Spreading Cheer

So far December has delivered a lump of coal to investors, with the market declining six of the seven trading days. The S&P 500 dropped 3.4% last week, while the Nasdaq and Russell 2000 fared even worse, shedding 4.0% and 5.1% respectively. The Utility sector eked out a gain of 0.1%, with every other sector in the red led by a 6.5% drop in the Oil and Gas group. Crude oil suffered a double-digit slide, the Dollar and Gold were stable, and the yield on the 10-year Treasury increased 6 basis points to 3.57%.

While not necessarily jolly, the news itself seemed somewhat more cheerful. On Wednesday, Chinese health authorities announced a plan to ease COVID-19 restrictions, perhaps alleviating some of the supply chain concerns, as well as improving the global demand outlook. Friday offered a mixed bag of economic reports, with a slightly higher than expected producer price index report paired with an upbeat University of Michigan Sentiment Index. The index measuring Americans’ assessment of the current economic conditions increased to 60.2 in December from 58.8 a month earlier, while the measure gauging short-term expectations rose to 58.4 from 55.6. The index also showed moderating inflation concerns, with consumers expecting prices to rise by 4.6% in the next year, easing from the 4.9% increase they anticipated in November and the lowest reading in 15 months.

We recognize that sentiment in general might be somewhat elevated at the University of Michigan as the Wolverine football team heads to the College Football National Championship Playoffs. At North Star we have noticed a clear uptick in mood from Michigan Alums Peter Gottlieb and Eric Papenhagen. Nevertheless, we believe the findings in the sentiment index are meaningful, and we remain optimistic about the health of the U.S. economy. We also agree with the rankings that suggests that the Georgia Bulldogs are the best college football team in the nation, and that if USC quarterback and 2022 Heisman Trophy winner Caleb Williams had not been injured in the PAC 12 championship game, then the Trojans might have been this year’s champions.

The Chicago Bears did not lose this week (they had a bye).

Encouragement

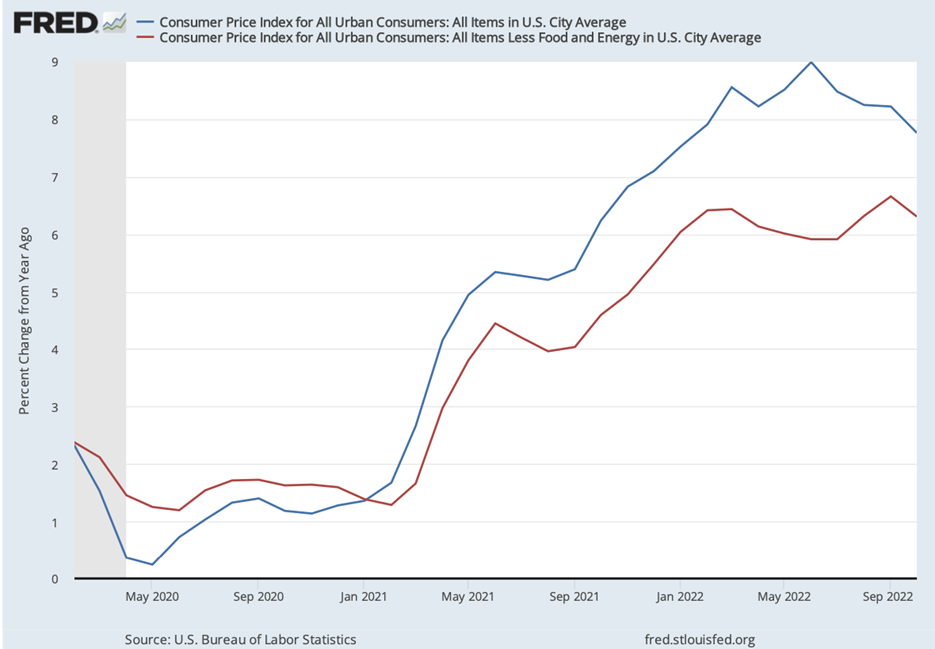

The two biggest economic events that remain for 2022 hit the calendar, with the November CPI report on Tuesday and Federal Reserve meeting on Wednesday likely setting the tone for the remaining three weeks of the year. The consensus estimate for CPI is a 0.3% increase from October, representing a 7.3% year-over-year jump, but would be a fifth straight month of decline in headline inflation and likely a second month of decline in core CPI as well. We have been encouraged recently as economists, such as Austin Goolsbee, the incoming Chicago Fed President and noted University of Chicago professor, have focused on the monthly rather than annual changes in inflation. The average monthly increase in the first half of 2022 was almost 1%, while it has increased less than 1% in total over the last four months.

Stocks on the Move

Companies with news…

-14.2% Rocky Brands Inc (RCKY) designs, develops, manufactures, and markets men’s and women’s footwear. Its footwear brands, which are sold in retail sporting goods and outdoor stores, include Rocky, Georgia Boot, Creative Recreation, Durango, Lehigh, Honeywell, XTRATUF and licensed brand Michelin. Footwear companies faced an aftershock of VF Corp (VFC) cutting full year sales and earnings guidance, as well as the unexpected retirement announcement of CEO Steve Rendle.

+15.9% Johnson Outdoors Inc (JOUT) designs, manufactures, and markets outdoor recreational products. The Company offers products including outdoor clothing, tents, canoes, compasses, sailboats, flotation devices, diving equipment, and motors. JOUT soared last week after the company reported an 18% increase in sales in the third quarter from a healed supply chain and stronger demand in fishing.

+11.9% CarParts.com Inc (PRTS) retails automobile parts online. The Company offers mirrors, engines, headlights, brakes, interior and exterior accessories, tools, wheels, lighting, bumpers, and other aftermarket autobody parts in its network of over 1.2 million SKUs. Last week, PRTS announced the company had hired Michael Huffaker as COO. Mr. Huffaker has extensive experience and most recently served as Vice President, Category Leader, for Amazon Fresh Grocery.

-33.4% Sono Group N.V. (SEV) manufactures and sells electric cars with integrated solar cells and panels. In addition, the Company monetizes its variable battery technology for integration in numerous types of vehicles, including buses, trucks, camper vans, trains, and boats, as it aims to reduce carbon emissions and provide clean and affordable transportation for the masses. SEV third quarter earnings disappointed with a loss of $(0.53) missing estimates by $0.17. The Company also announced it would sell $195M of stock, as well as consider pivoting to potentially focusing only on licensing its advanced solar car technology.

-12.2% John Wiley & Sons Inc (WLY) publishes print and electronic products. The Company specializes in scientific, technical, and medical books and journals, as well as professional and consumer books and subscription services. Wiley also provides textbooks and educational materials. WLY reported solid fiscal second quarter earnings of $1.20 and revenue of $514.8M. Although the company reaffirmed its EPS guidance, it revised its FY23 revenue guidance to be in the range of $2.11B to $2.15B vs prior outlook $2.175B to $2.215B. The Company reported solid growth and margins across publishing, solutions, and talent development segments. However, the business is highly dependent on university enrollment, which has been trending down.

-17.0% Madison Square Garden Entertainment Corp (MSGE) produces, presents, and hosts various live entertainment events, including concerts, family shows, and special events, as well as sporting events, in its venues including New York’s Madison Square Garden, Hulu Theater, Radio City Music Hall, the Beacon Theater, and The Chicago Theater. The Company also operates entertainment dining and nightlife venues in New York City, Las Vegas, Los Angeles, Chicago, Singapore, and Australia under the Tao, Marquee, Lavo, Avenue, Beauty & Essex, and Cathédrale brand names. MSGE was down last week as investors were left skeptical of its revised spin-off plan which would separate live entertainment from MSG Sphere, MSG Networks and Tao Hospitality Group.

-10.3% Bank of America Corporation (BAC) operates as a bank. The Bank offers saving accounts, deposits, mortgage and construction loans, cash and wealth management, certificates of deposit, investment fund, credit and debit cards, insurance, mobile, and online banking services. The Corporation operates nearly 4,500 branch locations and 17,000 ATMs. BAC announced it would be redeeming all outstanding $6B of its 3.004% fixed/floating rate senior notes due 2023.

Companies with no news…

-14.6% U.S. Silica Holdings Inc (SLCA) is a global performance materials company and leading producer of commercial silica used in the oil and gas industry and in a wide range of industrial applications.

-14.6% Turtle Beach Corporation (HEAR) operates as a sound technology company. The Company designs and markets audio peripherals for video game consoles, personal computers, and mobile devices.

-10.6% Duluth Holdings Inc (DLTH) is a lifestyle brand of men’s and women’s casual wear, workwear, and accessories sold primarily through the Company’s own omnichannel platform. The Company’s products are marketed under the Duluth Trading names, with the majority of products being exclusively developed and sold as Duluth Trading branded merchandise.

-10.0% Denny’s Corporation (DENN) operates as a full-service family restaurant chain directly and through franchises. The Company consists of more than 1,700 franchised, licensed, and company-operated restaurants around the world.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.