggested last week, the consensus “higher-for-longer” should be shifting to a consensus of “higher-than-necessary” – the monthly jobs report for October certainly supported our premise.

Third-quarter corporate earnings reports continued to exceed expectations, leading to an increase in composite results to +3.7% from + 2.6% the week earlier, and an expected decline of -0.3% as of the end of September. Eight of the eleven sectors are showing positive earnings growth, with only Energy, Healthcare, and Materials showing declines. If this trend holds up, it will mark the first growth for overall earnings since the third quarter of 2022, with the upward trajectory improving further in the fourth quarter and into 2024.

The combination of higher earnings and lower interest rates was music to the ears of equity investors, and the S&P 500 posted gains in all five sessions, advancing 5.85% for the best weekly rally since November 2022. The rally was broad-based, with advancing issues outnumbering declining issues by a factor of almost 8-1!

Turning to the weekly sector performance, all 11 ended in the green. Real Estate was the top gainer at +8%, followed by Financials and Consumer Discretionary. The Energy sector was the bottom performer, moving +2.5% even as crude prices nosedived more than $5 per barrel to $80.51.

The Nasdaq gained 6.6%, and the small-cap Russell 2000 Index surged 7.6%. We still believe that beaten-up small caps could be the biggest beneficiary of a sustained “soft landing” rally.

Our own research of specific company earnings reports generally suggests some slowdown in demand in the Industrials sector, such as in the railcar manufacturing and servicing industry, as well as in big-ticket items spending, such as for appliances and automobiles. These areas of slowing growth, however, are exactly what the Fed has been looking for regarding slowing the rate of inflation.

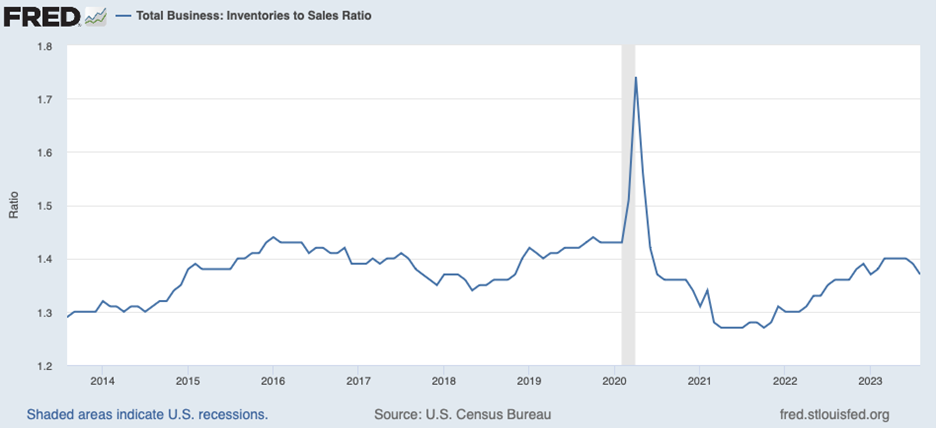

In addition, so far, there is little evidence of a hard landing scenario, given that we are hearing companies forecasting slowing growth due to higher borrowing costs, but we are not hearing companies forecasting declining sales or bloated inventories. In fact, as shown above, Inventory-to-Sales levels are at levels consistent with the past 10 years, excluding the Covid period aberrations of 2020 through late 2021.

“Now is the winter of discontent” on the Chicago Sports Scene, as the Bears, Bulls, and Blackhawks all continued to struggle. Perhaps they will all be beneficiaries of high draft picks in 2024.

Further Discontent

The economic calendar is light, with the publication of the Federal Reserve Senior Loan Officer Opinion Survey being one of the key releases. Analysts think the reading on bank lending conditions will be important in assessing credit and growth risks going forward. Global central bankers will be once again in the news with Federal Reserve Chairman Jerome Powell, European Central Bank President Christine Lagarde, Bank of Japan Governor Kazuo Ueda, and Bank of England Governor Andrew Bailey all on the speaking circuit.

Earnings season will wind down with 55 S&P 500 companies reporting results for the third quarter.

The University of Michigan Consumer Sentiment Index will be released on Friday and is expected to indicate further discontent. Rumor has it that Jim Harbaugh has an inside track on the survey and has a good trading plan in place.

October Stocks on the Move

+40.0% SP Plus Corp (SP) was announced to be acquired by Metropolis Technologies for $54/share, or $1.5B, representing over a 50% premium. The transaction is expected to close in 2024.

+14.1% Weyco Group Inc (WEYS) had no significant company news in the month of October.

+12.6% Acme United Corp (ACU) posted very solid Q3 2023 earnings on October 23rd, reporting in-line sales and EPS of $0.58 vs $0.02 in the prior year period. Gross margin improved to 38.7% from 32% due to the positive impact of a productivity program initiated a year ago.

+11.3% Escalade Inc (ESCA) reported Q3 2023 earnings that showed improvement in wholesale inventory destocking and order activity, driven by strong demand in basketball and pickleball categories.

-13.8% Blackstone Inc (BX) reported mixed Q3 2023 results with lower fee-related earnings, a solid $25.3B in inflows, and robust activity on the credit side of the business.

-14.4% Boot Barn Holdings Inc (BOOT) reported a soft FQ2 2024 with a 4.8% same-store sales decline and a modest $0.90 in earnings per share.

-15.7% Build-A-Bear Workshop Inc (BBW) had no significant company news in the month of October.

-19.5% Douglas Dynamics Inc (PLOW) posted weaker than expected Q3 results, particularly in the Work Truck Attachments segment, and lowered its guidance for the remainder of 2023.

-21.8% Axcelis Technologies Inc (ACLS) had no significant company news in the month of October.

-31.3% CarParts.com Inc (PRTS) reported mixed Q3 2023 results with slightly higher year-over-year results but some margin erosion due to mix shift and higher freight costs.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.