Last Week

It was the best of times for Magnificent 7 and Crypto enthusiasts, with both asset classes surging over 6%. Fundamental investors, handicapped by paying attention to traditional valuation measures, missed the party. In fact, declining issues outnumbered advancing issues by a factor of 1.7-1, with only the Tech and Consumer sectors finishing in the green. The hot sectors boosted the S&P 500 to a 1% gain, but mid- and small-cap indices finished around 1% in the red.

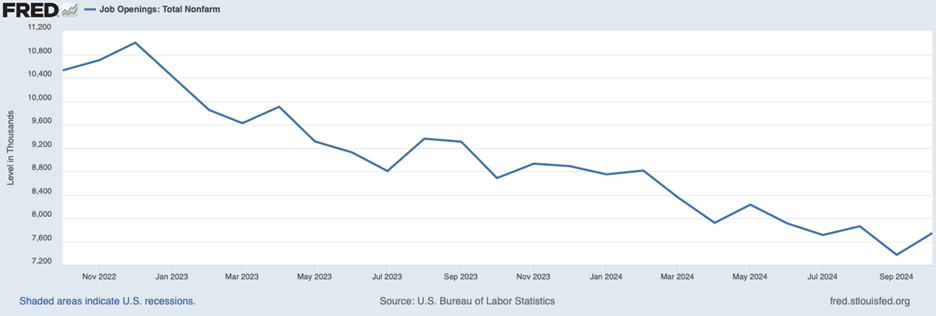

The highlight of the economic data was the November employment report, which showed an addition of 227,000 jobs, with a slight uptick in the unemployment rate and decent wage growth. That report strengthened expectations for another interest rate cut by the Federal Reserve at its final monetary policy committee meeting of the year later this month; the report was basically “room temperature” and perhaps some softening, given it showed 700,000 fewer people employed versus last November and 900,000 more classified as unemployed versus last November (the difference in those two numbers is that there were about 150,000 more people classified as in the “Civilian Labor Force”). So, while the sequential monthly increase was more than 200,000 jobs, the year-over-year trend was subdued enough to warrant a likely Fed cut at the next meeting. Given this recent November jobs report and the ongoing decline in the ‘Job Openings’ data (see below), the Fed likely has plenty of room to move towards a neutral Fed Fund Rate (FFR) where the FFR and inflation are aligned.

In the bond market, the yield on the 10-year Treasury ticked down three basis points to 4.15%. The Dollar inched higher, while Gold and Crude Oil slipped a similar amount lower.

Meanwhile, cryptocurrencies bubbled higher, fueled by the incoming administration’s affinity and investments in the sector. Bitcoin crossed over the $100,000 mark, surpassing the value of a kilo of gold. Rumor has it that Led Zeppelin is rereleasing a 2025 version of Stairway to Heaven, with the revised lyric “All that glitters is crypto.”

The Led Zeppelin song that best describes the Chicago Sports Scene is

‘When the Levee Breaks” was first recorded by Memphis Minnie and Kansas Joe McCoy in 1929 and made famous by Led Zeppelin in 1979. The Zeppelin version ends:

“Going down, going down now

Going down, going down now

Going down, going down now

Going down, going, dow- dow- dow- dow- down, now

Ooh, ooh”

This Week

On Wednesday, the Bureau of Labor Statistics will release the November consumer price index. The consensus calls for a 2.7% year-over-year increase. Any significant deviation from that estimate would create active trading in the financial markets.

The stocks mentioned above may be holdings in our mutual funds. For more information, please visit www.nsinvestfunds.com.