Monetary Policy and Midpoints

The stock market continued to move higher, fueled by economic data that clearly contradicted the doomsday narrative promoted by the inflation and recession fear mongers. The Fed still raised interest rates by another 25 basis points on Wednesday to its highest level since 2001, but the market yawned, suggesting a new investor consensus that the Fed hiking cycle is in its final innings.

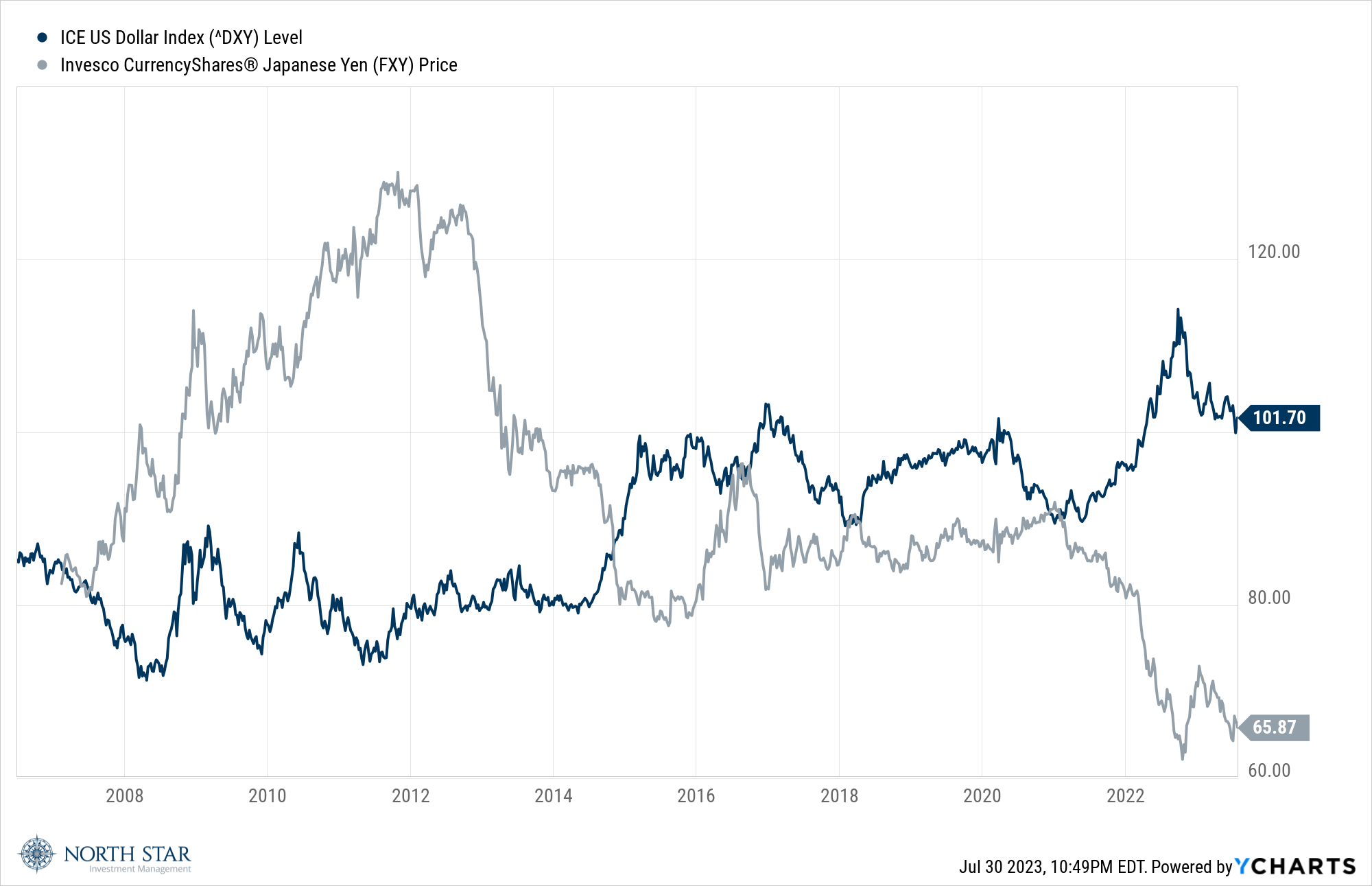

A strong GDP report on Thursday provided evidence that the economic recovery gained momentum in the spring, as buoyant consumer spending and resurgent business investment helped keep a recession at bay. Gross Domestic Product, adjusted for inflation, rose at a healthy 2.4% clip in the second quarter according to the Commerce Department, up from a 2 percent growth rate in the first three months of the year and far stronger than forecasters expected a few months ago. The positive U.S. GDP report was offset to some extent by a statement from the Bank of Japan that it will employ more flexibility in its monetary policy actions, possibly signaling a pivot from decades of expansionary monetary policy in the BOJ’s fight against deflation. This could be a significant shift given that the BOJ has been fighting deflation for decades which has driven significant weakness in the Japanese Yen versus the U.S. Dollar, but especially since the 2008 Financial Crisis and since the onset of the pandemic as shown in the chart below. Given Japan’s high ranking as a creditworthy borrower, a stronger yen and higher interest rates could drive investors toward Japanese bonds and away from alternative sovereign debt such as that of the U.S. and Germany, two other highly trusted borrower nations.

Back in the U.S., the good news parade for the economy continued Friday, as data from the U.S. Department of Commerce showed that the Federal Reserve’s favored inflation gauge, the core personal consumption expenditures price index, moderated significantly in June, while consumer spending rose at a faster clip than income.

Earnings season reached its midpoint, with some modest improvement, albeit still on track for the worst year-over-year decline since the onset of the pandemic in the second quarter of 2020. Stronger than expected results during this past week reduced that expected decline to 7.3% versus an expected decline of 9% during the previous week. Earnings are still expected to show a modest year-over-year uptick in the third quarter, and then accelerate in the fourth quarter.

Once again, the tech-heavy Nasdaq was the biggest winner, advancing 2%, while the S&P 500 added 1% and the Russell 2000 gained 1.1%. The broader market was more mixed, with the S&P 500 Equal Weight ETF (RSP) only rising 0.2% and advancing issues outnumbering declining issues by 17-13. The Dow Jones Industrial Average had its longest winning streak since 1987 snapped at 13 days on Thursday, but then rallied again on Friday, and finished 0.6% higher for the week.

Apart from the Bank of Japan possibly signaling a pivot to less dovish policy, which rattled markets a bit on Thursday, the currency and metals markets were quiet, with Gold unchanged and the Dollar up fractionally. Interest rates across the board moved higher, with the yield on the 10-Year Treasury jumping 14 basis points to 3.97%.

The Chicago Cubs are suddenly on fire, winning 8 games in a row before losing on Sunday. Some fair-weather fans are contemplating jumping on the bandwagon.

Swing Low, Guide High

The labor market and corporate earnings will be in focus, with 170 S&P 500 companies reporting results for the second quarter, and the JOLTS on Thursday followed by the July jobs report on Friday. The jobs data is expected to show fewer job openings, reflecting a better balance in the labor market, and approximately 200,000 new jobs added in the month. Corporate earnings are expected to be challenged, with more positive guidance for the rest of the year.