Healthy Equilibrium

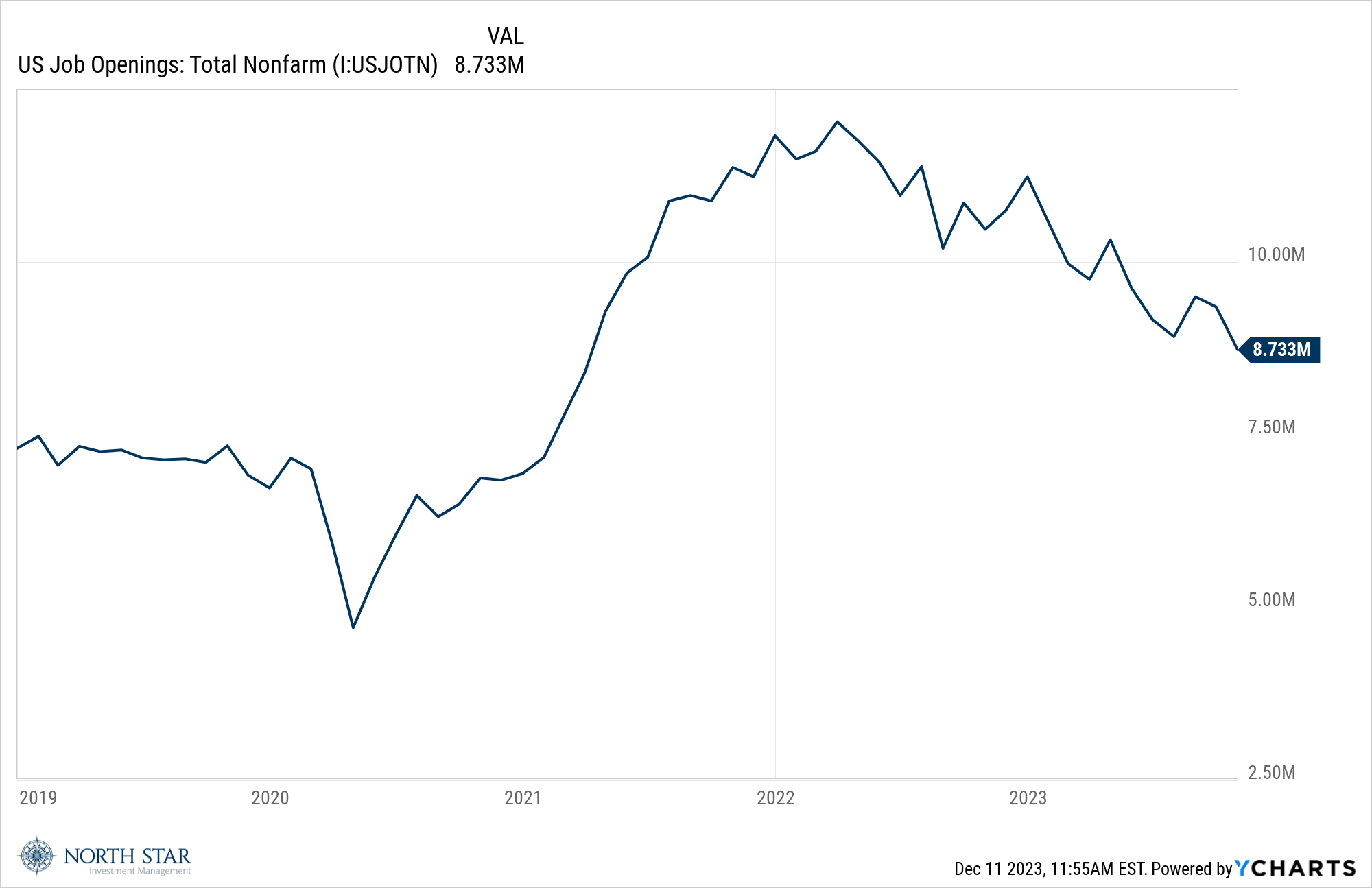

The data from the Labor Department further illuminated an economy on a path back to normal conditions, otherwise known as the soft-landing proposition. On Tuesday, the Job Openings and Labor Turnover Survey, or JOLTS report, showed that U.S. job openings fell to more than a 2-1/2-year low in October and that there were 1.34 vacancies for every unemployed person in October, the lowest since August 2021 and down from 1.47 in September. Notably, fewer workers are resigning, which should help ease wage inflation further. On Friday, the Labor Department’s report indicated that in November, 199,000 jobs were added, with the unemployment rate dropping to 3.7% with modestly rising payrolls. In summary, the supply/demand dynamics in the labor market are reaching a healthy equilibrium level, with full employment without escalating wage inflation.

The equity markets embraced the news, and stocks rallied modestly to post the sixth straight week of gains, with the S&P 500 up 0.2%, the Nasdaq Composite +0.7%, and the Russell 2000 + 1%. The action was mixed, with an equal amount of advancing and declining issues. The bond market held steady following the recent significant declines in interest rates, with the 10-Year Treasury inching up two basis points to 4.25%. Crude Oil prices declined almost 4%, leading to a similar decline in the equities in the Oil and Gas sector. Gold prices retraced some of their recent gains while the dollar moved slightly higher.

The economic data from China, the world’s second-largest economy, pointed to deepening deflation. Whereas that weakness has negative consequences for some U.S. companies in which the Chinese market is significant, it does aid the downward trend in inflation domestically.

Hold Steady

The Bureau of Labor Statistics consumer price index report on Tuesday will be in focus. Consensus estimates call for a 3.1% year-over-year increase, with the core CPI at its lowest level in over two years.

Over the course of the week, there are several treasury auctions. As cited in previous blogs, the massive US government deficit is funded by successful issuances. The market will keep an eye on the level of demand for these US bonds as foreign buyers continue to show limited interest.

On Wednesday, attention will turn to the Federal Reserve’s last monetary policy committee meeting of the year, with almost a 100% certainty that the central bank will hold rates steady.

There is a ray of sunshine in the winter of discontent for Chicago Sports Fans as the Bears show signs of improvement. We support sticking with Justin Fields as quarterback and using the top draft pick to boost the defense further.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.