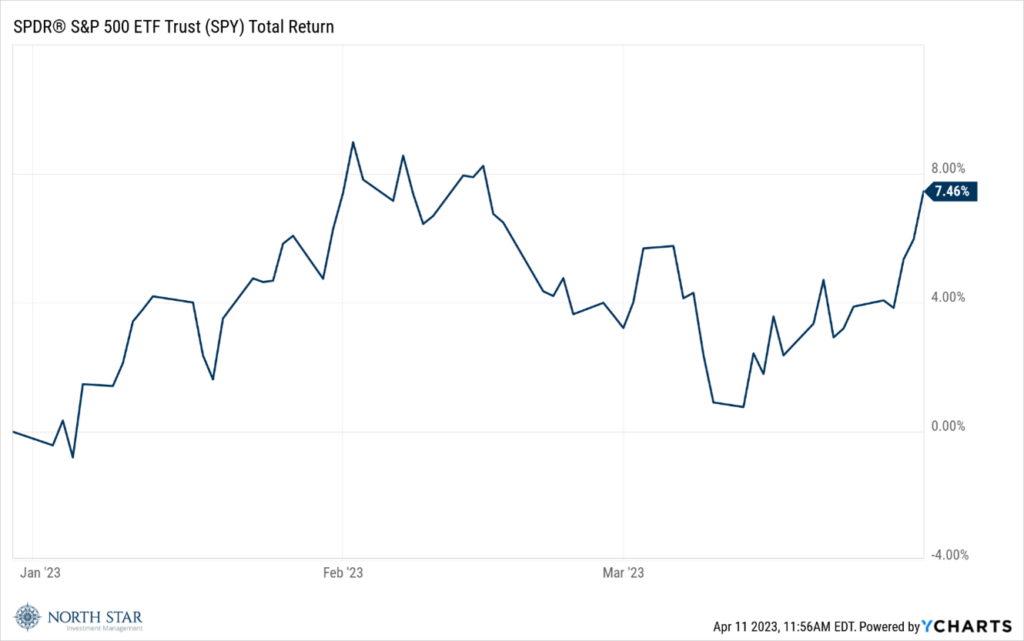

For the three-month period, the S&P 500 Total Return Index increased 7.5% while the Bloomberg U.S. Aggregate Intermediate Bond Index rose 2.4%.

After a difficult 2022, most financial markets recovered in the first three months of 2023. It might be more accurate to say that the markets recovered sharply in January, with the combination of hawkish jawboning from the Fed and a mini-financial crisis erasing those gains by mid-March, followed by a recovery during the last two weeks of the quarter.

For another quarter the Federal Reserve dominated the headlines, as it continued to raise interest rates as inflation, while moderating, remained stubbornly elevated. An unintended consequence of the fastest rate increases in history was a decline in the value of the Treasury securities held by financial institutions, contributing to the failure of three of those institutions during the quarter. Prompt response by government agencies with the assistance of the big healthy banks alleviated the concerns of financial contagion and restored confidence in the markets. Looking forward, investors will focus on corporate earnings and banks will likely continue to dominate the headlines as information on the health of other financial institutions remains in flux. Corporate earnings are expected to decline mid-single digits for the second consecutive quarter, with substantial earnings growth anticipated in the back half of the year.

Previous periods of market volatility have also demonstrated that trying to time the market is a difficult and typically underperforming pursuit. For long term investors, simply staying invested is the most prudent investment strategy. In addition, we encourage investors to manage risk by staying in their asset allocation range and maintaining a diversified portfolio.